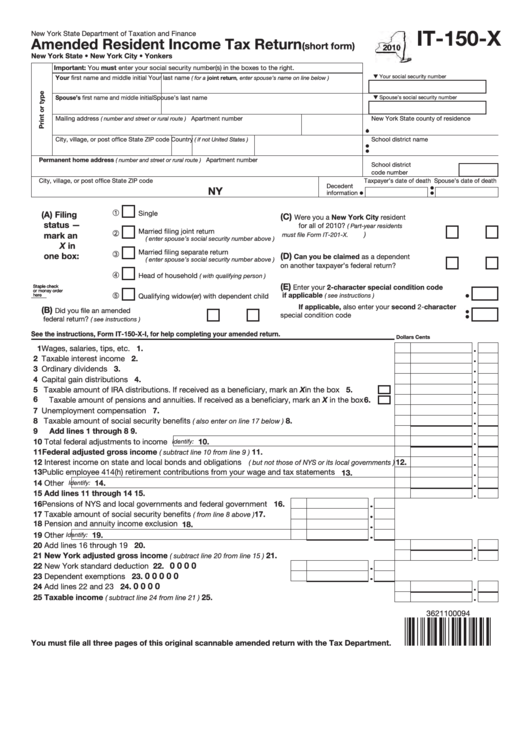

IT-150-X

New York State Department of Taxation and Finance

Amended Resident Income Tax Return

(short form)

New York State • New York City • Yonkers

Important: You must enter your social security number(s) in the boxes to the right.

Your social security number

Your first name and middle initial

Your last name

( for a joint return, enter spouse’s name on line below )

Spouse’s first name and middle initial

Spouse’s last name

Spouse’s social security number

Mailing address

( number and street or rural route )

Apartment number

New York State county of residence

City, village, or post office

State

ZIP code

Country

School district name

( if not United States )

Permanent home address

Apartment number

( number and street or rural route )

School district

code number .........................

City, village, or post office

State

ZIP code

Taxpayer’s date of death

Spouse’s date of death

Decedent

NY

information

(A) Filing

Single

(C)

Were you a New York City resident

status —

for all of 2010?

( Part-year residents

Married filing joint return

mark an

) ............................... Yes

No

must file Form IT-201-X.

( enter spouse’s social security number above )

X in

Married filing separate return

one box:

(D)

Can you be claimed as a dependent

( enter spouse’s social security number above )

on another taxpayer’s federal return? ....... Yes

No

Head of household

( with qualifying person )

(E)

Enter your 2‑character special condition code

Staple check

Staple check

or money order

or money order

if applicable

......................................

Qualifying widow(er) with dependent child

( see instructions )

here

here

If applicable, also enter your second 2-character

(B)

Did you file an amended

special condition code ...............................................

federal return?

................. Yes

No

( see instructions )

See the instructions, Form IT‑150‑X‑I, for help completing your amended return.

Dollars

Cents

1 Wages, salaries, tips, etc. ...................................................................................................................

1.

2 Taxable interest income ......................................................................................................................

2.

3 Ordinary dividends ..............................................................................................................................

3.

4 Capital gain distributions ....................................................................................................................

4.

5 Taxable amount of IRA distributions. If received as a beneficiary, mark an X in the box ...........

5.

6 Taxable amount of pensions and annuities. If received as a beneficiary, mark an X in the box ....

6.

7 Unemployment compensation ............................................................................................................

7.

8 Taxable amount of social security benefits

8.

...............................................

( also enter on line 17 below )

9 Add lines 1 through 8 ........................................................................................................................

9.

10 Total federal adjustments to income

10.

Identify:

11 Federal adjusted gross income

.............................................................. 11.

( subtract line 10 from line 9 )

12 Interest income on state and local bonds and obligations

12.

( but not those of NYS or its local governments )

13 Public employee 414(h) retirement contributions from your wage and tax statements ..................... 13.

14 Other

14.

Identify:

15 Add lines 11 through 14 .................................................................................................................... 15.

16 Pensions of NYS and local governments and federal government .... 16.

17 Taxable amount of social security benefits

............. 17.

( from line 8 above )

18 Pension and annuity income exclusion ............................................... 18.

19 Other

19.

Identify:

20 Add lines 16 through 19 ...................................................................................................................... 20.

21 New York adjusted gross income

......................................................... 21.

( subtract line 20 from line 15 )

0 0

0 0

22 New York standard deduction ............................................................. 22.

0 0 0

0 0

23 Dependent exemptions ....................................................................... 23.

0 0

0 0

24 Add lines 22 and 23 ............................................................................................................................ 24.

25 Taxable income

...................................................................................... 25.

( subtract line 24 from line 21 )

3621100094

You must file all three pages of this original scannable amended return with the Tax Department.

1

1 2

2 3

3