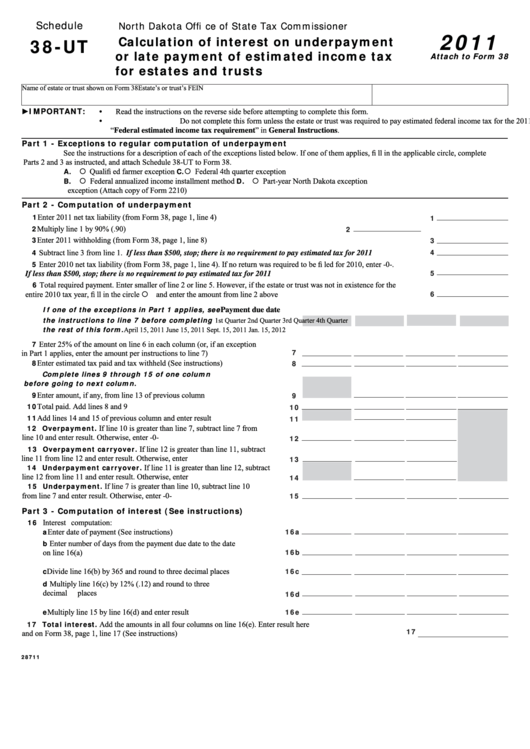

Schedule

North Dakota Offi ce of State Tax Commissioner

2011

Calculation of interest on underpayment

38-UT

or late payment of estimated income tax

Attach to Form 38

for estates and trusts

Name of estate or trust shown on Form 38

Estate’s or trust’s FEIN

►IMPORTANT:

• Read the instructions on the reverse side before attempting to complete this form.

• Do not complete this form unless the estate or trust was required to pay estimated federal income tax for the 2011 tax year. See

“Federal estimated income tax requirement” in General Instructions.

Part 1 - Exceptions to regular computation of underpayment

See the instructions for a description of each of the exceptions listed below. If one of them applies, fi ll in the applicable circle, complete

Parts 2 and 3 as instructed, and attach Schedule 38-UT to Form 38.

A.

Qualifi ed farmer exception

C.

Federal 4th quarter exception

B.

Federal annualized income installment method

D.

Part-year North Dakota exception

exception (Attach copy of Form 2210)

Part 2 - Computation of underpayment

1

Enter 2011 net tax liability (from Form 38, page 1, line 4) .....................................................................................................

1

2

Multiply line 1 by 90% (.90) .........................................................................................................

2

3

Enter 2011 withholding (from Form 38, page 1, line 8) ..........................................................................................................

3

4

4

Subtract line 3 from line 1. If less than $500, stop; there is no requirement to pay estimated tax for 2011 ......................

5

Enter 2010 net tax liability (from Form 38, page 1, line 4). If no return was required to be fi led for 2010, enter -0-.

5

If less than $500, stop; there is no requirement to pay estimated tax for 2011 ...................................................................

6

Total required payment. Enter smaller of line 2 or line 5. However, if the estate or trust was not in existence for the

entire 2010 tax year, fi ll in the circle and enter the amount from line 2 above ...................................................................

6

If one of the exceptions in Part 1 applies, see

Payment due date

the instructions to line 7 before completing

1st Quarter

2nd Quarter

3rd Quarter

4th Quarter

the rest of this form.

April 15, 2011

June 15, 2011

Sept. 15, 2011

Jan. 15, 2012

7

Enter 25% of the amount on line 6 in each column (or, if an exception

7

in Part 1 applies, enter the amount per instructions to line 7) ..........................

8

Enter estimated tax paid and tax withheld (See instructions) ..........................

8

Complete lines 9 through 15 of one column

before going to next column.

9

Enter amount, if any, from line 13 of previous column ...................................

9

10

Total paid. Add lines 8 and 9 ............................................................................

10

11

Add lines 14 and 15 of previous column and enter result ................................

11

12 Overpayment.

If line 10 is greater than line 7, subtract line 7 from

line 10 and enter result. Otherwise, enter -0- ...................................................

12

13 Overpayment carryover.

If line 12 is greater than line 11, subtract

line 11 from line 12 and enter result. Otherwise, enter -0-...............................

13

14 Underpayment carryover.

If line 11 is greater than line 12, subtract

line 12 from line 11 and enter result. Otherwise, enter -0-...............................

14

15 Underpayment.

If line 7 is greater than line 10, subtract line 10

from line 7 and enter result. Otherwise, enter -0- ............................................

15

Part 3 - Computation of interest (See instructions)

16

Interest computation:

a

Enter date of payment (See instructions) ....................................................

16a

b

Enter number of days from the payment due date to the date

16b

on line 16(a) ................................................................................................

c

Divide line 16(b) by 365 and round to three decimal places ......................

16c

d

Multiply line 16(c) by 12% (.12) and round to three

decimal places .............................................................................................

16d

e

Multiply line 15 by line 16(d) and enter result ...........................................

16e

17 Total interest.

Add the amounts in all four columns on line 16(e). Enter result here

17

and on Form 38, page 1, line 17 (See instructions) .......................................................................................................

28711

1

1 2

2