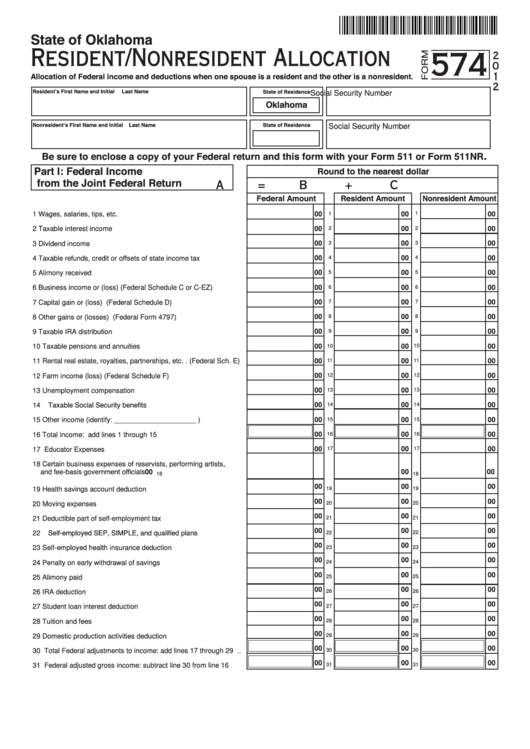

State of Oklahoma

Resident/Nonresident Allocation

574

2

0

1

Allocation of Federal income and deductions when one spouse is a resident and the other is a nonresident.

2

Resident’s First Name and Initial

Last Name

State of Residence

Social Security Number

Oklahoma

Nonresident’s First Name and Initial

Last Name

State of Residence

Social Security Number

.

Be sure to enclose a copy of your Federal return and this form with your Form 511 or Form 511NR

Part I:

Federal Income

Round to the nearest dollar

from the Joint Federal Return

A

=

B

+

C

Federal Amount

Resident Amount

Nonresident Amount

1

Wages, salaries, tips, etc. ...........................................................

00

1

00

1

00

00

00

2

00

2

Taxable interest income ..............................................................

2

3

Dividend income ..........................................................................

00

3

00

3

00

00

4

00

4

00

4

Taxable refunds, credit or offsets of state income tax ................

00

00

00

5

Alimony received ........................................................................

5

5

00

6

00

6

00

6

Business income or (loss) (Federal Schedule C or C-EZ) .........

00

00

00

7

Capital gain or (loss) (Federal Schedule D) ...............................

7

7

00

8

00

8

00

8

Other gains or (losses) (Federal Form 4797) .............................

00

00

00

9

Taxable IRA distribution ...............................................................

9

9

00

10

00

10

00

10

Taxable pensions and annuities .................................................

00

00

00

11

Rental real estate, royalties, partnerships, etc. . (Federal Sch. E)

11

11

00

12

00

12

00

12

Farm income (loss) (Federal Schedule F) ..................................

00

00

00

13

Unemployment compensation ....................................................

13

13

14 Taxable Social Security benefits ................................................

00

14

00

14

00

00

00

00

15

Other income (identify: _____________________ ) ..................

15

15

00

16

00

16

00

16

Total income: add lines 1 through 15 .........................................

00

00

00

17

Educator Expenses ....................................................................

17

17

18

Certain business expenses of reservists, performing artists,

and fee-basis government officials ..............................................

00

00

00

18

18

00

00

00

19

Health savings account deduction ...............................................

19

19

00

00

00

20

Moving expenses .......................................................................

20

20

00

00

00

21

Deductible part of self-employment tax ......................................

21

21

22 Self-employed SEP, SIMPLE, and qualified plans .....................

00

00

00

22

22

00

00

00

23

Self-employed health insurance deduction .................................

23

23

00

00

00

24

Penalty on early withdrawal of savings ......................................

24

24

00

00

00

25

Alimony paid ...............................................................................

25

25

00

00

00

26

IRA deduction .............................................................................

26

26

00

00

00

27

Student loan interest deduction ..................................................

27

27

00

00

00

28

Tuition and fees ..........................................................................

28

28

00

00

00

29

Domestic production activities deduction ....................................

29

29

00

00

00

30

Total Federal adjustments to income: add lines 17 through 29 ..

30

30

00

00

00

31

Federal adjusted gross income: subtract line 30 from line 16 .....

31

31

1

1 2

2 3

3