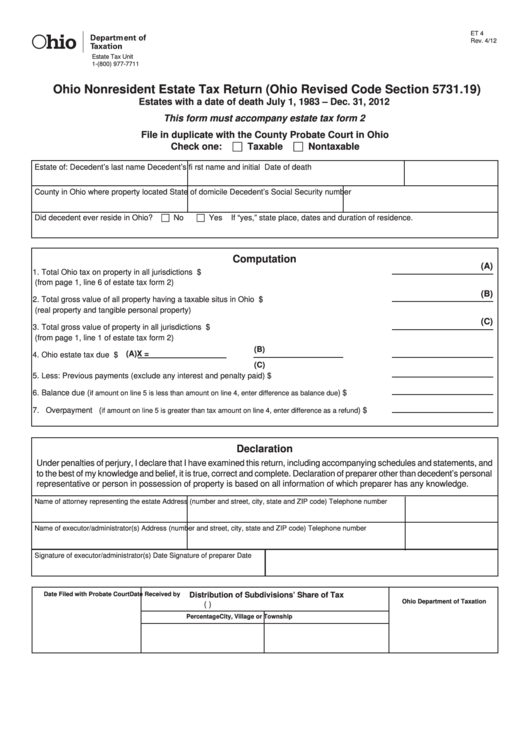

ET 4

Rev. 4/12

Estate Tax Unit

1-(800) 977-7711

Reset Form

tax.ohio.gov

Ohio Nonresident Estate Tax Return (Ohio Revised Code Section 5731.19)

Estates with a date of death July 1, 1983 – Dec. 31, 2012

This form must accompany estate tax form 2

File in duplicate with the County Probate Court in Ohio

Taxable

Nontaxable

Check one:

Estate of: Decedent’s last name

Decedent’s fi rst name and initial

Date of death

County in Ohio where property located

State of domicile

Decedent’s Social Security number

No

Yes

Did decedent ever reside in Ohio?

If “yes,” state place, dates and duration of residence.

Computation

(A)

1. Total Ohio tax on property in all jurisdictions ......................................................................................$

(from page 1, line 6 of estate tax form 2)

(B)

2. Total gross value of all property having a taxable situs in Ohio ..........................................................$

(real property and tangible personal property)

(C)

3. Total gross value of property in all jurisdictions ..................................................................................$

(from page 1, line 1 of estate tax form 2)

(B)

(A)

X

=

4. Ohio estate tax due

$

(C)

5. Less: Previous payments (exclude any interest and penalty paid).....................................................$

6. Balance due (

) ..................$

if amount on line 5 is less than amount on line 4, enter difference as balance due

7. Overpayment (

).............$

if amount on line 5 is greater than tax amount on line 4, enter difference as a refund

Declaration

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and

to the best of my knowledge and belief, it is true, correct and complete. Declaration of preparer other than decedent’s personal

representative or person in possession of property is based on all information of which preparer has any knowledge.

Name of attorney representing the estate

Address (number and street, city, state and ZIP code)

Telephone number

Name of executor/administrator(s)

Address (number and street, city, state and ZIP code)

Telephone number

Signature of executor/administrator(s)

Date

Signature of preparer

Date

Date Filed with Probate Court

Distribution of Subdivisions’ Share of Tax

Date Received by

Ohio Department of Taxation

(R.C. Section 5731.48 and 5731.50)

Percentage

City, Village or Township

1

1 2

2