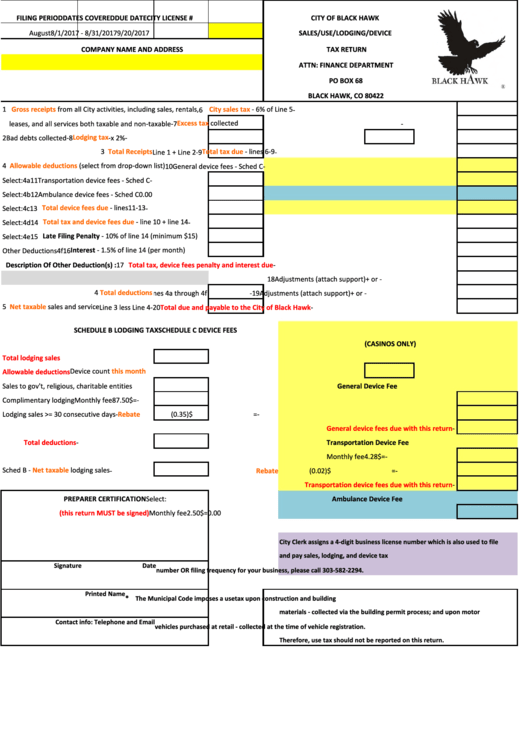

Sales/use/lodging/device Tax Return Form - City Of Black Hawk

ADVERTISEMENT

FILING PERIOD

DATES COVERED

DUE DATE

CITY LICENSE #

CITY OF BLACK HAWK

August

8/1/2017 - 8/31/2017

9/20/2017

SALES/USE/LODGING/DEVICE

COMPANY NAME AND ADDRESS

TAX RETURN

ATTN: FINANCE DEPARTMENT

PO BOX 68

BLACK HAWK, CO 80422

1

Gross receipts

from all City activities, including sales, rentals,

City sales tax

- 6% of Line 5

6

-

Excess tax

collected

leases, and all services both taxable and non-taxable

-

7

-

Lodging tax

2 Bad debts collected

-

8

-

x 2%

-

3

Total Receipts

Total tax due

- lines 6-9

Line 1 + Line 2

-

9

-

4

Allowable deductions

(select from drop-down list)

10 General device fees - Sched C

-

Select:

4a

11 Transportation device fees - Sched C

-

Select:

4b

12 Ambulance device fees - Sched C

0.00

Total device fees due

- lines 11-13

Select:

4c

13

-

Total tax and device fees due

- line 10 + line 14

Select:

4d

14

-

15 Late Filing Penalty - 10% of line 14 (minimum $15)

Select:

4e

16 Interest - 1.5% of line 14 (per month)

Other Deductions

4f

Description Of Other Deduction(s) :

17

Total tax, device fees penalty and interest due

-

18 Adjustments (attach support) + or -

4

Total deductions

Lines 4a through 4f

-

19 Adjustments (attach support) + or -

5

Net taxable

sales and service

Line 3 less Line 4

-

20

Total due and payable to the City of Black Hawk

-

SCHEDULE B LODGING TAX

SCHEDULE C DEVICE FEES

(CASINOS ONLY)

Total lodging sales

Device count

this month

Allowable deductions

Sales to gov't, religious, charitable entities

General Device Fee

Complimentary lodging

Monthly fee

$

87.50

=

-

Lodging sales >= 30 consecutive days

-

Rebate

$

(0.35)

=

-

General device fees due with this return

-

Total deductions

-

Transportation Device Fee

Monthly fee

$

4.28

=

-

Sched B -

Net taxable

lodging sales

-

Rebate

$

(0.02)

=

-

Transportation device fees due with this return

-

PREPARER CERTIFICATION

Ambulance Device Fee

Select:

(this return MUST be signed)

Monthly fee

$

2.50

=

0.00

City Clerk assigns a 4-digit business license number which is also used to file

and pay sales, lodging, and device tax returns. If you do not know the license

Signature

Date

number OR filing frequency for your business, please call 303-582-2294.

Printed Name

*

The Municipal Code imposes a use tax upon construction and building

materials - collected via the building permit process; and upon motor

Contact info: Telephone and Email

vehicles purchased at retail - collected at the time of vehicle registration.

Therefore, use tax should not be reported on this return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1