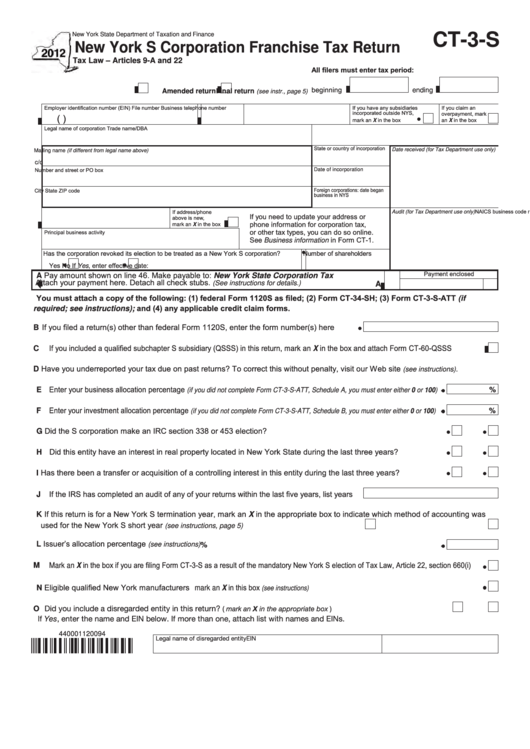

Form Ct-3-S - New York S Corporation Franchise Tax Return - 2012

ADVERTISEMENT

New York State Department of Taxation and Finance

CT-3-S

New York S Corporation Franchise Tax Return

Tax Law – Articles 9-A and 22

All filers must enter tax period:

beginning

ending

Final return

Amended return

(see instr., page 5)

Employer identification number (EIN)

File number

Business telephone number

If you have any subsidiaries

If you claim an

incorporated outside NYS,

overpayment, mark

(

)

mark an X in the box

an X in the box

Legal name of corporation

Trade name/DBA

State or country of incorporation

Date received (for Tax Department use only)

Mailing name (if different from legal name above)

c/o

Number and street or PO box

Date of incorporation

Foreign corporations: date began

City

State

ZIP code

business in NYS

NAICS business code number

If address/phone

Audit (for Tax Department use only)

(from federal return)

If you need to update your address or

above is new,

phone information for corporation tax,

mark an X in the box

or other tax types, you can do so online.

Principal business activity

See Business information in Form CT-1.

Has the corporation revoked its election to be treated as a New York S corporation?

Number of shareholders

Yes

No

If Yes, enter effective date:

Payment enclosed

A Pay amount shown on line 46. Make payable to: New York State Corporation Tax

Attach your payment here. Detach all check stubs.

(See instructions for details.)

A

You must attach a copy of the following: (1) federal Form 1120S as filed; (2) Form CT-34-SH; (3) Form CT-3-S-ATT (if

required; see instructions); and (4) any applicable credit claim forms.

B If you filed a return(s) other than federal Form 1120S, enter the form number(s) here .......

C If you included a qualified subchapter S subsidiary (QSSS) in this return, mark an X in the box and attach Form CT-60-QSSS ...............

D Have you underreported your tax due on past returns? To correct this without penalty, visit our Web site

.

(see instructions)

E Enter your business allocation percentage

%

(if you did not complete Form CT-3-S-ATT, Schedule A, you must enter either 0 or 100)

Enter your investment allocation percentage

F

%

(if you did not complete Form CT-3-S-ATT, Schedule B, you must enter either 0 or 100)

G Did the S corporation make an IRC section 338 or 453 election? ........................................................................ Yes

No

H Did this entity have an interest in real property located in New York State during the last three years? .............. Yes

No

Has there been a transfer or acquisition of a controlling interest in this entity during the last three years? ......... Yes

No

I

If the IRS has completed an audit of any of your returns within the last five years, list years ....

J

K If this return is for a New York S termination year, mark an X in the appropriate box to indicate which method of accounting was

used for the New York S short year

....... Normal accounting rules

Daily pro rata allocation

(see instructions, page 5)

Issuer’s allocation percentage

(see instructions) ..........................................................................................................................

L

%

M Mark an X in the box if you are filing Form CT-3-S as a result of the mandatory New York S election of Tax Law, Article 22, section 660(i) .......

N Eligible qualified New York manufacturers mark an X in this box

.................................................................................

(see instructions)

O Did you include a disregarded entity in this return?

........................................... Yes

No

( mark an X in the appropriate box )

If Yes, enter the name and EIN below. If more than one, attach list with names and EINs.

440001120094

Legal name of disregarded entity

EIN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3