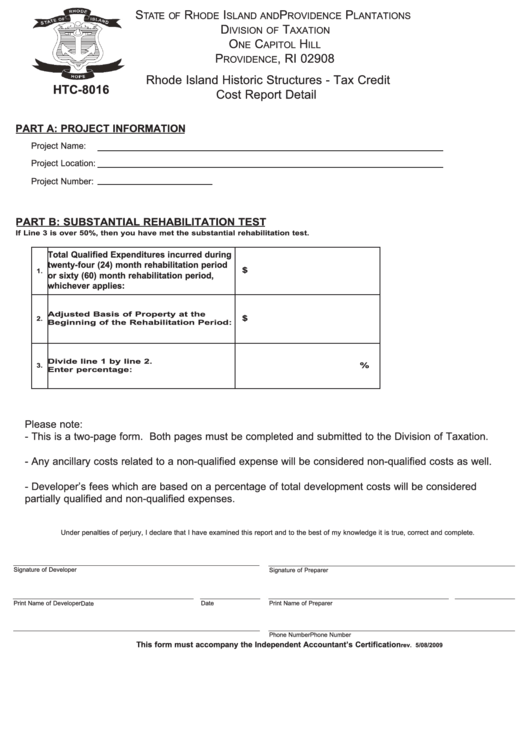

Form Htc-8016 - Rhode Island Historic Structures - Tax Credit Cost Report Detail

ADVERTISEMENT

S

R

I

P

P

TATE OF

HODE

SLAND AND

ROVIDENCE

LANTATIONS

D

T

IVISION OF

AXATION

O

C

H

NE

APITOL

ILL

P

, RI 02908

ROVIDENCE

Rhode Island Historic Structures - Tax Credit

HTC-8016

Cost Report Detail

PART A: PROJECT INFORMATION

Project Name:

Project Location:

Project Number:

PART B: SUBSTANTIAL REHABILITATION TEST

If Line 3 is over 50%, then you have met the substantial rehabilitation test.

Total Qualified Expenditures incurred during

twenty-four (24) month rehabilitation period

$

1.

or sixty (60) month rehabilitation period,

whichever applies:

Adjusted Basis of Property at the

$

2.

Beginning of the Rehabilitation Period:

Divide line 1 by line 2.

%

3.

Enter percentage:

Please note:

- This is a two-page form. Both pages must be completed and submitted to the Division of Taxation.

- Any ancillary costs related to a non-qualified expense will be considered non-qualified costs as well.

- Developer’s fees which are based on a percentage of total development costs will be considered

partially qualified and non-qualified expenses.

Under penalties of perjury, I declare that I have examined this report and to the best of my knowledge it is true, correct and complete.

Signature of Developer

Signature of Preparer

Print Name of Developer

Date

Print Name of Preparer

Date

Phone Number

Phone Number

This form must accompany the Independent Accountant’s Certification

rev. 5/08/2009

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2