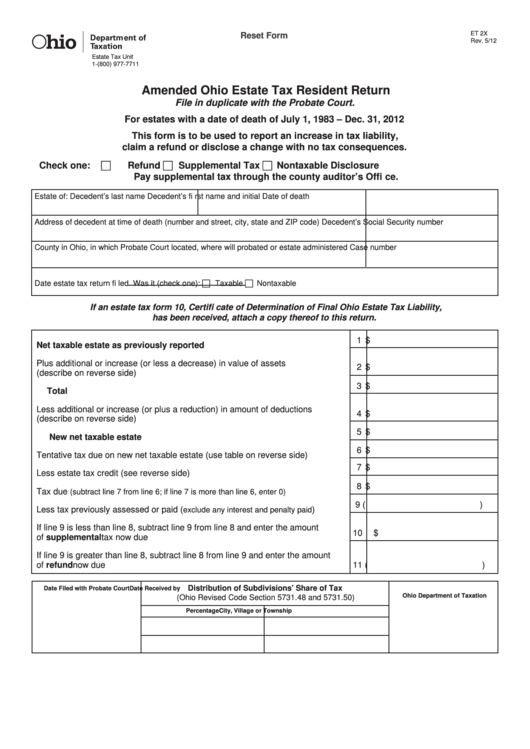

ET 2X

Reset Form

Rev. 5/12

Estate Tax Unit

1-(800) 977-7711

tax.ohio.gov

Amended Ohio Estate Tax Resident Return

File in duplicate with the Probate Court.

For estates with a date of death of July 1, 1983 – Dec. 31, 2012

This form is to be used to report an increase in tax liability,

claim a refund or disclose a change with no tax consequences.

Check one: Refund

Supplemental Tax

Nontaxable Disclosure

Pay supplemental tax through the county auditor’s Offi ce.

Estate of: Decedent’s last name

Decedent’s fi rst name and initial

Date of death

Address of decedent at time of death (number and street, city, state and ZIP code)

Decedent’s Social Security number

County in Ohio, in which Probate Court located, where will probated or estate administered

Case number

Taxable

Nontaxable

Date estate tax return fi led

Was it (check one):

If an estate tax form 10, Certifi cate of Determination of Final Ohio Estate Tax Liability,

has been received, attach a copy thereof to this return.

1

$

Net taxable estate as previously reported ..........................................................

Plus additional or increase (or less a decrease) in value of assets

2

$

(describe on reverse side) .......................................................................................

3

$

Total ............................................................................

Less additional or increase (or plus a reduction) in amount of deductions

4

$

(describe on reverse side) .......................................................................................

5

$

New net taxable estate ..............................................

6

$

Tentative tax due on new net taxable estate (use table on reverse side)................

7

$

Less estate tax credit (see reverse side) .................................................................

8

$

Tax due

.........................

(subtract line 7 from line 6; if line 7 is more than line 6, enter 0)

9

(

)

Less tax previously assessed or paid (

) .............

exclude any interest and penalty paid

If line 9 is less than line 8, subtract line 9 from line 8 and enter the amount

10

$

of supplemental tax now due .................................................................................

If line 9 is greater than line 8, subtract line 8 from line 9 and enter the amount

of refund now due ...................................................................................................

11

(

)

Distribution of Subdivisions’ Share of Tax

Date Filed with Probate Court

Date Received by

Ohio Department of Taxation

(Ohio Revised Code Section 5731.48 and 5731.50)

Percentage

City, Village or Township

1

1 2

2