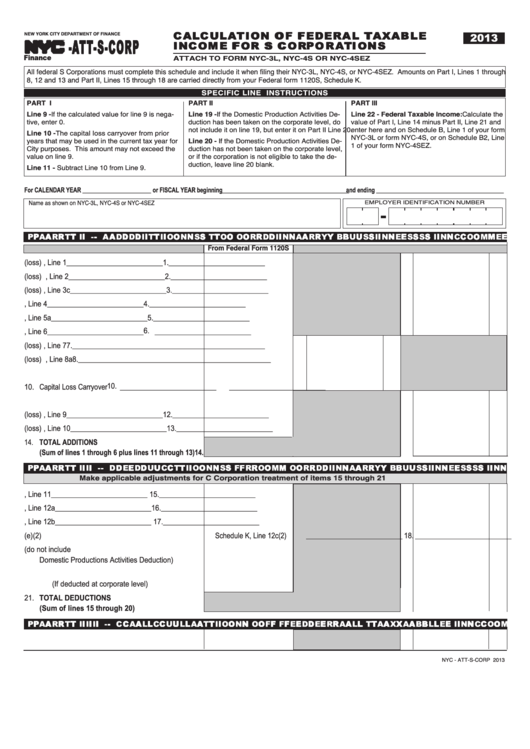

Form Nys-Att-S-Corp - Calculation Of Federal Taxable Income For S Corporations - 2013

ADVERTISEMENT

- - A A T T T T - - S S - - C C O O R R P P

C C A A L L C C U U L L A A T T I I O O N N O O F F F F E E D D E E R R A A L L T T A A X X A A B B L L E E

2013

NEW YORK CITY DEPARTMENT OF FINANCE

I I N N C C O O M M E E F F O O R R S S C C O O R R P P O O R R A A T T I I O O N N S S

TM

ATTACH TO FORM NYC-3L, NYC-4S OR NYC-4SEZ

Finance

All federal S Corporations must complete this schedule and include it when filing their NYC-3L, NYC-4S, or NYC-4SEZ. Amounts on Part I, Lines 1 through

8, 12 and 13 and Part II, Lines 15 through 18 are carried directly from your Federal form 1120S, Schedule K.

SPECIFIC LINE INSTRUCTIONS

PART I

PART II

PART III

Line 9 - If the calculated value for line 9 is nega-

Line 19 - If the Domestic Production Activities De-

Line 22 - Federal Taxable Income: Calculate the

tive, enter 0.

duction has been taken on the corporate level, do

value of Part I, Line 14 minus Part II, Line 21 and

not include it on line 19, but enter it on Part II Line 20.

enter here and on Schedule B, Line 1 of your form

Line 10 - The capital loss carryover from prior

NYC-3L or form NYC-4S, or on Schedule B2, Line

Line 20 - If the Domestic Production Activities De-

years that may be used in the current tax year for

1 of your form NYC-4SEZ.

City purposes. This amount may not exceed the

duction has not been taken on the corporate level,

value on line 9.

or if the corporation is not eligible to take the de-

duction, leave line 20 blank.

Line 11 - Subtract Line 10 from Line 9.

For CALENDAR YEAR ______________________ or FISCAL YEAR beginning _____________________________________ and ending _____________________________________

Name as shown on NYC-3L, NYC-4S or NYC-4SEZ

EMPLOYER IDENTIFICATION NUMBER

P P A A R R T T I I - - A A D D D D I I T T I I O O N N S S T T O O O O R R D D I I N N A A R R Y Y B B U U S S I I N N E E S S S S I I N N C C O O M M E E

From Federal Form 1120S

1.

Ordinary business income (loss)................................

Schedule K, Line 1

________________________ 1. ________________________

2.

Net rental real estate income (loss) ...........................

Schedule K, Line 2

________________________ 2. ________________________

3.

Other net rental income (loss)....................................

Schedule K, Line 3c

________________________ 3. ________________________

4.

Interest income...........................................................

Schedule K, Line 4

________________________ 4. ________________________

5.

Ordinary dividends .....................................................

Schedule K, Line 5a

________________________ 5. ________________________

________________________ 6. ________________________

6.

Royalties ....................................................................

Schedule K, Line 6

7.

Net short-term capital gain (loss) ...............................

Schedule K, Line 7

7. ________________________

________________________

8.

Net long-term capital gain (loss) ................................

Schedule K, Line 8a

8. ________________________

________________________

9.

Sum of lines 7 and 8 ..................................................

See Instructions

9. ________________________

________________________

10. ________________________

10. Capital Loss Carryover .................................................

See Instructions

________________________

11. Net Capital Gain.........................................................

See Instructions

________________________ 11. ________________________

12. Net Section 1231 gain (loss) ......................................

Schedule K, Line 9

________________________ 12. ________________________

13. Other income (loss)....................................................

Schedule K, Line 10

________________________ 13. ________________________

14. TOTAL ADDITIONS

....

_____________________

__________________

(Sum of lines 1 through 6 plus lines 11 through 13)

14.

P P A A R R T T I I I I - - D D E E D D U U C C T T I I O O N N S S F F R R O O M M O O R R D D I I N N A A R R Y Y B B U U S S I I N N E E S S S S I I N N C C O O M M E E

Make applicable adjustments for C Corporation treatment of items 15 through 21

15. Section 179 deduction................................................

Schedule K, Line 11

________________________ 15. ________________________

16. Contributions ..............................................................

Schedule K, Line 12a

________________________ 16. ________________________

17. Investment interest expense ......................................

Schedule K, Line 12b

________________________ 17. ________________________

18. Section 59(e)(2) expenditures....................................

Schedule K, Line 12c(2)

________________________ 18. ________________________

19. Other deductions (do not include

Domestic Productions Activities Deduction)...............

See Instructions

________________________ 19. ________________________

20. Domestic Production Activities Deduction..................

(If deducted at corporate level) ............................

See Instructions

________________________ 20. ________________________

21. TOTAL DEDUCTIONS

(Sum of lines 15 through 20)...................................

________________________ 21. ________________________

P P A A R R T T I I I I I I - - C C A A L L C C U U L L A A T T I I O O N N O O F F F F E E D D E E R R A A L L T T A A X X A A B B L L E E I I N N C C O O M M E E

22. Federal Taxable Income ...........................................

See Instructions

________________________ 22. ________________________

NYC - ATT-S-CORP 2013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1