hio

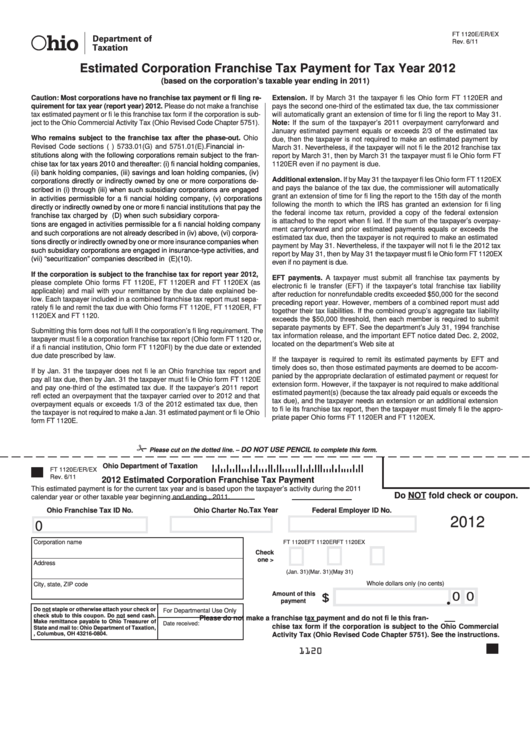

FT 1120E/ER/EX

Department of

Rev. 6/11

Taxation

Estimated Corporation Franchise Tax Payment for Tax Year 2012

(based on the corporation’s taxable year ending in 2011)

Caution: Most corporations have no franchise tax payment or fi ling re-

Extension. If by March 31 the taxpayer fi les Ohio form FT 1120ER and

quirement for tax year (report year) 2012. Please do not make a franchise

pays the second one-third of the estimated tax due, the tax commissioner

tax estimated payment or fi le this franchise tax form if the corporation is sub-

will automatically grant an extension of time for fi ling the report to May 31.

ject to the Ohio Commercial Activity Tax (Ohio Revised Code Chapter 5751).

Note: If the sum of the taxpayer’s 2011 overpayment carryforward and

January estimated payment equals or exceeds 2/3 of the estimated tax

Who remains subject to the franchise tax after the phase-out. Ohio

due, then the taxpayer is not required to make an estimated payment by

Revised Code sections (R.C.) 5733.01(G) and 5751.01(E).

Financial in-

March 31. Nevertheless, if the taxpayer will not fi le the 2012 franchise tax

stitutions along with the following corporations remain subject to the fran-

report by March 31, then by March 31 the taxpayer must fi le Ohio form FT

chise tax for tax years 2010 and thereafter: (i) fi nancial holding companies,

1120ER even if no payment is due.

(ii) bank holding companies, (iii) savings and loan holding companies, (iv)

Additional extension. If by May 31 the taxpayer fi les Ohio form FT 1120EX

corporations directly or indirectly owned by one or more corporations de-

and pays the balance of the tax due, the commissioner will automatically

scribed in (i) through (iii) when such subsidiary corporations are engaged

grant an extension of time for fi ling the report to the 15th day of the month

in activities permissible for a fi nancial holding company, (v) corporations

following the month to which the IRS has granted an extension for fi ling

directly or indirectly owned by one or more fi nancial institutions that pay the

the federal income tax return, provided a copy of the federal extension

franchise tax charged by R.C. 5733.06(D) when such subsidiary corpora-

is attached to the report when fi led. If the sum of the taxpayer’s overpay-

tions are engaged in activities permissible for a fi nancial holding company

ment carryforward and prior estimated payments equals or exceeds the

and such corporations are not already described in (iv) above, (vi) corpora-

estimated tax due, then the taxpayer is not required to make an estimated

tions directly or indirectly owned by one or more insurance companies when

payment by May 31. Nevertheless, if the taxpayer will not fi le the 2012 tax

such subsidiary corporations are engaged in insurance-type activities, and

report by May 31, then by May 31 the taxpayer must fi le Ohio form FT 1120EX

(vii) “securitization” companies described in R.C. 5751.01(E)(10).

even if no payment is due.

If the corporation is subject to the franchise tax for report year 2012,

EFT payments. A taxpayer must submit all franchise tax payments by

please complete Ohio forms FT 1120E, FT 1120ER and FT 1120EX (as

electronic fi le transfer (EFT) if the taxpayer’s total franchise tax liability

applicable) and mail with your remittance by the due date explained be-

after reduction for nonrefundable credits exceeded $50,000 for the second

low. Each taxpayer included in a combined franchise tax report must sepa-

preceding report year. However, members of a combined report must add

rately fi le and remit the tax due with Ohio forms FT 1120E, FT 1120ER, FT

together their tax liabilities. If the combined group’s aggregate tax liability

1120EX and FT 1120.

exceeds the $50,000 threshold, then each member is required to submit

separate payments by EFT. See the department’s July 31, 1994 franchise

Submitting this form does not fulfi ll the corporation’s fi ling requirement. The

tax information release, and the important EFT notice dated Dec. 2, 2002,

taxpayer must fi le a corporation franchise tax report (Ohio form FT 1120 or,

located on the department’s Web site at tax.ohio.gov.

if a fi nancial institution, Ohio form FT 1120FI) by the due date or extended

due date prescribed by law.

If the taxpayer is required to remit its estimated payments by EFT and

timely does so, then those estimated payments are deemed to be accom-

If by Jan. 31 the taxpayer does not fi le an Ohio franchise tax report and

panied by the appropriate declaration of estimated payment or request for

pay all tax due, then by Jan. 31 the taxpayer must fi le Ohio form FT 1120E

extension form. However, if the taxpayer is not required to make additional

and pay one-third of the estimated tax due. If the taxpayer’s 2011 report

estimated payment(s) (because the tax already paid equals or exceeds the

refl ected an overpayment that the taxpayer carried over to 2012 and that

tax due), and the taxpayer needs an extension or an additional extension

overpayment equals or exceeds 1/3 of the 2012 estimated tax due, then

to fi le its franchise tax report, then the taxpayer must timely fi le the appro-

the taxpayer is not required to make a Jan. 31 estimated payment or fi le Ohio

priate paper Ohio forms FT 1120ER and FT 1120EX.

form FT 1120E.

DO NOT USE PENCIL

Please cut on the dotted line. –

to complete this form.

Ohio Department of Taxation

FT 1120E/ER/EX

Reset Form

Rev. 6/11

2012 Estimated Corporation Franchise Tax Payment

This estimated payment is for the current tax year and is based upon the taxpayer’s activity during the 2011

Do NOT fold check or coupon.

calendar year or other taxable year beginning

and ending

, 2011.

Ohio Franchise Tax ID No.

Ohio Charter No.

Federal Employer ID No.

Tax Year

2012

0

Corporation name

FT 1120E

FT 1120ER

FT 1120EX

Check

one >

Address

(Jan. 31)

(Mar. 31)

(May 31)

Whole dollars only (no cents)

City, state, ZIP code

Amount of this

0 0

$

.

payment

Do not staple or otherwise attach your check or

For Departmental Use Only

check stub to this coupon. Do not send cash.

Please do not make a franchise tax payment and do not fi le this fran-

Make remittance payable to Ohio Treasurer of

Date received:

chise tax form if the corporation is subject to the Ohio Commercial

State and mail to: Ohio Department of Taxation,

P.O. Box 804, Columbus, OH 43216-0804.

Activity Tax (Ohio Revised Code Chapter 5751). See the instructions.

1

1