Print Form

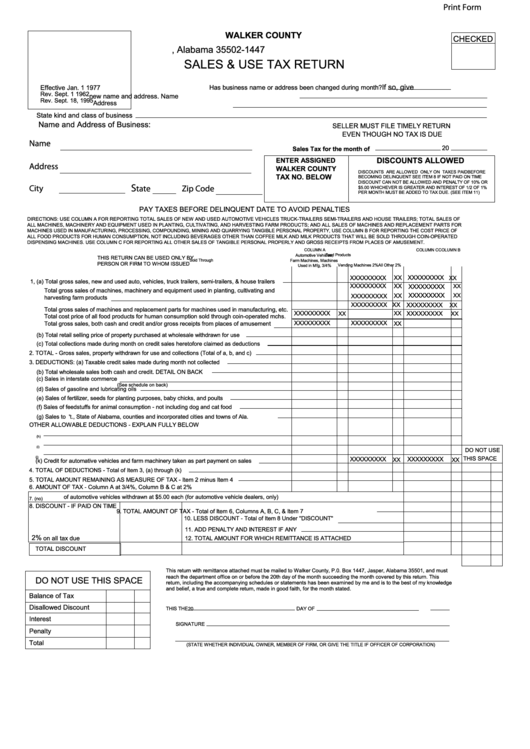

WALKER COUNTY

CHECKED

P.O. Box 1447 Jasper, Alabama 35502-1447

SALES & USE TAX RETURN

If so, give

Has business name or address been changed during month?

Effective Jan. 1 1977

Rev. Sept. 1 1962

new name and address. Name

Rev. Sept. 18, 1995

Address

State kind and class of business

Name and Address of Business:

SELLER MUST FILE TIMELY RETURN

EVEN THOUGH NO TAX IS DUE

Name

20

Sales Tax for the month of

DISCOUNTS ALLOWED

ENTER ASSIGNED

Address

WALKER COUNTY

DISCOUNTS ARE ALLOWED ONLY ON TAXES PAID BEFORE

TAX NO. BELOW

BECOMING DELINQUENT SEE ITEM 8 IF NOT PAID ON TIME

DISCOUNT CAN NOT BE ALLOWED AND PENALTY OF 10% OR

S

City

Zip Code

tate

$5.00 WHICHEVER IS GREATER AND INTEREST OF 1/2 OF 1%

PER MONTH MUST BE ADDED TO TAX DUE. (SEE ITEM 11)

PAY TAXES BEFORE DELINQUENT DATE TO AVOID PENALTIES

DIRECTIONS: USE COLUMN A FOR REPORTING TOTAL SALES OF NEW AND USED AUTOMOTIVE VEHICLES TRUCK-TRAILERS SEMI-TRAILERS AND HOUSE TRAILERS; TOTAL SALES OF

ALL MACHINES, MACHINERY AND EQUIPMENT USED IN PLANTING, CULTIVATING, AND HARVESTING FARM PRODUCTS; AND ALL SALES OF MACHINES AND REPLACEMENT PARTS FOR

MACHINES USED IN MANUFACTURING, PROCESSING, COMPOUNDING, MINING AND QUARRYING TANGIBLE PERSONAL PROPERTY, USE COLUMN B FOR REPORTING THE COST PRICE OF

ALL FOOD PRODUCTS FOR HUMAN CONSUMPTION, NOT INCLUDING BEVERAGES OTHER THAN COFFEE MILK AND MILK PRODUCTS THAT WILL BE SOLD THROUGH COIN-OPERATED

DISPENSING MACHINES. USE COLUMN C FOR REPORTING ALL OTHER SALES OF TANGIBLE PERSONAL PROPERLY AND GROSS RECEIPTS FROM PLACES OF AMUSEMENT.

COLUMN B

COLUMN C

COLUMN A

Automotive Vehicles,

Food Products

THIS RETURN CAN BE USED ONLY BY

Farm Machines, Machines

Sold Through

PERSON OR FIRM TO WHOM ISSUED

Vending Machines 2%

All Other 2%

Used in Mfg, 3/4%

XXXXXXXXX

XX

XXXXXXXXX

XX

1, (a) Total gross sales, new and used auto, vehicles, truck trailers, semi-trailers, & house trailers

XXXXXXXXX

XX

XXXXXXXXX

XX

Total gross sales of machines, machinery and equipment used in planting, cultivating and

XXXXXXXXX

XXXXXXXXX

XX

XX

harvesting farm products

XXXXXXXXX XX XXXXXXXXX

XX

Total gross sales of machines and replacement parts for machines used in manufacturing, etc.

XXXXXXXXX

XX

XXXXXXXXX

XX

XX

Total cost price of all food products for human consumption sold through coin-operated mchs.

XXXXXXXXX

XXXXXXXXX

XX

Total gross sales, both cash and credit and/or gross receipts from places of amusement

(b) Total retail selling price of property purchased at wholesale withdrawn for use

(c) Total collections made during month on credit sales heretofore claimed as deductions

2. TOTAL - Gross sales, property withdrawn for use and collections (Total of a, b, and c)

3. DEDUCTIONS: (a) Taxable credit sales made during month not collected

(b) Total wholesale sales both cash and credit. DETAIL ON BACK

(c) Sales in interstate commerce

(See schedule on back)

(d) Sales of gasoline and lubricating oils

(e) Sales of fertilizer, seeds for planting purposes, baby chicks, and poults

(f) Sales of feedstuffs for animal consumption - not including dog and cat food

(g) Sales to U.S. Gov't., State of Alabama, counties and incorporated cities and towns of Ala.

OTHER ALLOWABLE DEDUCTIONS - EXPLAIN FULLY BELOW

(h)

(i)

DO NOT USE

(j)

XXXXXXXXX

XXXXXXXXX

THIS SPACE

XX

XX

(k) Credit for automative vehicles and farm machinery taken as part payment on sales

4. TOTAL OF DEDUCTIONS - Total of Item 3, (a) through (k)

5. TOTAL AMOUNT REMAINING AS MEASURE OF TAX - Item 2 minus Item 4

6. AMOUNT OF TAX - Column A at 3/4%, Column B & C at 2%

of automotive vehicles withdrawn at $5.00 each (for automotive vehicle dealers, only)

7. (no)

8. DISCOUNT - IF PAID ON TIME

9. TOTAL AMOUNT OF TAX - Total of Item 6, Columns A, B, C, & Item 7

10. LESS DISCOUNT - Total of Item 8 Under ''DISCOUNT''

11. ADD PENALTY AND INTEREST IF ANY

2%

on all tax due

12. TOTAL AMOUNT FOR WHICH REMITTANCE IS ATTACHED

TOTAL DISCOUNT

This return with remittance attached must be mailed to Walker County, P.0. Box 1447, Jasper, Alabama 35501, and must

reach the department office on or before the 20th day of the month succeeding the month covered by this return. This

DO NOT USE THIS SPACE

return, including the accompanying schedules or statements has been examined by me and is to the best of my knowledge

and belief, a true and complete return, made in good faith, for the month stated.

Balance of Tax

Disallowed Discount

THIS THE

DAY OF

20

Interest

SIGNATURE

Penalty

Total

(STATE WHETHER INDIVIDUAL OWNER, MEMBER OF FIRM, OR GIVE THE TITLE IF OFFICER OF CORPORATION)

1

1 2

2