Form Dtf-406 - Claim For Highway Use Tax (Hut) Refund

ADVERTISEMENT

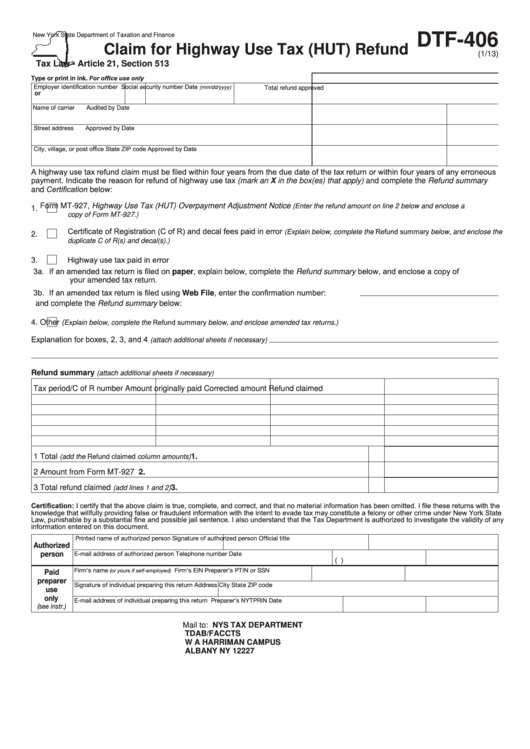

DTF-406

New York State Department of Taxation and Finance

Claim for Highway Use Tax (HUT) Refund

(1/13)

Tax Law - Article 21, Section 513

For office use only

Type or print in ink.

Employer identification number

Social security number

Date

(mm/dd/yyyy)

Total refund approved

or

Name of carrier

Audited by

Date

Street address

Approved by

Date

City, village, or post office

State

ZIP code

Approved by

Date

A highway use tax refund claim must be filed within four years from the due date of the tax return or within four years of any erroneous

payment. Indicate the reason for refund of highway use tax (mark an X in the box(es) that apply) and complete the Refund summary

and Certification below:

Form MT-927, Highway Use Tax (HUT) Overpayment Adjustment Notice

(Enter the refund amount on line 2 below and enclose a

1.

copy of Form MT-927.)

2.

Certificate of Registration (C of R) and decal fees paid in error

(Explain below, complete the Refund summary below, and enclose the

duplicate C of R(s) and decal(s).)

3.

Highway use tax paid in error

3a. If an amended tax return is filed on paper, explain below, complete the Refund summary below, and enclose a copy of

your amended tax return.

3b. If an amended tax return is filed using Web File, enter the confirmation number:

and complete the Refund summary below:

Explain below, complete the Refund summary below, and enclose amended tax returns.)

4.

Other (

Explanation for boxes, 2, 3, and 4

(attach additional sheets if necessary)

Refund summary

(attach additional sheets if necessary)

Tax period/C of R number

Amount originally paid

Corrected amount

Refund claimed

1

Total

.............................................................................

1.

(add the Refund claimed column amounts)

2

Amount from Form MT-927 .......................................................................................................

2.

3

Total refund claimed

.......................................................................................

3.

(add lines 1 and 2)

Certification: I certify that the above claim is true, complete, and correct, and that no material information has been omitted. I file these returns with the

knowledge that willfully providing false or fraudulent information with the intent to evade tax may constitute a felony or other crime under New York State

Law, punishable by a substantial fine and possible jail sentence. I also understand that the Tax Department is authorized to investigate the validity of any

information entered on this document.

Printed name of authorized person

Signature of authorized person

Official title

Authorized

person

E-mail address of authorized person

Telephone number

Date

(

)

Firm’s name

Firm’s EIN

Preparer’s PTIN or SSN

Paid

(or yours if self-employed)

preparer

Signature of individual preparing this return

Address

City

State

ZIP code

use

only

E-mail address of individual preparing this return

Preparer’s NYTPRIN

Date

(see instr.)

Mail to: NYS TAX DEPARTMENT

TDAB/FACCTS

W A HARRIMAN CAMPUS

ALBANY NY 12227

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2