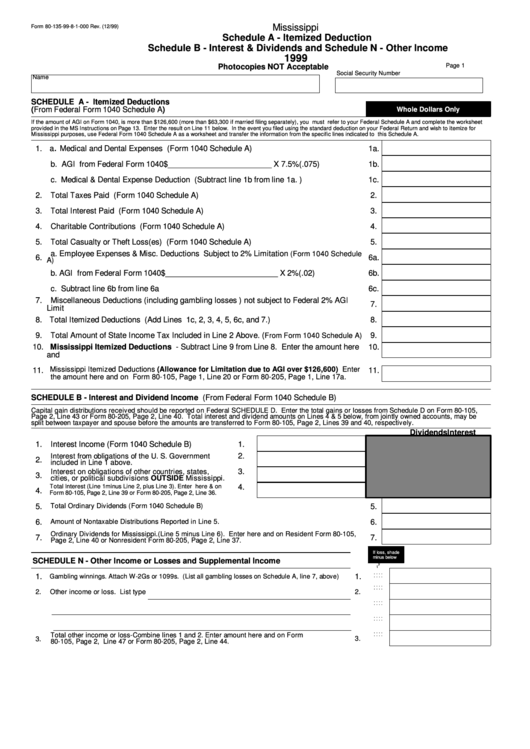

Form 80-135-99-8-1-000 - Schedule A - Itemized Deduction Schedule B - Interest & Dividends And Schedule N - Other Income - 1999

ADVERTISEMENT

Mississippi

Form 80-135-99-8-1-000 Rev. (12/99)

Schedule A - Itemized Deduction

Schedule B - Interest & Dividends and Schedule N - Other Income

1999

Page 1

Photocopies NOT Acceptable

Social Security Number

Name

SCHEDULE A - Itemized Deductions

(From Federal Form 1040 Schedule A)

Whole Dollars Only

If the amount of AGI on Form 1040, is more than $126,600 (more than $63,300 if married filing separately), you must refer to your Federal Schedule A and complete the worksheet

provided in the MS Instructions on Page 13. Enter the result on Line 11 below. In the event you filed using the standard deduction on your Federal Return and wish to itemize for

Mississippi purposes, use Federal Form 1040 Schedule A as a worksheet and transfer the information from the specific lines indicated to this Schedule A.

.

a

Medical and Dental Expenses (Form 1040 Schedule A)

1.

1a.

b. AGI from Federal Form 1040 $________________________ X 7.5%(.075)

1b.

c. Medical & Dental Expense Deduction (Subtract line 1b from line 1a. )

1c.

2.

Total Taxes Paid (Form 1040 Schedule A)

2.

3.

Total Interest Paid (Form 1040 Schedule A)

3.

4.

Charitable Contributions (Form 1040 Schedule A)

4.

5.

Total Casualty or Theft Loss(es) (Form 1040 Schedule A)

5.

a. Employee Expenses & Misc. Deductions Subject to 2% Limitation

(Form 1040 Schedule

6.

6a.

A)

b. AGI from Federal Form 1040 $__________________________ X 2%(.02)

6b.

c. Subtract line 6b from line 6a

6c.

7.

Miscellaneous Deductions (including gambling losses ) not subject to Federal 2% AGI

7.

Limit

Total Itemized Deductions (Add Lines 1c, 2, 3, 4, 5, 6c, and 7.)

8.

8.

9.

Total Amount of State Income Tax Included in Line 2 Above. (

9.

From Form 1040 Schedule A)

10. Mississippi Itemized Deductions - Subtract Line 9 from Line 8. Enter the amount here

10.

and

Mississippi Itemized Deductions (Allowance for Limitation due to AGI over $126,600) Enter

11.

11.

the amount here and on Form 80-105, Page 1, Line 20 or Form 80-205, Page 1, Line 17a.

SCHEDULE B - Interest and Dividend Income (From Federal Form 1040 Schedule B)

Capital gain distributions received should be reported on Federal SCHEDULE D. Enter the total gains or losses from Schedule D on Form 80-105,

Page 2, Line 43 or Form 80-205, Page 2, Line 40. Total interest and dividend amounts on Lines 4 & 5 below, from jointly owned accounts, may be

split between taxpayer and spouse before the amounts are transferred to Form 80-105, Page 2, Lines 39 and 40, respectively.

Interest

Dividends

1.

Interest Income (Form 1040 Schedule B)

1.

2.

Interest from obligations of the U. S. Government

2.

included in Line 1 above.

3.

Interest on obligations of other countries, states,

3.

cities, or political subdivisions OUTSIDE Mississippi.

4.

Total Interest (Line 1 minus Line 2, plus Line 3). Enter here & on

4.

Form 80-105, Page 2, Line 39 or Form 80-205, Page 2, Line 36.

5.

Total Ordinary Dividends (Form 1040 Schedule B)

5.

Amount of Nontaxable Distributions Reported in Line 5.

6.

6.

Ordinary Dividends for Mississippi.(Line 5 minus Line 6). Enter here and on Resident Form 80-105,

7.

7.

Page 2, Line 40 or Nonresident Form 80-205, Page 2, Line 37.

If loss, shade

minus below

SCHEDULE N - Other Income or Losses and Supplemental Income

y

t

. . . .

1.

Gambling winnings. Attach W-2Gs or 1099s. (List all gambling losses on Schedule A, line 7, above)

1.

. . . .

. . . .

. . . .

2.

Other income or loss. List type

2.

. . . .

. . . .

. . . .

. . . .

. . . .

Total other income or loss-Combine lines 1 and 2. Enter amount here and on Form

. . . .

3.

3.

80-105, Page 2, Line 47 or Form 80-205, Page 2, Line 44.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2