Form Rpd-41072 - Annual Summary Of Withholding Tax For Crs-1 Filers - State Of New Mexico Taxation And Revenue Department

ADVERTISEMENT

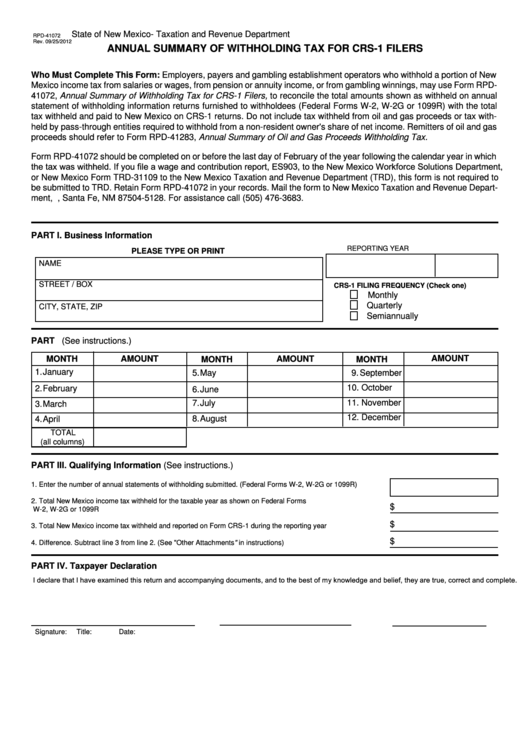

State of New Mexico - Taxation and Revenue Department

RPD-41072

Rev. 09/25/2012

ANNUAL SUMMARY OF WITHHOLDING TAX FOR CRS-1 FILERS

Who Must Complete This Form: Employers, payers and gambling establishment operators who withhold a portion of New

Mexico income tax from salaries or wages, from pension or annuity income, or from gambling winnings, may use Form RPD-

41072, Annual Summary of Withholding Tax for CRS-1 Filers, to reconcile the total amounts shown as withheld on annual

statement of withholding information returns furnished to withholdees (Federal Forms W-2, W-2G or 1099R) with the total

tax withheld and paid to New Mexico on CRS-1 returns. Do not include tax withheld from oil and gas proceeds or tax with-

held by pass-through entities required to withhold from a non-resident owner's share of net income. Remitters of oil and gas

proceeds should refer to Form RPD-41283, Annual Summary of Oil and Gas Proceeds Withholding Tax.

Form RPD-41072 should be completed on or before the last day of February of the year following the calendar year in which

the tax was withheld. If you file a wage and contribution report, ES903, to the New Mexico Workforce Solutions Department,

or New Mexico Form TRD-31109 to the New Mexico Taxation and Revenue Department (TRD), this form is not required to

be submitted to TRD. Retain Form RPD-41072 in your records. Mail the form to New Mexico Taxation and Revenue Depart-

ment, P.O. Box 25128, Santa Fe, NM 87504-5128. For assistance call (505) 476-3683.

PART I. Business Information

N.M. CRS ID NUMBER

REPORTING YEAR

PLEASE TYPE OR PRINT

NAME

STREET / BOX

CRS-1 FILING FREQUENCY (Check one)

Monthly

Quarterly

CITY, STATE, ZIP

Semiannually

PART II. Schedule of New Mexico Income Tax Withheld and Reported on Form CRS-1 (See instructions.)

AMOUNT

MONTH

AMOUNT

AMOUNT

MONTH

MONTH

1. January

5. May

9. September

10. October

2. February

6. June

7. July

11. November

3. March

12. December

8. August

4. April

TOTAL

(all columns)

PART III. Qualifying Information (See instructions.)

1.

Enter the number of annual statements of withholding submitted. (Federal Forms W-2, W-2G or 1099R) ..........

2.

Total New Mexico income tax withheld for the taxable year as shown on Federal Forms

$

W-2, W-2G or 1099R .............................................................................................................................................

$

3.

Total New Mexico income tax withheld and reported on Form CRS-1 during the reporting year ..........................

$

4.

Difference. Subtract line 3 from line 2. (See "Other Attachments" in instructions) ................................................

PART IV. Taxpayer Declaration

I declare that I have examined this return and accompanying documents, and to the best of my knowledge and belief, they are true, correct and complete.

Signature:

Title:

Date:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2