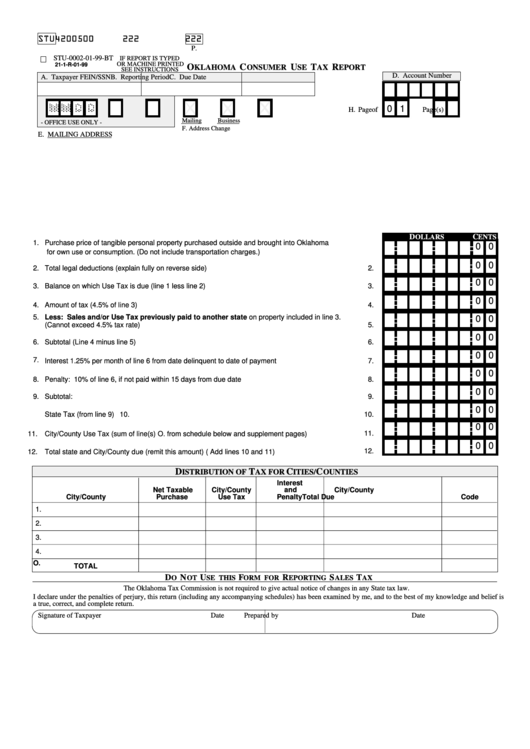

Form Stu-0002-01-99-Bt - Oklahoma Consumer Use Tax Report

ADVERTISEMENT

STU

4200500

222

222

P.

STU-0002-01-99-BT

IF REPORT IS TYPED

OR MACHINE PRINTED

21-1-R-01-99

O

C

U

T

R

KLAHOMA

ONSUMER

SE

AX

EPORT

SEE INSTRUCTIONS

D. Account Number

A. Taxpayer FEIN/SSN

B. Reporting Period

C. Due Date

0 1

H.

Page

of

Page(s)

P.T.

Mailing

Business

G. Out of Business

- OFFICE USE ONLY -

F.C.

F. Address Change

E. MAILING ADDRESS

D

C

OLLARS

ENTS

1.

Purchase price of tangible personal property purchased outside and brought into Oklahoma

0 0

for own use or consumption. (Do not include transportation charges.)

................................................. 1.

0 0

2.

Total legal deductions (explain fully on reverse side)

.............................................................................

2.

0 0

3.

Balance on which Use Tax is due (line 1 less line 2)

...............................................................................

3.

0 0

4.

Amount of tax (4.5% of line 3)

4.

...............................................................................................................................

5.

Less: Sales and/or Use Tax previously paid to another state on property included in line 3.

0 0

(Cannot exceed 4.5% tax rate)

.............................................................................................................................

5.

0 0

6.

Subtotal (Line 4 minus line 5)

................................................................................................................................

6.

0 0

7.

Interest 1.25% per month of line 6 from date delinquent to date of payment

...............................................

7.

0 0

8.

Penalty: 10% of line 6, if not paid within 15 days from due date

8.

...................................................................

0 0

9.

Subtotal:

9.

..................................................................................................................................................................

0 0

10.

State Tax (from line 9)

10.

...........................................................................................................................................

0 0

11.

11.

City/County Use Tax (sum of line(s) O. from schedule below and supplement pages)

.............................

0 0

12.

12.

Total state and City/County due (remit this amount) ( Add lines 10 and 11)

.................................................

D

T

C

C

ISTRIBUTION OF

AX FOR

ITIES/

OUNTIES

I.

J.

K.

L.

M.

N.

Interest

Net Taxable

City/County

and

City/County

City/County

Purchase

Use Tax

Penalty

Total Due

Code

1.

2.

3.

4.

O.

TOTAL

D

N

U

F

R

S

T

O

OT

SE THIS

ORM FOR

EPORTING

ALES

AX

The Oklahoma Tax Commission is not required to give actual notice of changes in any State tax law.

I declare under the penalties of perjury, this return (including any accompanying schedules) has been examined by me, and to the best of my knowledge and belief is

a true, correct, and complete return.

Signature of Taxpayer

Date

Prepared by

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1