Reset Form

IT DA

Rev. 11/12

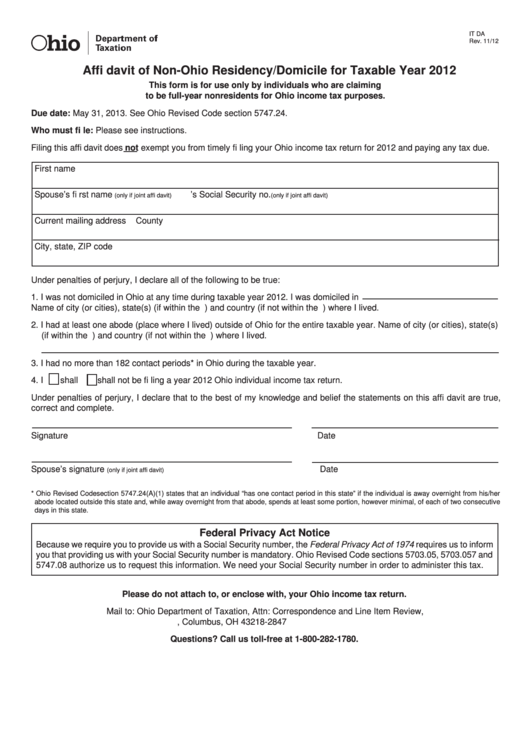

Affi davit of Non-Ohio Residency/Domicile for Taxable Year 2012

This form is for use only by individuals who are claiming

to be full-year nonresidents for Ohio income tax purposes.

Due date: May 31, 2013. See Ohio Revised Code section 5747.24.

Who must fi le: Please see instructions.

Filing this affi davit does not exempt you from timely fi ling your Ohio income tax return for 2012 and paying any tax due.

First name

M.I.

Last name

Social Security no.

Spouse’s fi rst name

M.I.

Last name

Spouse’s Social Security no.

(only if joint affi davit)

(only if joint affi davit)

Current mailing address

County

City, state, ZIP code

Under penalties of perjury, I declare all of the following to be true:

1. I was not domiciled in Ohio at any time during taxable year 2012. I was domiciled in

Name of city (or cities), state(s) (if within the U.S.) and country (if not within the U.S.) where I lived.

2. I had at least one abode (place where I lived) outside of Ohio for the entire taxable year. Name of city (or cities), state(s)

(if within the U.S.) and country (if not within the U.S.) where I lived.

3. I had no more than 182 contact periods* in Ohio during the taxable year.

4. I

shall

shall not be fi ling a year 2012 Ohio individual income tax return.

Under penalties of perjury, I declare that to the best of my knowledge and belief the statements on this affi davit are true,

correct and complete.

Signature

Date

Spouse’s signature

Date

(only if joint affi davit)

* Ohio Revised Code section 5747.24(A)(1) states that an individual “has one contact period in this state” if the individual is away overnight from his/her

abode located outside this state and, while away overnight from that abode, spends at least some portion, however minimal, of each of two consecutive

days in this state.

Federal Privacy Act Notice

Because we require you to provide us with a Social Security number, the Federal Privacy Act of 1974 requires us to inform

you that providing us with your Social Security number is mandatory. Ohio Revised Code sections 5703.05, 5703.057 and

5747.08 authorize us to request this information. We need your Social Security number in order to administer this tax.

Please do not attach to, or enclose with, your Ohio income tax return.

Mail to: Ohio Department of Taxation, Attn: Correspondence and Line Item Review,

P.O. Box 182847, Columbus, OH 43218-2847

Questions? Call us toll-free at 1-800-282-1780.

1

1 2

2