BOE-531-AB (FRONT) REV. 2 (1-02)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

PREPAYMENT OF SALES TAX TO SUPPLIERS AND WHOLESALERS ON FUEL PURCHASES - SCHEDULES

DUE ON OR BEFORE

YOUR ACCOUNT NO.

[

]

FOID

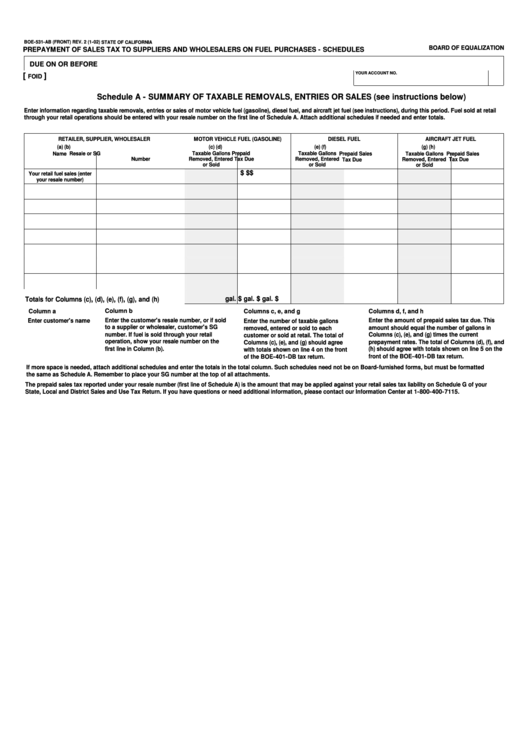

Schedule A - SUMMARY OF TAXABLE REMOVALS, ENTRIES OR SALES (see instructions below)

Enter information regarding taxable removals, entries or sales of motor vehicle fuel (gasoline), diesel fuel, and aircraft jet fuel (see instructions), during this period. Fuel sold at retail

through your retail operations should be entered with your resale number on the first line of Schedule A. Attach additional schedules if needed and enter totals.

RETAILER, SUPPLIER, WHOLESALER

MOTOR VEHICLE FUEL (GASOLINE)

DIESEL FUEL

AIRCRAFT JET FUEL

(a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

Name

Resale or SG

Taxable Gallons

Prepaid

Taxable Gallons

Prepaid Sales

Taxable Gallons

Prepaid Sales

Number

Removed, Entered

Tax Due

Removed, Entered

Removed, Entered

Tax Due

Tax Due

or Sold

or Sold

or Sold

$

$

$

Your retail fuel sales (enter

your resale number)

gal. $

gal. $

gal. $

Totals for Columns (c), (d), (e), (f), (g), and (h)

Column a

Column b

Columns c, e, and g

Columns d, f, and h

Enter the customer's resale number, or if sold

Enter customer's name

Enter the amount of prepaid sales tax due. This

Enter the number of taxable gallons

to a supplier or wholesaler, customer's SG

amount should equal the number of gallons in

removed, entered or sold to each

number. If fuel is sold through your retail

Columns (c), (e), and (g) times the current

customer or sold at retail. The total of

operation, show your resale number on the

prepayment rates. The total of Columns (d), (f), and

Columns (c), (e), and (g) should agree

first line in Column (b).

(h) should agree with totals shown on line 5 on the

with totals shown on line 4 on the front

front of the BOE-401-DB tax return.

of the BOE-401-DB tax return.

If more space is needed, attach additional schedules and enter the totals in the total column. Such schedules need not be on Board-furnished forms, but must be formatted

the same as Schedule A. Remember to place your SG number at the top of all attachments.

The prepaid sales tax reported under your resale number (first line of Schedule A) is the amount that may be applied against your retail sales tax liability on Schedule G of your

State, Local and District Sales and Use Tax Return. If you have questions or need additional information, please contact our Information Center at 1-800-400-7115.

1

1 2

2