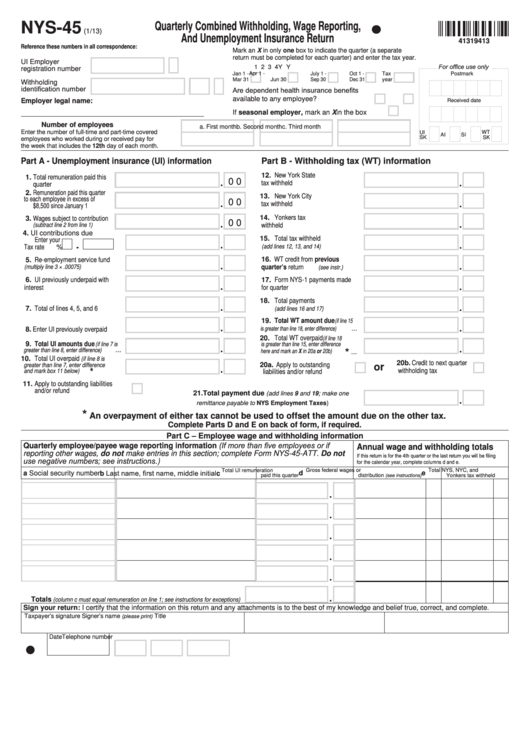

NYS-45

Quarterly Combined Withholding, Wage Reporting,

(1/13)

And Unemployment Insurance Return

41319413

Reference these numbers in all correspondence:

Mark an X in only one box to indicate the quarter (a separate

return must be completed for each quarter) and enter the tax year.

UI Employer

For office use only

1

2

3

4

Y

Y

registration number

Jan 1 -

Apr 1 -

July 1 -

Oct 1 -

Tax

Postmark

Mar 31

Jun 30

Sep 30

Dec 31

year

Withholding

identification number

Are dependent health insurance benefits

Employer legal name:

available to any employee? ..................... Yes

No

Received date

If seasonal employer, mark an X in the box ........

Number of employees

a. First month

b. Second month

c. Third month

Enter the number of full-time and part-time covered

UI

WT

AI

SI

SK

SK

employees who worked during or received pay for

the week that includes the 12th day of each month.

Part A - Unemployment insurance (UI) information

Part B - Withholding tax (WT) information

12. New York State

1. Total remuneration paid this

0 0

tax withheld .........................

quarter .............................

2. Remuneration paid this quarter

13. New York City

to each employee in excess of

0 0

tax withheld .........................

$8,500 since January 1 ...........

14. Yonkers tax

3. Wages subject to contribution

0 0

........

withheld ..............................

(subtract line 2 from line 1)

4. UI contributions due

15. Total tax withheld

Enter your

...........

Tax rate

%

(add lines 12, 13, and 14)

16. WT credit from previous

5. Re-employment service fund

quarter’s return

..............

......

(multiply line 3 × .00075)

(see instr.)

6. UI previously underpaid with

17. Form NYS-1 payments made

interest .................................

for quarter ...........................

18. Total payments

7. Total of lines 4, 5, and 6 ...........

................

(add lines 16 and 17)

19. Total WT amount due

(if line 15

8. Enter UI previously overpaid .....

...

is greater than line 18, enter difference)

20. Total WT overpaid

(if line 18

9. Total UI amounts due

(if line 7 is

is greater than line 15, enter difference

*

...

greater than line 8, enter difference)

here and mark an X in 20a or 20b)

...

10. Total UI overpaid

(if line 8 is

20b. Credit to next quarter

20a. Apply to outstanding

or

greater than line 7, enter difference

*

............

withholding tax .......

and mark box 11 below)

liabilities and/or refund ......

11. Apply to outstanding liabilities

and/or refund .........................

21. Total payment due

(add lines 9 and 19; make one

remittance payable to NYS Employment Taxes)

..........

*

An overpayment of either tax cannot be used to offset the amount due on the other tax.

Complete Parts D and E on back of form, if required.

Part C – Employee wage and withholding information

Quarterly employee/payee wage reporting information (If more than five employees or if

Annual wage and withholding totals

reporting other wages, do not make entries in this section; complete Form NYS-45-ATT. Do not

If this return is for the 4th quarter or the last return you will be filing

use negative numbers; see instructions.)

for the calendar year, complete columns d and e.

a

c

Total UI remuneration

d

Gross federal wages or

e

Total NYS, NYC, and

b

Last name, first name, middle initial

Social security number

paid this quarter

distribution

Yonkers tax withheld

(see instructions)

Totals

(column c must equal remuneration on line 1; see instructions for exceptions)

Sign your return: I certify that the information on this return and any attachments is to the best of my knowledge and belief true, correct, and complete.

Taxpayer’s signature

Signer’s name

Title

(please print)

Date

Telephone number

1

1 2

2