Form Rpd-41290 - High-Wage Jobs Tax Credit Claim Form - State Of New Mexico Taxation And Revenue Department

ADVERTISEMENT

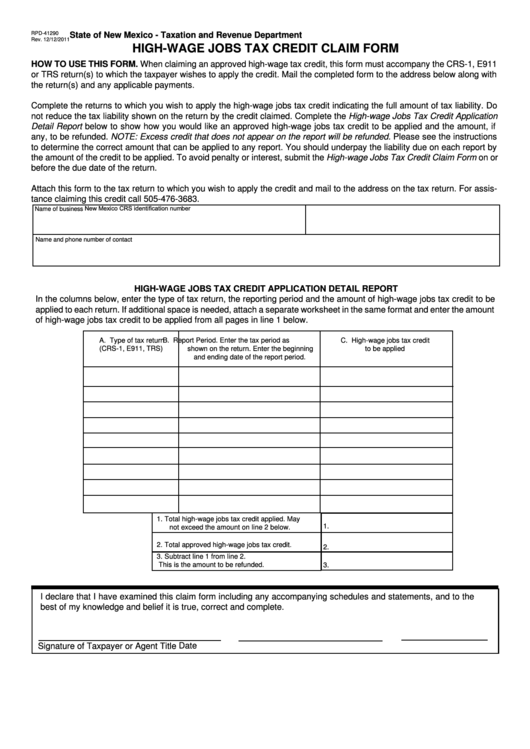

RPD-41290

State of New Mexico - Taxation and Revenue Department

Rev. 12/12/2011

HIGH-WAGE JOBS TAX CREDIT CLAIM FORM

HOW TO USE THIS FORM. When claiming an approved high-wage tax credit, this form must accompany the CRS-1, E911

or TRS return(s) to which the taxpayer wishes to apply the credit. Mail the completed form to the address below along with

the return(s) and any applicable payments.

Complete the returns to which you wish to apply the high-wage jobs tax credit indicating the full amount of tax liability. Do

not reduce the tax liability shown on the return by the credit claimed. Complete the High-wage Jobs Tax Credit Application

Detail Report below to show how you would like an approved high-wage jobs tax credit to be applied and the amount, if

any, to be refunded. NOTE: Excess credit that does not appear on the report will be refunded. Please see the instructions

to determine the correct amount that can be applied to any report. You should underpay the liability due on each report by

the amount of the credit to be applied. To avoid penalty or interest, submit the High-wage Jobs Tax Credit Claim Form on or

before the due date of the return.

Attach this form to the tax return to which you wish to apply the credit and mail to the address on the tax return. For assis-

tance claiming this credit call 505-476-3683.

New Mexico CRS identification number

Name of business

Name and phone number of contact

HIGH-WAGE JOBS TAX CREDIT APPLICATION DETAIL REPORT

In the columns below, enter the type of tax return, the reporting period and the amount of high-wage jobs tax credit to be

applied to each return. If additional space is needed, attach a separate worksheet in the same format and enter the amount

of high-wage jobs tax credit to be applied from all pages in line 1 below.

A. Type of tax return

B. Report Period. Enter the tax period as

C. High-wage jobs tax credit

(CRS-1, E911, TRS)

shown on the return. Enter the beginning

to be applied

and ending date of the report period.

1. Total high-wage jobs tax credit applied. May

1.

not exceed the amount on line 2 below.

2. Total approved high-wage jobs tax credit.

2.

3. Subtract line 1 from line 2.

This is the amount to be refunded.

3.

I declare that I have examined this claim form including any accompanying schedules and statements, and to the

best of my knowledge and belief it is true, correct and complete.

Date

Signature of Taxpayer or Agent

Title

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2