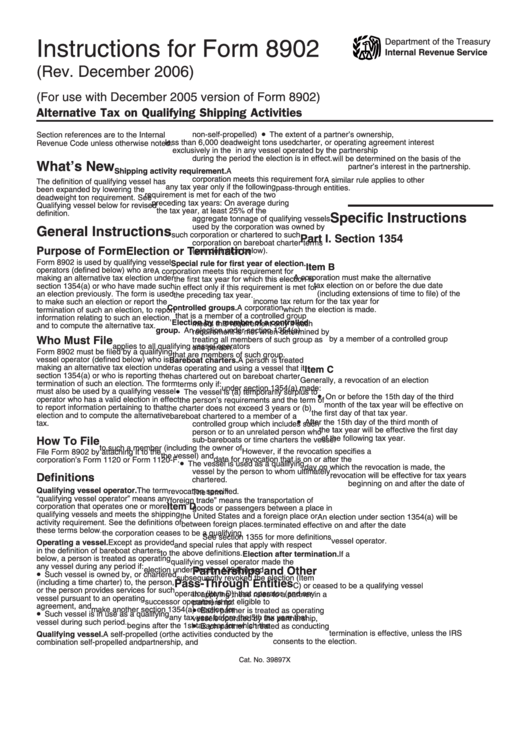

Instructions For Form 8902 - Alternative Tax On Qualifying Shipping Activities

ADVERTISEMENT

Department of the Treasury

Instructions for Form 8902

Internal Revenue Service

(Rev. December 2006)

(For use with December 2005 version of Form 8902)

Alternative Tax on Qualifying Shipping Activities

•

non-self-propelled) U.S. flag vessel of not

The extent of a partner’s ownership,

Section references are to the Internal

less than 6,000 deadweight tons used

charter, or operating agreement interest

Revenue Code unless otherwise noted.

exclusively in the U.S. foreign trade

in any vessel operated by the partnership

during the period the election is in effect.

will be determined on the basis of the

What’s New

partner’s interest in the partnership.

Shipping activity requirement. A

corporation meets this requirement for

A similar rule applies to other

The definition of qualifying vessel has

any tax year only if the following

pass-through entities.

been expanded by lowering the

requirement is met for each of the two

deadweight ton requirement. See

preceding tax years: On average during

Qualifying vessel below for revised

the tax year, at least 25% of the

definition.

Specific Instructions

aggregate tonnage of qualifying vessels

used by the corporation was owned by

General Instructions

such corporation or chartered to such

Part I. Section 1354

corporation on bareboat charter terms

Purpose of Form

Election or Termination

(see definition below).

Form 8902 is used by qualifying vessel

Special rule for first year of election.

Item B

operators (defined below) who are

A corporation meets this requirement for

A corporation must make the alternative

making an alternative tax election under

the first tax year for which this election is

tax election on or before the due date

section 1354(a) or who have made such

in effect only if this requirement is met for

an election previously. The form is used

(including extensions of time to file) of the

the preceding tax year.

income tax return for the tax year for

to make such an election or report the

Controlled groups. A corporation

which the election is made.

termination of such an election, to report

that is a member of a controlled group

information relating to such an election,

Election by a member of a controlled

meets this requirement only if such

and to compute the alternative tax.

group. An election under section 1354(a)

requirement is met when determined by

by a member of a controlled group

Who Must File

treating all members of such group as

applies to all qualifying vessel operators

one person.

Form 8902 must be filed by a qualifying

that are members of such group.

vessel operator (defined below) who is

Bareboat charters. A person is treated

making an alternative tax election under

as operating and using a vessel that it

Item C

section 1354(a) or who is reporting the

has chartered out on bareboat charter

Generally, a revocation of an election

termination of such an election. The form

terms only if:

under section 1354(a) made:

•

must also be used by a qualifying vessel

The vessel is (a) temporarily surplus to

•

On or before the 15th day of the third

operator who has a valid election in effect

the person’s requirements and the term of

month of the tax year will be effective on

to report information pertaining to that

the charter does not exceed 3 years or (b)

the first day of that tax year.

election and to compute the alternative

bareboat chartered to a member of a

•

After the 15th day of the third month of

tax.

controlled group which includes such

the tax year will be effective the first day

person or to an unrelated person who

of the following tax year.

How To File

sub-bareboats or time charters the vessel

to such a member (including the owner of

However, if the revocation specifies a

File Form 8902 by attaching it to the

the vessel) and

date for revocation that is on or after the

corporation’s Form 1120 or Form 1120-F.

•

The vessel is used as a qualifying

day on which the revocation is made, the

vessel by the person to whom ultimately

revocation will be effective for tax years

Definitions

chartered.

beginning on and after the date of

Qualifying vessel operator. The term

revocation specified.

U.S. foreign trade. The term “U.S.

“qualifying vessel operator” means any

foreign trade” means the transportation of

Item D

corporation that operates one or more

goods or passengers between a place in

qualifying vessels and meets the shipping

the United States and a foreign place or

An election under section 1354(a) will be

activity requirement. See the definitions of

between foreign places.

terminated effective on and after the date

these terms below.

the corporation ceases to be a qualifying

See section 1355 for more definitions

vessel operator.

Operating a vessel. Except as provided

and special rules that apply with respect

in the definition of bareboat charters

to the above definitions.

Election after termination. If a

below, a person is treated as operating

qualifying vessel operator made the

any vessel during any period if:

Partnerships and Other

election under section 1354(a) and

•

Such vessel is owned by, or chartered

subsequently revoked the election (Item

(including a time charter) to, the person,

Pass-Through Entities

C) or ceased to be a qualifying vessel

or the person provides services for such

operator (Item D), that operator (and any

In applying these rules to a partner in a

vessel pursuant to an operating

successor operator) is not eligible to

partnership:

agreement, and

•

make another section 1354(a) election for

Each partner is treated as operating

•

Such vessel is in use as a qualifying

any tax year before the 5th tax year that

vessels operated by the partnership,

vessel during such period.

•

begins after the 1st tax year for which the

Each partner is treated as conducting

termination is effective, unless the IRS

Qualifying vessel. A self-propelled (or

the activities conducted by the

consents to the election.

combination self-propelled and

partnership, and

Cat. No. 39897X

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2