Form Nc-3 - Instructions For Form Nc-3 Annual Withholding Reconciliation

ADVERTISEMENT

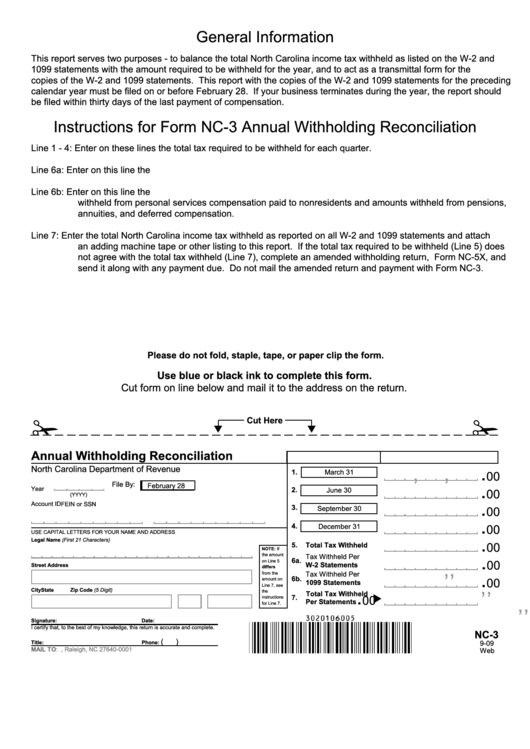

General Information

This report serves two purposes - to balance the total North Carolina income tax withheld as listed on the W-2 and

1099 statements with the amount required to be withheld for the year, and to act as a transmittal form for the N.C.

copies of the W-2 and 1099 statements. This report with the copies of the W-2 and 1099 statements for the preceding

calendar year must be filed on or before February 28. If your business terminates during the year, the report should

be filed within thirty days of the last payment of compensation.

Instructions for Form NC-3 Annual Withholding Reconciliation

Line 1 - 4: Enter on these lines the total tax required to be withheld for each quarter.

Line 6a:

Enter on this line the N.C. income tax withheld from wages as reported on W-2 statements.

Line 6b:

Enter on this line the N.C. income tax withheld as reported on 1099 statements. This includes amounts

withheld from personal services compensation paid to nonresidents and amounts withheld from pensions,

annuities, and deferred compensation.

Line 7:

Enter the total North Carolina income tax withheld as reported on all W-2 and 1099 statements and attach

an adding machine tape or other listing to this report. If the total tax required to be withheld (Line 5) does

not agree with the total tax withheld (Line 7), complete an amended withholding return, Form NC-5X, and

send it along with any payment due. Do not mail the amended return and payment with Form NC-3.

Please do not fold, staple, tape, or paper clip the form.

Use blue or black ink to complete this form.

Cut form on line below and mail it to the address on the return.

Cut Here

Annual Withholding Reconciliation

Quarter Ending

N.C. Income Tax Withheld

.

,

,

North Carolina Department of Revenue

1.

March 31

00

.

,

,

File By:

February 28

Year

2.

June 30

00

(YYYY)

.

,

,

Account ID

FEIN or SSN

3.

September 30

00

.

,

,

4.

December 31

00

USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS

.

,

,

Legal Name (First 21 Characters)

00

5.

Total Tax Withheld

NOTE: If

,

,

.

the amount

Tax Withheld Per

6a.

00

on Line 5

W-2 Statements

Street Address

differs

.

,

,

Tax Withheld Per

from the

6b.

00

amount on

1099 Statements

Line 7, see

.

,

,

City

State

Zip Code (5 Digit)

the

Total Tax Withheld

7.

00

instructions

Per Statements

for Line 7.

Signature:

Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

NC-3

(

)

Title:

Phone:

9-09

MAIL TO: P.O. Box 25000, Raleigh, NC 27640-0001

Web

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1