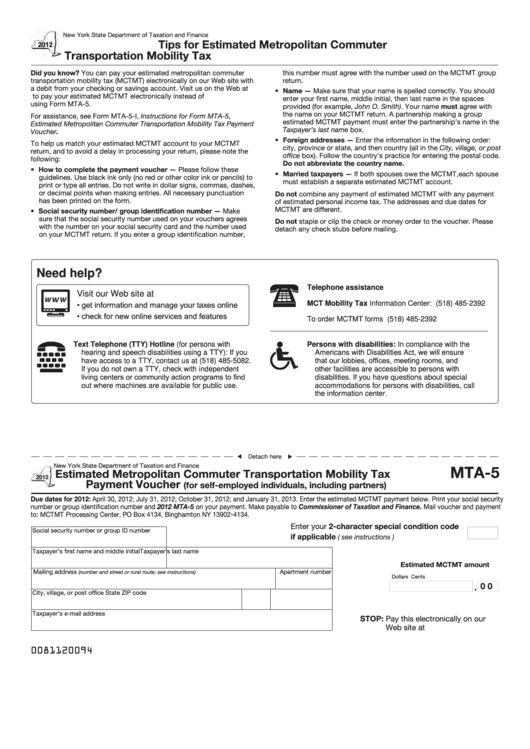

New York State Department of Taxation and Finance

Tips for Estimated Metropolitan Commuter

Transportation Mobility Tax

Did you know? You can pay your estimated metropolitan commuter

this number must agree with the number used on the MCTMT group

transportation mobility tax (MCTMT) electronically on our Web site with

return.

a debit from your checking or savings account. Visit us on the Web at

• Name — Make sure that your name is spelled correctly. You should

to pay your estimated MCTMT electronically instead of

enter your first name, middle initial, then last name in the spaces

using Form MTA-5.

provided (for example, John O. Smith). Your name must agree with

the name on your MCTMT return. A partnership making a group

For assistance, see Form MTA-5-I, Instructions for Form MTA-5,

estimated MCTMT payment must enter the partnership’s name in the

Estimated Metropolitan Commuter Transportation Mobility Tax Payment

Taxpayer’s last name box.

Voucher.

• Foreign addresses — Enter the information in the following order:

To help us match your estimated MCTMT account to your MCTMT

city, province or state, and then country (all in the City, village, or post

return, and to avoid a delay in processing your return, please note the

office box). Follow the country’s practice for entering the postal code.

following:

Do not abbreviate the country name.

• How to complete the payment voucher — Please follow these

• Married taxpayers — If both spouses owe the MCTMT, each spouse

guidelines. Use black ink only (no red or other color ink or pencils) to

must establish a separate estimated MCTMT account.

print or type all entries. Do not write in dollar signs, commas, dashes,

or decimal points when making entries. All necessary punctuation

Do not combine any payment of estimated MCTMT with any payment

has been printed on the form.

of estimated personal income tax. The addresses and due dates for

MCTMT are different.

• Social security number/ group identification number — Make

sure that the social security number used on your vouchers agrees

Do not staple or clip the check or money order to the voucher. Please

with the number on your social security card and the number used

detach any check stubs before mailing.

on your MCTMT return. If you enter a group identification number,

Need help?

Telephone assistance

Visit our Web site at

• get information and manage your taxes online

MCT Mobility Tax Information Center: (518) 485-2392

• check for new online services and features

To order MCTMT forms

(518) 485-2392

Text Telephone (TTY) Hotline (for persons with

Persons with disabilities: In compliance with the

hearing and speech disabilities using a TTY): If you

Americans with Disabilities Act, we will ensure

that our lobbies, offices, meeting rooms, and

have access to a TTY, contact us at (518) 485-5082.

If you do not own a TTY, check with independent

other facilities are accessible to persons with

living centers or community action programs to find

disabilities. If you have questions about special

out where machines are available for public use.

accommodations for persons with disabilities, call

the information center.

Detach here

New York State Department of Taxation and Finance

MTA-5

Estimated Metropolitan Commuter Transportation Mobility Tax

Payment Voucher

(for self-employed individuals, including partners)

Due dates for 2012: April 30, 2012; July 31, 2012; October 31, 2012; and January 31, 2013. Enter the estimated MCTMT payment below. Print your social security

number or group identification number and 2012 MTA-5 on your payment. Make payable to Commissioner of Taxation and Finance. Mail voucher and payment

to: MCTMT Processing Center, PO Box 4134, Binghamton NY 13902-4134.

Enter your 2-character special condition code

Social security number or group ID number

if applicable

.................................

( see instructions )

Taxpayer’s first name and middle initial

Taxpayer’s last name

Estimated MCTMT amount

Mailing address

Apartment number

(number and street or rural route; see instructions)

Dollars

Cents

0 0

City, village, or post office

State

ZIP code

Taxpayer’s e-mail address

STOP: Pay this electronically on our

Web site at

0081120094

1

1