Form Rpd-41228 - Film-Related Tax Credit Claim Form/schedule A

ADVERTISEMENT

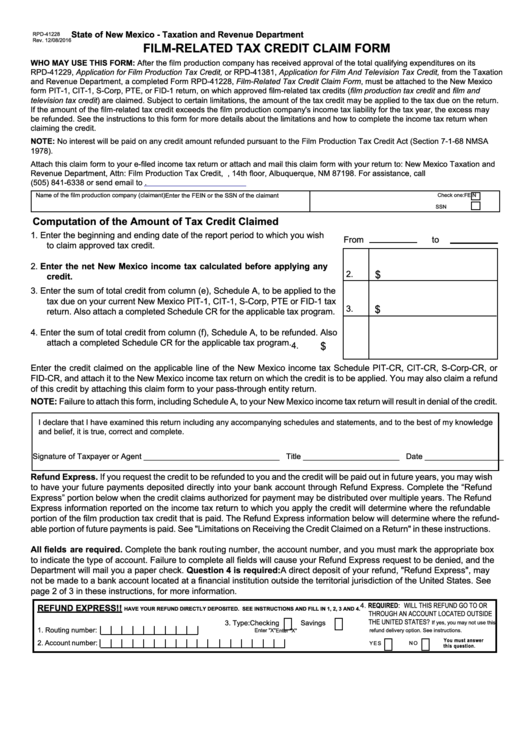

State of New Mexico - Taxation and Revenue Department

RPD-41228

Rev. 12/08/2016

FILM-RELATED TAX CREDIT CLAIM FORM

WHO MAY USE THIS FORM: After the film production company has received approval of the total qualifying expenditures on its

RPD-41229, Application for Film Production Tax Credit, or RPD-41381, Application for Film And Television Tax Credit, from the Taxation

and Revenue Department, a completed Form RPD-41228, Film-Related Tax Credit Claim Form, must be attached to the New Mexico

form PIT-1, CIT-1, S-Corp, PTE, or FID-1 return, on which approved film-related tax credits (film production tax credit and film and

television tax credit) are claimed. Subject to certain limitations, the amount of the tax credit may be applied to the tax due on the return.

If the amount of the film-related tax credit exceeds the film production company's income tax liability for the tax year, the excess may

be refunded. See the instructions to this form for more details about the limitations and how to complete the income tax return when

claiming the credit.

NOTE: No interest will be paid on any credit amount refunded pursuant to the Film Production Tax Credit Act (Section 7-1-68 NMSA

1978).

Attach this claim form to your e-filed income tax return or attach and mail this claim form with your return to: New Mexico Taxation and

Revenue Department, Attn: Film Production Tax Credit, P.O. Box 8485, 14th floor, Albuquerque, NM 87198. For assistance, call

(505) 841-6338 or send email to TRD-FilmCredit@state.nm.us.

Name of the film production company (claimant)

Enter the FEIN or the SSN of the claimant

Check one:

FEIN

SSN

Computation of the Amount of Tax Credit Claimed

1. Enter the beginning and ending date of the report period to which you wish

From

to

to claim approved tax credit.

2. Enter the net New Mexico income tax calculated before applying any

$

2.

credit.

3. Enter the sum of total credit from column (e), Schedule A, to be applied to the

tax due on your current New Mexico PIT-1, CIT-1, S-Corp, PTE or FID-1 tax

$

3.

return. Also attach a completed Schedule CR for the applicable tax program.

4. Enter the sum of total credit from column (f), Schedule A, to be refunded. Also

attach a completed Schedule CR for the applicable tax program.

$

4.

Enter the credit claimed on the applicable line of the New Mexico income tax Schedule PIT-CR, CIT-CR, S-Corp-CR, or

FID-CR, and attach it to the New Mexico income tax return on which the credit is to be applied. You may also claim a refund

of this credit by attaching this claim form to your pass-through entity return.

NOTE: Failure to attach this form, including Schedule A, to your New Mexico income tax return will result in denial of the credit.

I declare that I have examined this return including any accompanying schedules and statements, and to the best of my knowledge

and belief, it is true, correct and complete.

Signature of Taxpayer or Agent _______________________________ Title ______________________ Date __________________

Refund Express. If you request the credit to be refunded to you and the credit will be paid out in future years, you may wish

to have your future payments deposited directly into your bank account through Refund Express. Complete the “Refund

Express” portion below when the credit claims authorized for payment may be distributed over multiple years. The Refund

Express information reported on the income tax return to which you apply the credit will determine where the refundable

portion of the film production tax credit that is paid. The Refund Express information below will determine where the refund-

able portion of future payments is paid. See "Limitations on Receiving the Credit Claimed on a Return" in these instructions.

All fields are required. Complete the bank routing number, the account number, and you must mark the appropriate box

to indicate the type of account. Failure to complete all fields will cause your Refund Express request to be denied, and the

Department will mail you a paper check. Question 4 is required: A direct deposit of your refund, "Refund Express", may

not be made to a bank account located at a financial institution outside the territorial jurisdiction of the United States. See

page 2 of 3 in these instructions, for more information.

4. REQUIRED: WILL THIS REFUND GO TO OR

REFUND EXpRESS!!

HAvE YOUR REFUND DIRECTLY DEpOSITED. SEE INSTRUCTIONS AND FILL IN 1, 2, 3 AND 4.

THROUGH AN ACCOUNT LOCATED OUTSIDE

THE UNITED STATES?

3. Type: Checking

Savings

If yes, you may not use this

1. Routing number:

Enter "X"

Enter "X"

refund delivery option. See instructions.

You must answer

2. Account number:

N O

Y E S

this question.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5