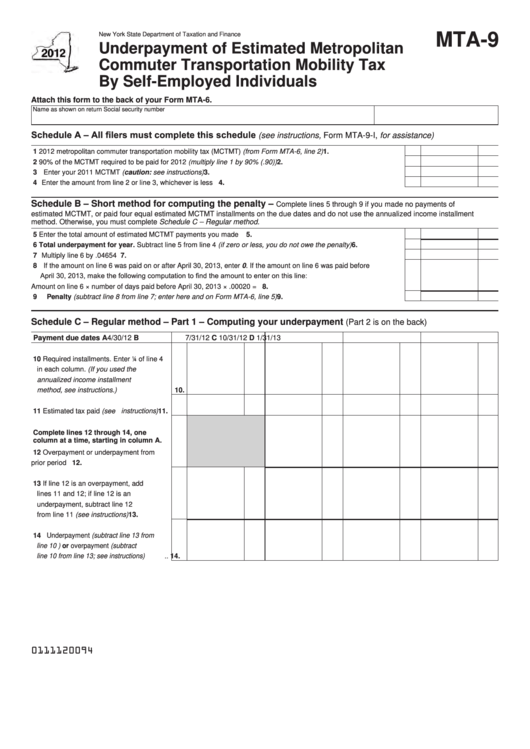

New York State Department of Taxation and Finance

MTA-9

Underpayment of Estimated Metropolitan

Commuter Transportation Mobility Tax

By Self-Employed Individuals

Attach this form to the back of your Form MTA-6.

Name as shown on return

Social security number

Schedule A – All filers must complete this schedule

(see instructions, Form MTA-9-I, for assistance)

1 2012 metropolitan commuter transportation mobility tax (MCTMT) (from Form MTA-6, line 2) .....................................

1.

2 90% of the MCTMT required to be paid for 2012 (multiply line 1 by 90% (.90)) ............................................................

2.

3 Enter your 2011 MCTMT (caution: see instructions) .....................................................................................................

3.

4 Enter the amount from line 2 or line 3, whichever is less ...............................................................................................

4.

Schedule B – Short method for computing the penalty –

Complete lines 5 through 9 if you made no payments of

estimated MCTMT, or paid four equal estimated MCTMT installments on the due dates and do not use the annualized income installment

method. Otherwise, you must complete Schedule C – Regular method.

5 Enter the total amount of estimated MCTMT payments you made ...............................................................................

5.

6 Total underpayment for year. Subtract line 5 from line 4 (if zero or less, you do not owe the penalty) .......................

6.

7 Multiply line 6 by .04654 .................................................................................................................................................

7.

8 If the amount on line 6 was paid on or after April 30, 2013, enter 0. If the amount on line 6 was paid before

April 30, 2013, make the following computation to find the amount to enter on this line:

Amount on line 6 × number of days paid before April 30, 2013 × .00020 = ................................................................

8.

9 Penalty (subtract line 8 from line 7; enter here and on Form MTA-6, line 5) .................................................................

9.

Schedule C – Regular method – Part 1 – Computing your underpayment

(Part 2 is on the back)

Payment due dates

A

4/30/12

B

7/31/12

C 10/31/12

D 1/31/13

10 Required installments. Enter ¼ of line 4

in each column. (If you used the

annualized income installment

method, see instructions.) ................. 10.

11 Estimated tax paid (see instructions) ....

11.

Complete lines 12 through 14, one

column at a time, starting in column A.

12 Overpayment or underpayment from

prior period ........................................ 12.

13 If line 12 is an overpayment, add

lines 11 and 12; if line 12 is an

underpayment, subtract line 12

from line 11 (see instructions) ........... 13.

14 Underpayment (subtract line 13 from

line 10 ) or overpayment (subtract

line 10 from line 13; see instructions) .. 14.

0111120094

1

1 2

2