Instructions For Form C-8000itc - Investment Tax Credit

ADVERTISEMENT

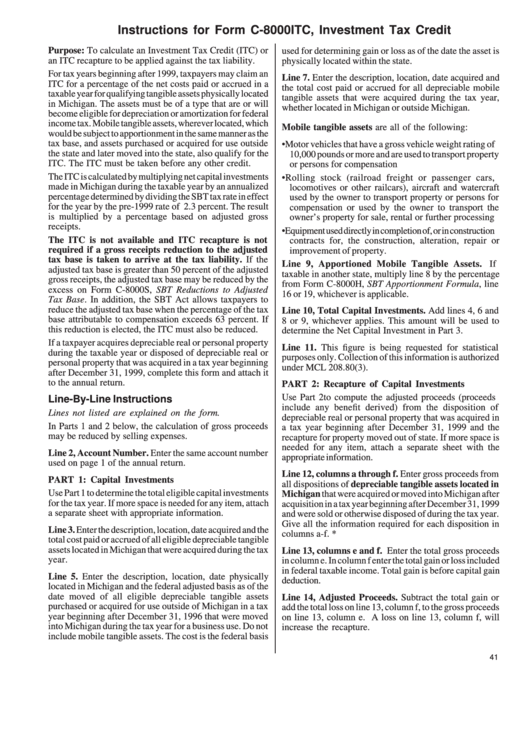

Instructions for Form C-8000ITC, Investment Tax Credit

Purpose: To calculate an Investment Tax Credit (ITC) or

used for determining gain or loss as of the date the asset is

an ITC recapture to be applied against the tax liability.

physically located within the state.

For tax years beginning after 1999, taxpayers may claim an

Line 7. Enter the description, location, date acquired and

ITC for a percentage of the net costs paid or accrued in a

the total cost paid or accrued for all depreciable mobile

taxable year for qualifying tangible assets physically located

tangible assets that were acquired during the tax year,

in Michigan. The assets must be of a type that are or will

whether located in Michigan or outside Michigan.

become eligible for depreciation or amortization for federal

income tax. Mobile tangible assets, wherever located, which

Mobile tangible assets are all of the following:

would be subject to apportionment in the same manner as the

tax base, and assets purchased or acquired for use outside

• Motor vehicles that have a gross vehicle weight rating of

the state and later moved into the state, also qualify for the

10,000 pounds or more and are used to transport property

ITC. The ITC must be taken before any other credit.

or persons for compensation

The ITC is calculated by multiplying net capital investments

• Rolling stock (railroad freight or passenger cars,

made in Michigan during the taxable year by an annualized

locomotives or other railcars), aircraft and watercraft

percentage determined by dividing the SBT tax rate in effect

used by the owner to transport property or persons for

for the year by the pre-1999 rate of 2.3 percent. The result

compensation or used by the owner to transport the

is multiplied by a percentage based on adjusted gross

owner’s property for sale, rental or further processing

receipts.

• Equipment used directly in completion of, or in construction

The ITC is not available and ITC recapture is not

contracts for, the construction, alteration, repair or

required if a gross receipts reduction to the adjusted

improvement of property.

tax base is taken to arrive at the tax liability. If the

Line 9, Apportioned Mobile Tangible Assets.

If

adjusted tax base is greater than 50 percent of the adjusted

taxable in another state, multiply line 8 by the percentage

gross receipts, the adjusted tax base may be reduced by the

from Form C-8000H, SBT Apportionment Formula, line

excess on Form C-8000S, SBT Reductions to Adjusted

16 or 19, whichever is applicable.

Tax Base. In addition, the SBT Act allows taxpayers to

reduce the adjusted tax base when the percentage of the tax

Line 10, Total Capital Investments. Add lines 4, 6 and

base attributable to compensation exceeds 63 percent. If

8 or 9, whichever applies. This amount will be used to

this reduction is elected, the ITC must also be reduced.

determine the Net Capital Investment in Part 3.

If a taxpayer acquires depreciable real or personal property

Line 11. This figure is being requested for statistical

during the taxable year or disposed of depreciable real or

purposes only. Collection of this information is authorized

personal property that was acquired in a tax year beginning

under MCL 208.80(3).

after December 31, 1999, complete this form and attach it

to the annual return.

PART 2: Recapture of Capital Investments

Use Part 2 to compute the adjusted proceeds (proceeds

Line-By-Line Instructions

include any benefit derived) from the disposition of

Lines not listed are explained on the form.

depreciable real or personal property that was acquired in

In Parts 1 and 2 below, the calculation of gross proceeds

a tax year beginning after December 31, 1999 and the

may be reduced by selling expenses.

recapture for property moved out of state. If more space is

needed for any item, attach a separate sheet with the

Line 2, Account Number. Enter the same account number

appropriate information.

used on page 1 of the annual return.

Line 12, columns a through f. Enter gross proceeds from

PART 1: Capital Investments

all dispositions of depreciable tangible assets located in

Use Part 1 to determine the total eligible capital investments

Michigan that were acquired or moved into Michigan after

for the tax year. If more space is needed for any item, attach

acquisition in a tax year beginning after December 31, 1999

a separate sheet with appropriate information.

and were sold or otherwise disposed of during the tax year.

Give all the information required for each disposition in

Line 3. Enter the description, location, date acquired and the

columns a-f. *

total cost paid or accrued of all eligible depreciable tangible

assets located in Michigan that were acquired during the tax

Line 13, columns e and f. Enter the total gross proceeds

year.

in column e. In column f enter the total gain or loss included

in federal taxable income. Total gain is before capital gain

Line 5. Enter the description, location, date physically

deduction.

located in Michigan and the federal adjusted basis as of the

date moved of all eligible depreciable tangible assets

Line 14, Adjusted Proceeds. Subtract the total gain or

purchased or acquired for use outside of Michigan in a tax

add the total loss on line 13, column f, to the gross proceeds

year beginning after December 31, 1996 that were moved

on line 13, column e. A loss on line 13, column f, will

into Michigan during the tax year for a business use. Do not

increase the recapture.

include mobile tangible assets. The cost is the federal basis

41

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2