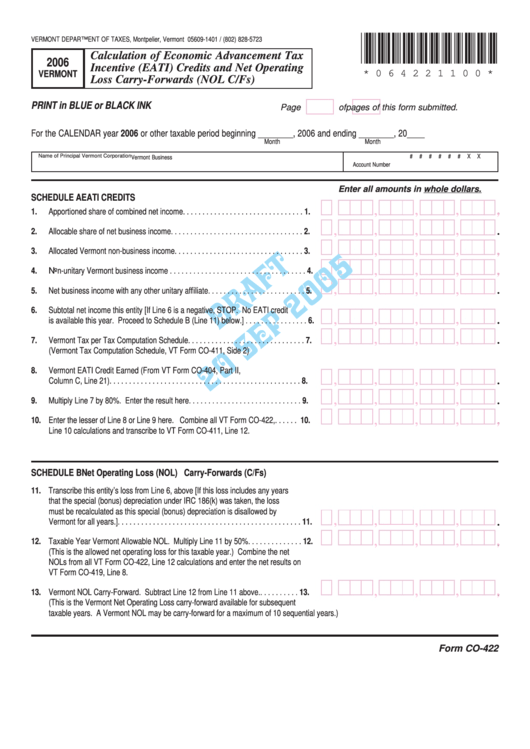

Form Co-422 Draft - Calculation Of Economic Advancement Tax Incentive (Eati) Credits And Net Operating Loss Carry-Forwards (Nol C/fs) - 2006

ADVERTISEMENT

*064191100*

VERMONT DEPARTMENT OF TAXES, Montpelier, Vermont 05609-1401 / (802) 828-5723

Calculation of Economic Advancement Tax

2006

Incentive (EATI) Credits and Net Operating

* 0 6 4 2 2 1 1 0 0 *

VERMONT

Loss Carry-Forwards (NOL C/Fs)

PRINT in BLUE or BLACK INK

Page

of

pages of this form submitted.

For the CALENDAR year 2006 or other taxable period beginning ________, 2006 and ending ________, 20____

Month

Month

Name of Principal Vermont Corporation

#

#

#

#

#

#

X

X

Vermont Business

Account Number

Enter all amounts in whole dollars.

SCHEDULE A

EATI CREDITS

,

,

,

,

.

1.

Apportioned share of combined net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

.

,

,

,

,

2.

Allocable share of net business income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

,

,

,

.

,

3.

Allocated Vermont non-business income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

,

,

,

.

,

4.

Non-unitary Vermont business income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

,

,

,

,

.

5.

Net business income with any other unitary affiliate . . . . . . . . . . . . . . . . . . . . . . . . . 5.

6.

Subtotal net income this entity [If Line 6 is a negative, STOP. No EATI credit

,

,

,

.

,

is available this year. Proceed to Schedule B (Line 11) below.] . . . . . . . . . . . . . . . . 6.

,

,

,

,

.

7.

Vermont Tax per Tax Computation Schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

(Vermont Tax Computation Schedule, VT Form CO-411, Side 2)

8.

Vermont EATI Credit Earned (From VT Form CO-404, Part II,

,

,

,

,

.

Column C, Line 21) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.

,

,

,

.

,

9.

Multiply Line 7 by 80%. Enter the result here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.

,

,

,

.

,

10. Enter the lesser of Line 8 or Line 9 here. Combine all VT Form CO-422, . . . . . . 10.

Line 10 calculations and transcribe to VT Form CO-411, Line 12.

SCHEDULE B

Net Operating Loss (NOL) Carry-Forwards (C/Fs)

11. Transcribe this entity’s loss from Line 6, above [If this loss includes any years

that the special (bonus) depreciation under IRC 186(k) was taken, the loss

must be recalculated as this special (bonus) depreciation is disallowed by

,

,

,

,

.

Vermont for all years.] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.

,

,

,

,

.

12. Taxable Year Vermont Allowable NOL. Multiply Line 11 by 50% . . . . . . . . . . . . . . 12.

(This is the allowed net operating loss for this taxable year.) Combine the net

NOLs from all VT Form CO-422, Line 12 calculations and enter the net results on

VT Form CO-419, Line 8.

,

,

,

,

.

13. Vermont NOL Carry-Forward. Subtract Line 12 from Line 11 above. . . . . . . . . . . 13.

(This is the Vermont Net Operating Loss carry-forward available for subsequent

taxable years. A Vermont NOL may be carry-forward for a maximum of 10 sequential years.)

Form CO-422

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1