Form Ct-3-A/c - Report By A Corporation Included In A Combined Franchise Tax Return - New York State Department Of Taxation And Finance - 2012

ADVERTISEMENT

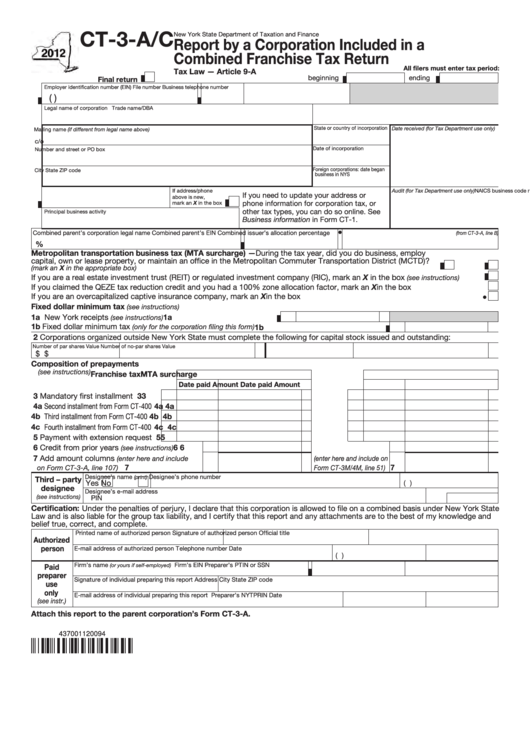

CT-3-A/C

New York State Department of Taxation and Finance

Report by a Corporation Included in a

Combined Franchise Tax Return

All filers must enter tax period:

Tax Law — Article 9-A

beginning

ending

Final return

Employer identification number (EIN)

File number

Business telephone number

(

)

Legal name of corporation

Trade name/DBA

State or country of incorporation

Date received (for Tax Department use only)

Mailing name (if different from legal name above)

c/o

Date of incorporation

Number and street or PO box

Foreign corporations: date began

City

State

ZIP code

business in NYS

NAICS business code number

If address/phone

Audit (for Tax Department use only)

(from federal return)

If you need to update your address or

above is new,

phone information for corporation tax, or

mark an X in the box

other tax types, you can do so online. See

Principal business activity

Business information in Form CT-1.

Combined parent’s corporation legal name

Combined parent’s EIN

Combined issuer’s allocation percentage

(from CT-3-A, line B)

%

Metropolitan transportation business tax (MTA surcharge) — During the tax year, did you do business, employ

capital, own or lease property, or maintain an office in the Metropolitan Commuter Transportation District (MCTD)?

.................................................................................................................................. Yes

No

(mark an X in the appropriate box)

If you are a real estate investment trust (REIT) or regulated investment company (RIC), mark an X in the box

............

(see instructions)

If you claimed the QEZE tax reduction credit and you had a 100% zone allocation factor, mark an X in the box .................................

If you are an overcapitalized captive insurance company, mark an X in the box ..................................................................................

Fixed dollar minimum tax

(see instructions)

1a New York receipts

...................................................

1a

(see instructions)

1b Fixed dollar minimum tax

..........................................................

(only for the corporation filing this form)

1b

2 Corporations organized outside New York State must complete the following for capital stock issued and outstanding:

Number of par shares

Value

Number of no-par shares

Value

$

$

Composition of prepayments

(see instructions)

Franchise tax

MTA surcharge

Date paid

Amount

Date paid

Amount

3 Mandatory first installment

3

3

..............

4a Second installment from Form CT-400

4a

.............. 4a

4b Third installment from Form CT-400

4b

.............. 4b

4c Fourth installment from Form CT-400

4c

.............. 4c

5 Payment with extension request

5

5

..............

6 Credit from prior years

.........

6

.................................

6

(see instructions)

7 Add amount columns

(enter here and include

(enter here and include on

7

7

on Form CT-3-A, line 107)

Form CT-3M/4M, line 51)

Designee’s name

Designee’s phone number

(print)

Third – party

Yes

No

(

)

designee

Designee’s e-mail address

(see instructions)

PIN

Certification: Under the penalties of perjury, I declare that this corporation is allowed to file on a combined basis under New York State

Law and is also liable for the group tax liability, and I certify that this report and any attachments are to the best of my knowledge and

belief true, correct, and complete.

Printed name of authorized person

Signature of authorized person

Official title

Authorized

person

E-mail address of authorized person

Telephone number

Date

(

)

Firm’s name

Firm’s EIN

Preparer’s PTIN or SSN

Paid

(or yours if self-employed)

preparer

Signature of individual preparing this report

Address

City

State

ZIP code

use

only

E-mail address of individual preparing this report

Preparer’s NYTPRIN

Date

(see instr.)

Attach this report to the parent corporation’s Form CT-3-A.

437001120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2