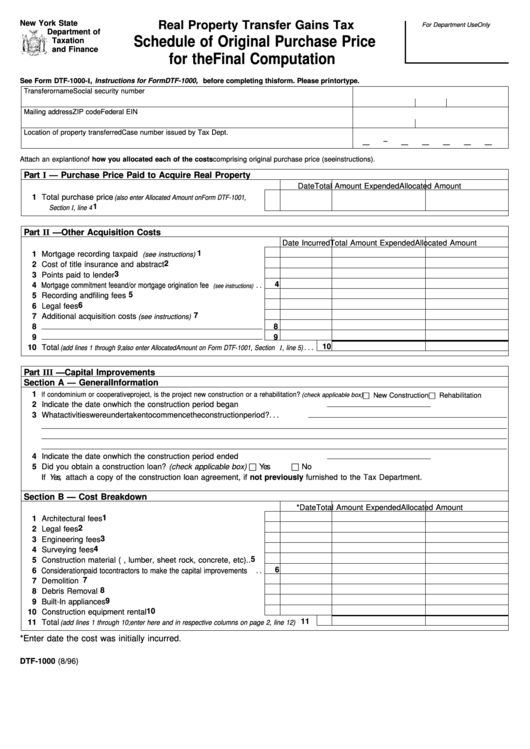

Form Dtf-1000 - Real Property Transfer Gains Tax Schedule Of Original Purchase Price For The Final Computation

ADVERTISEMENT

New York State

Real Property Transfer Gains Tax

For Department Use Only

Department of

Schedule of Original Purchase Price

Taxation

and Finance

for the Final Computation

See Form DTF-1000-I, Instructions for Form DTF-1000, before completing this form. Please print or type.

Transferor name

Social security number

Mailing address

ZIP code

Federal EIN

Location of property transferred

Case number issued by Tax Dept.

–

—

—

—

—

—

—

Attach an explantion of how you allocated each of the costs comprising original purchase price (see instructions).

Part I — Purchase Price Paid to Acquire Real Property

Date

Total Amount Expended

Allocated Amount

1 Total purchase price

(also enter Allocated Amount on Form DTF-1001,

1

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Section I , line 4

Part II — Other Acquisition Costs

Date Incurred Total Amount Expended

Allocated Amount

1

1 Mortgage recording tax paid

. . . . . . . . . . . . . . . . . . .

(see instructions)

2

2 Cost of title insurance and abstract . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3 Points paid to lender . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4 Mortgage commitment fee and/or mortgage origination fee

. .

(see instructions)

5

5 Recording and filing fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

6 Legal fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

7 Additional acquisition costs

. . . . . . . . . . . . . . . . . . . .

(see instructions)

8

8

9

9

10

10 Total

. . .

(add lines 1 through 9; also enter Allocated Amount on Form DTF-1001, Section I , line 5)

Part III — Capital Improvements

Section A — General Information

1

If condominium or cooperative project, is the project new construction or a rehabilitation?

. . . . . .

(check applicable box)

New Construction

Rehabilitation

2 Indicate the date on which the construction period began. . . . . . . . . . . . . . . . . . . . . . . .

3 What activities were undertaken to commence the construction period? . . .

4 Indicate the date on which the construction period ended. . . . . . . . . . . . . . . . . . . . . . . .

5 Did you obtain a construction loan? (check applicable box) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If Yes, attach a copy of the construction loan agreement, if not previously furnished to the Tax Department.

Section B — Cost Breakdown

*Date

Total Amount Expended

Allocated Amount

1

1 Architectural fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2 Legal fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3 Engineering fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4 Surveying fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

5 Construction material (i.e., lumber, sheet rock, concrete, etc) . .

6

6 Consideration paid to contractors to make the capital improvements . .

7

7 Demolition . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

8 Debris Removal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

9 Built-In appliances . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

10 Construction equipment rental . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

11 Total

. . . .

(add lines 1 through 10; enter here and in respective columns on page 2, line 12)

*Enter date the cost was initially incurred.

DTF-1000 (8/96)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3