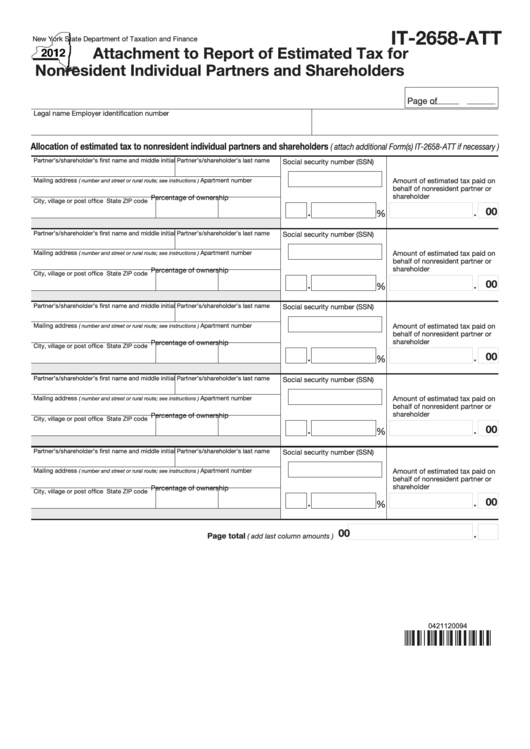

IT-2658-ATT

New York State Department of Taxation and Finance

Attachment to Report of Estimated Tax for

Nonresident Individual Partners and Shareholders

Page

of

Legal name

Employer identification number

Allocation of estimated tax to nonresident individual partners and shareholders

( attach additional Form(s) IT-2658-ATT if necessary )

Partner’s/shareholder’s first name and middle initial

Partner’s/shareholder’s last name

Social security number (SSN)

Mailing address

Apartment number

Amount of estimated tax paid on

( number and street or rural route; see instructions )

behalf of nonresident partner or

shareholder

Percentage of ownership

City, village or post office

State

ZIP code

00

%

Partner’s/shareholder’s first name and middle initial

Partner’s/shareholder’s last name

Social security number (SSN)

Mailing address

Apartment number

Amount of estimated tax paid on

( number and street or rural route; see instructions )

behalf of nonresident partner or

shareholder

Percentage of ownership

City, village or post office

State

ZIP code

00

%

Partner’s/shareholder’s first name and middle initial

Partner’s/shareholder’s last name

Social security number (SSN)

Mailing address

Apartment number

Amount of estimated tax paid on

( number and street or rural route; see instructions )

behalf of nonresident partner or

shareholder

Percentage of ownership

City, village or post office

State

ZIP code

00

%

Partner’s/shareholder’s first name and middle initial

Partner’s/shareholder’s last name

Social security number (SSN)

Mailing address

Apartment number

Amount of estimated tax paid on

( number and street or rural route; see instructions )

behalf of nonresident partner or

shareholder

Percentage of ownership

City, village or post office

State

ZIP code

00

%

Partner’s/shareholder’s first name and middle initial

Partner’s/shareholder’s last name

Social security number (SSN)

Mailing address

Apartment number

Amount of estimated tax paid on

( number and street or rural route; see instructions )

behalf of nonresident partner or

shareholder

Percentage of ownership

City, village or post office

State

ZIP code

00

%

00

Page total

.....

( add last column amounts )

0421120094

1

1 2

2