Instructions For Preparing The Boe-531-T Schedule T For Boe 401-A And Boe 401-Gs Returns

ADVERTISEMENT

BOE-531-T (BACK) REV. 5 (10-02)

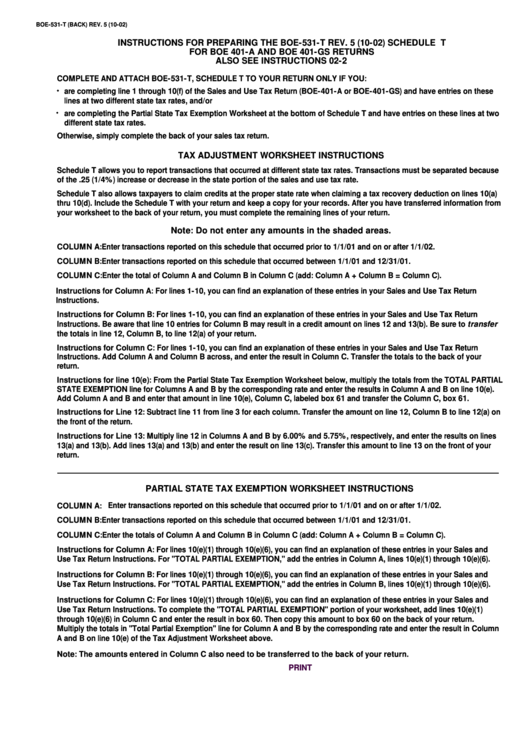

INSTRUCTIONS FOR PREPARING THE BOE-531-T REV. 5 (10-02) SCHEDULE T

FOR BOE 401-A AND BOE 401-GS RETURNS

ALSO SEE INSTRUCTIONS 02-2

COMPLETE AND ATTACH BOE-531-T, SCHEDULE T TO YOUR RETURN ONLY IF YOU:

are completing line 1 through 10(f) of the Sales and Use Tax Return (BOE-401-A or BOE-401-GS) and have entries on these

lines at two different state tax rates, and/or

are completing the Partial State Tax Exemption Worksheet at the bottom of Schedule T and have entries on these lines at two

different state tax rates.

Otherwise, simply complete the back of your sales tax return.

TAX ADJUSTMENT WORKSHEET INSTRUCTIONS

Schedule T allows you to report transactions that occurred at different state tax rates. Transactions must be separated because

of the .25 (1/4%) increase or decrease in the state portion of the sales and use tax rate.

Schedule T also allows taxpayers to claim credits at the proper state rate when claiming a tax recovery deduction on lines 10(a)

thru 10(d). Include the Schedule T with your return and keep a copy for your records. After you have transferred information from

your worksheet to the back of your return, you must complete the remaining lines of your return.

Note: Do not enter any amounts in the shaded areas.

COLUMN A: Enter transactions reported on this schedule that occurred prior to 1/1/01 and on or after 1/1/02.

COLUMN B: Enter transactions reported on this schedule that occurred between 1/1/01 and 12/31/01.

COLUMN C: Enter the total of Column A and Column B in Column C (add: Column A + Column B = Column C).

Instructions for Column A: For lines 1-10, you can find an explanation of these entries in your Sales and Use Tax Return

Instructions.

Instructions for Column B: For lines 1-10, you can find an explanation of these entries in your Sales and Use Tax Return

Instructions. Be aware that line 10 entries for Column B may result in a credit amount on lines 12 and 13(b). Be sure to transfer

the totals in line 12, Column B, to line 12(a) of your return.

Instructions for Column C: For lines 1-10, you can find an explanation of these entries in your Sales and Use Tax Return

Instructions. Add Column A and Column B across, and enter the result in Column C. Transfer the totals to the back of your

return.

Instructions for line 10(e): From the Partial State Tax Exemption Worksheet below, multiply the totals from the TOTAL PARTIAL

STATE EXEMPTION line for Columns A and B by the corresponding rate and enter the results in Column A and B on line 10(e).

Add Column A and B and enter that amount in line 10(e), Column C, labeled box 61 and transfer the Column C, box 61.

Instructions for Line 12: Subtract line 11 from line 3 for each column. Transfer the amount on line 12, Column B to line 12(a) on

the front of the return.

Instructions for Line 13: Multiply line 12 in Columns A and B by 6.00% and 5.75%, respectively, and enter the results on lines

13(a) and 13(b). Add lines 13(a) and 13(b) and enter the result on line 13(c). Transfer this amount to line 13 on the front of your

return.

PARTIAL STATE TAX EXEMPTION WORKSHEET INSTRUCTIONS

COLUMN A:

Enter transactions reported on this schedule that occurred prior to 1/1/01 and on or after 1/1/02.

COLUMN B: Enter transactions reported on this schedule that occurred between 1/1/01 and 12/31/01.

COLUMN C: Enter the totals of Column A and Column B in Column C (add: Column A + Column B = Column C).

Instructions for Column A: For lines 10(e)(1) through 10(e)(6), you can find an explanation of these entries in your Sales and

Use Tax Return Instructions. For "TOTAL PARTIAL EXEMPTION," add the entries in Column A, lines 10(e)(1) through 10(e)(6).

Instructions for Column B: For lines 10(e)(1) through 10(e)(6), you can find an explanation of these entries in your Sales and

Use Tax Return Instructions. For "TOTAL PARTIAL EXEMPTION," add the entries in Column B, lines 10(e)(1) through 10(e)(6).

Instructions for Column C: For lines 10(e)(1) through 10(e)(6), you can find an explanation of these entries in your Sales and

Use Tax Return Instructions. To complete the "TOTAL PARTIAL EXEMPTION" portion of your worksheet, add lines 10(e)(1)

through 10(e)(6) in Column C and enter the result in box 60. Then copy this amount to box 60 on the back of your return.

Multiply the totals in "Total Partial Exemption" line for Column A and B by the corresponding rate and enter the result in Column

A and B on line 10(e) of the Tax Adjustment Worksheet above.

Note: The amounts entered in Column C also need to be transferred to the back of your return.

CLEAR

PRINT

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1