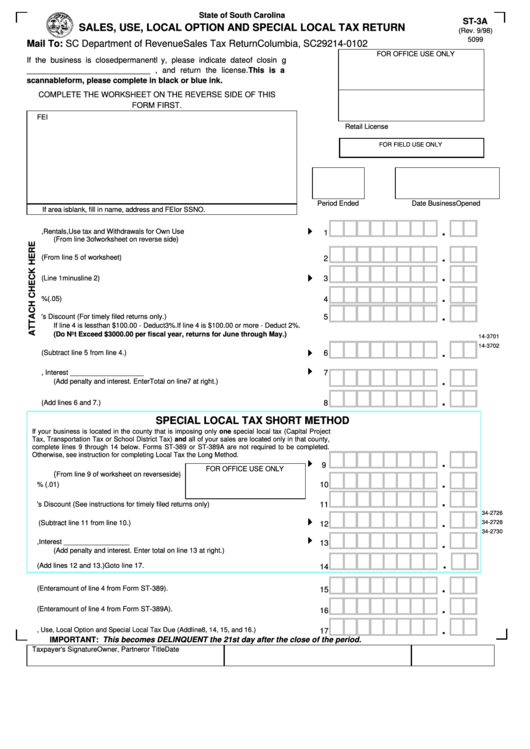

State of South Carolina

ST-3A

SALES, USE, LOCAL OPTION AND SPECIAL LOCAL TAX RETURN

(Rev. 9/98)

5099

Mail To: SC Department of Revenue

Sales Tax Return

Columbia, SC 29214-0102

FOR OFFICE USE ONLY

If the business is closed permanently, please indicate date of closing

____________________________ , and return the license. This is a

scannable form, please complete in black or blue ink.

COMPLETE THE WORKSHEET ON THE REVERSE SIDE OF THIS

FORM FIRST.

FEI NO.

SID NO.

Retail License No. or Use Tax Registration

FOR FIELD USE ONLY

Period Ended

Date Business Opened

If area is blank, fill in name, address and FEI or SS NO.

.

1. Gross Proceeds of sales, Rentals, Use tax and Withdrawals for Own Use

1

(From line 3 of worksheet on reverse side)

.

2. Total Amount of Deductions (From line 5 of worksheet)

2

.

3. Net Taxable Sales (Line 1 minus line 2)

3

.

4

4. Line 3 x 5% (.05)

.

5

5. Taxpayer's Discount (For timely filed returns only.)

If line 4 is less than $100.00 - Deduct 3%. If line 4 is $100.00 or more - Deduct 2%.

(Do Not Exceed $3000.00 per fiscal year, returns for June through May.)

14-3701

14-3702

.

6. Balance Due (Subtract line 5 from line 4.)

6

7. Penalty _________________ , Interest ___________________

7

.

(Add penalty and interest. Enter Total on line 7 at right.)

.

8

8. Total Sales and Use Tax Due (Add lines 6 and 7.)

SPECIAL LOCAL TAX SHORT METHOD

If your business is located in the county that is imposing only one special local tax (Capital Project

Type Local Tax

Tax, Transportation Tax or School District Tax) and all of your sales are located only in that county,

XX-XXXX Description

complete lines 9 through 14 below. Forms ST-389 or ST-389A are not required to be completed.

Otherwise, see instruction for completing Local Tax the Long Method.

.

9

9. Net Taxable Sales and/or Purchases

FOR OFFICE USE ONLY

(

From line 9 of worksheet on reverse side)

.

10. Line 9 x 1% (.01)

10

.

11. Taxpayer's Discount (See instructions for timely filed returns only)

11

34-2726

.

12. Net Amount Payable (Subtract line 11 from line 10.)

34-2728

12

34-2730

13. Penalty _______________ , Interest _________________

.

13

(Add penalty and interest. Enter total on line 13 at right.)

.

14. Total Special Local Tax Due (Add lines 12 and 13.) Go to line 17.

14

.

15. Total Local Option Tax Due (Enter amount of line 4 from Form ST-389).

15

.

16. Total Special Local Tax Due (Enter amount of line 4 from Form ST-389A).

16

.

17. Total Sales, Use, Local Option and Special Local Tax Due (Add line 8, 14, 15, and 16. )

17

IMPORTANT: This becomes DELINQUENT the 21st day after the close of the period.

Taxpayer's Signature

Owner, Partner or Title

Date

1

1 2

2