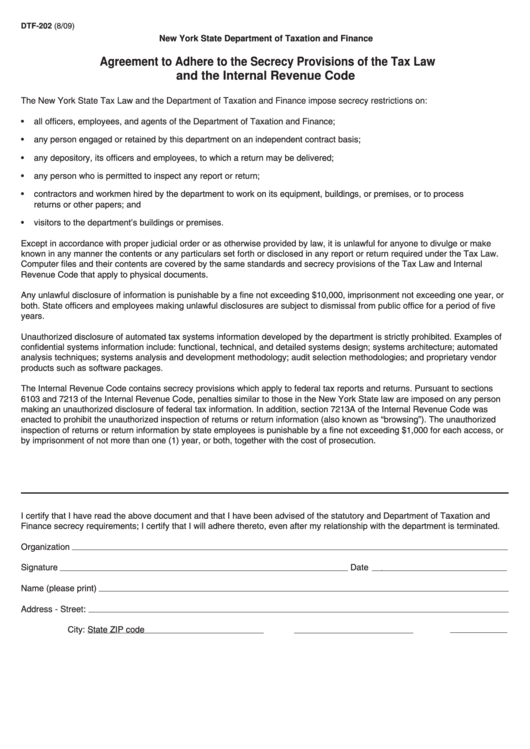

Form Dtf-202 - Agreement To Adhere To The Secrecy Provisions Of The Tax Law And The Internal Revenue Code

ADVERTISEMENT

DTF-202 (8/09)

New York State Department of Taxation and Finance

Agreement to Adhere to the Secrecy Provisions of the Tax Law

and the Internal Revenue Code

The New York State Tax Law and the Department of Taxation and Finance impose secrecy restrictions on:

•

all officers, employees, and agents of the Department of Taxation and Finance;

•

any person engaged or retained by this department on an independent contract basis;

•

any depository, its officers and employees, to which a return may be delivered;

•

any person who is permitted to inspect any report or return;

•

contractors and workmen hired by the department to work on its equipment, buildings, or premises, or to process

returns or other papers; and

•

visitors to the department’s buildings or premises.

Except in accordance with proper judicial order or as otherwise provided by law, it is unlawful for anyone to divulge or make

known in any manner the contents or any particulars set forth or disclosed in any report or return required under the Tax Law.

Computer files and their contents are covered by the same standards and secrecy provisions of the Tax Law and Internal

Revenue Code that apply to physical documents.

Any unlawful disclosure of information is punishable by a fine not exceeding $10,000, imprisonment not exceeding one year, or

both. State officers and employees making unlawful disclosures are subject to dismissal from public office for a period of five

years.

Unauthorized disclosure of automated tax systems information developed by the department is strictly prohibited. Examples of

confidential systems information include: functional, technical, and detailed systems design; systems architecture; automated

analysis techniques; systems analysis and development methodology; audit selection methodologies; and proprietary vendor

products such as software packages.

The Internal Revenue Code contains secrecy provisions which apply to federal tax reports and returns. Pursuant to sections

6103 and 7213 of the Internal Revenue Code, penalties similar to those in the New York State law are imposed on any person

making an unauthorized disclosure of federal tax information. In addition, section 7213A of the Internal Revenue Code was

enacted to prohibit the unauthorized inspection of returns or return information (also known as “browsing”). The unauthorized

inspection of returns or return information by state employees is punishable by a fine not exceeding $1,000 for each access, or

by imprisonment of not more than one (1) year, or both, together with the cost of prosecution.

I certify that I have read the above document and that I have been advised of the statutory and Department of Taxation and

Finance secrecy requirements; I certify that I will adhere thereto, even after my relationship with the department is terminated.

Organization

Signature

Date

Name (please print)

Address - Street:

City:

State

ZIP code

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2