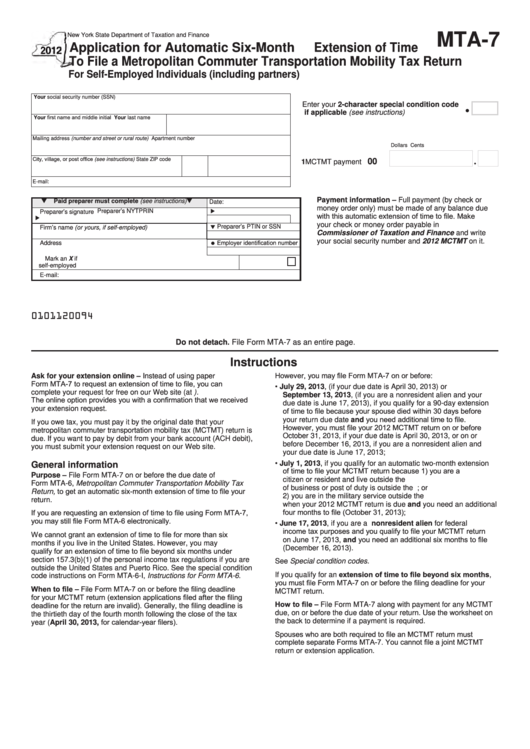

MTA-7

New York State Department of Taxation and Finance

Application for Automatic Six-Month Extension of Time

To File a Metropolitan Commuter Transportation Mobility Tax Return

For Self-Employed Individuals (including partners)

Your social security number (SSN)

Enter your 2-character special condition code

if applicable (see instructions) ........................

Your first name and middle initial

Your last name

Mailing address (number and street or rural route)

Apartment number

Dollars

Cents

City, village, or post office (see instructions)

State

ZIP code

00

1 MCTMT payment ........

E-mail:

Payment information – Full payment (by check or

Paid preparer must complete (see instructions)

Date:

money order only) must be made of any balance due

Preparer’s NYTPRIN

Preparer’s signature

with this automatic extension of time to file. Make

your check or money order payable in U.S. funds to

Preparer’s PTIN or SSN

Firm’s name (or yours, if self-employed)

Commissioner of Taxation and Finance and write

your social security number and 2012 MCTMT on it.

Employer identification number

Address

Mark an X if

self-employed

E-mail:

0101120094

Do not detach. File Form MTA-7 as an entire page.

Instructions

However, you may file Form MTA-7 on or before:

Ask for your extension online – Instead of using paper

Form MTA-7 to request an extension of time to file, you can

• July 29, 2013, (if your due date is April 30, 2013) or

complete your request for free on our Web site (at ).

September 13, 2013, (if you are a nonresident alien and your

The online option provides you with a confirmation that we received

due date is June 17, 2013), if you qualify for a 90-day extension

your extension request.

of time to file because your spouse died within 30 days before

your return due date and you need additional time to file.

If you owe tax, you must pay it by the original date that your

However, you must file your 2012 MCTMT return on or before

metropolitan commuter transportation mobility tax (MCTMT) return is

October 31, 2013, if your due date is April 30, 2013, or on or

due. If you want to pay by debit from your bank account (ACH debit),

before December 16, 2013, if you are a nonresident alien and

you must submit your extension request on our Web site.

your due date is June 17, 2013;

• July 1, 2013, if you qualify for an automatic two-month extension

General information

of time to file your MCTMT return because 1) you are a U.S.

Purpose – File Form MTA-7 on or before the due date of

citizen or resident and live outside the U.S. and your main place

Form MTA-6, Metropolitan Commuter Transportation Mobility Tax

of business or post of duty is outside the U.S. and Puerto Rico; or

Return, to get an automatic six-month extension of time to file your

2) you are in the military service outside the U.S. and Puerto Rico

return.

when your 2012 MCTMT return is due and you need an additional

four months to file (October 31, 2013);

If you are requesting an extension of time to file using Form MTA-7,

you may still file Form MTA-6 electronically.

• June 17, 2013, if you are a U.S. nonresident alien for federal

income tax purposes and you qualify to file your MCTMT return

We cannot grant an extension of time to file for more than six

on June 17, 2013, and you need an additional six months to file

months if you live in the United States. However, you may

(December 16, 2013).

qualify for an extension of time to file beyond six months under

section 157.3(b)(1) of the personal income tax regulations if you are

See Special condition codes.

outside the United States and Puerto Rico. See the special condition

If you qualify for an extension of time to file beyond six months,

code instructions on Form MTA-6-I, Instructions for Form MTA-6.

you must file Form MTA-7 on or before the filing deadline for your

When to file – File Form MTA-7 on or before the filing deadline

MCTMT return.

for your MCTMT return (extension applications filed after the filing

How to file – File Form MTA-7 along with payment for any MCTMT

deadline for the return are invalid). Generally, the filing deadline is

due, on or before the due date of your return. Use the worksheet on

the thirtieth day of the fourth month following the close of the tax

year (April 30, 2013, for calendar-year filers).

the back to determine if a payment is required.

Spouses who are both required to file an MCTMT return must

complete separate Forms MTA-7. You cannot file a joint MCTMT

return or extension application.

1

1 2

2