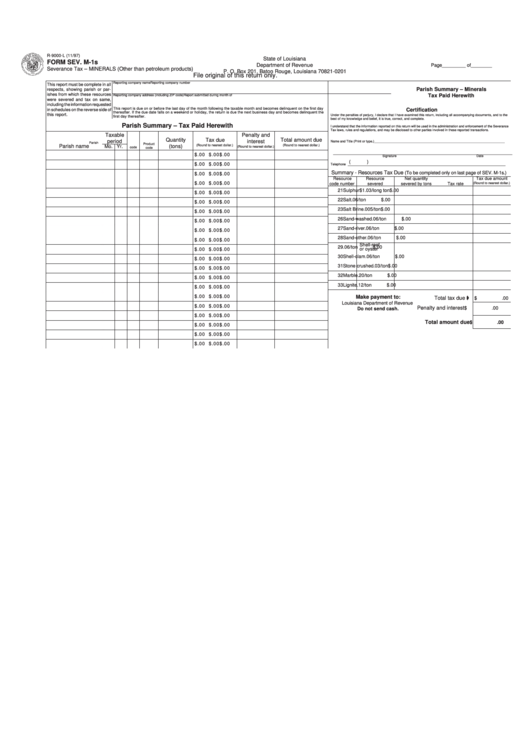

R-9000-L (11/97)

State of Louisiana

FORM SEV. M-1s

Department of Revenue

Page _________ of ________

Severance Tax – MINERALS (Other than petroleum products)

P. O. Box 201, Baton Rouge, Louisiana 70821-0201

File original of this return only.

Reporting company name

Reporting company number

This report must be complete in all

Parish Summary – Minerals

respects, showing parish or par-

ishes from which these resources

Tax Paid Herewith

Reporting company address (including ZIP code)

Report submitted during month of

were severed and tax on same,

including the information requested

This report is due on or before the last day of the month following the taxable month and becomes delinquent on the first day

Certification

in schedules on the reverse side of

thereafter. If the due date falls on a weekend or holiday, the return is due the next business day and becomes delinquent the

this report.

Under the penalties of perjury, I declare that I have examined this return, including all accompanying documents, and to the

first day thereafter.

best of my knowledge and belief, it is true, correct, and complete.

Parish Summary – Tax Paid Herewith

I understand that the information reported on this return will be used in the administration and enforcement of the Severance

Tax laws, rules and regulations, and may be disclosed to other parties involved in these reported transactions.

Taxable

Penalty and

Quantity

Tax due

Total amount due

period

interest

Name and Title (Print or type.) _____________________________________________________________________________

Parish

Product

Parish name

(tons)

(Round to nearest dollar.)

(Round to nearest dollar.)

Mo. Yr.

(Round to nearest dollar.)

code

code

____________________________________________________________________

$

.00 $

.00 $

.00

Signature

Date

(

)

$

.00 $

.00 $

.00

Telephone _____________________________________________________________________________________________

Summary - Resources Tax Due

(To be completed only on last page of SEV. M-1s.)

$

.00 $

.00 $

.00

Resource

Resource

Net quantity

Tax due amount

$

.00 $

.00 $

.00

code number

severed

severed by tons

Tax rate

(Round to nearest dollar.)

21

Sulphur

$1.03/long ton $

.00

$

.00 $

.00 $

.00

22

Salt

.06/ton

$

.00

$

.00 $

.00 $

.00

23

Salt Brine

.005/ton

$

.00

$

.00 $

.00 $

.00

26

Sand-washed

.06/ton

$

.00

$

.00 $

.00 $

.00

27

Sand-river

.06/ton

$

.00

$

.00 $

.00 $

.00

28

Sand-other

.06/ton

$

.00

$

.00 $

.00 $

.00

Shell-reef

29

.06/ton

$

.00

$

.00 $

.00 $

.00

or oyster

30

Shell-clam

.06/ton

$

.00

$

.00 $

.00 $

.00

31

Stone crushed

.03/ton

$

.00

$

.00 $

.00 $

.00

32

Marble

.20/ton

$

.00

$

.00 $

.00 $

.00

33

Lignite

.12/ton

$

.00

$

.00 $

.00 $

.00

$

.00 $

.00 $

.00

Make payment to:

Total tax due

$

.00

Louisiana Department of Revenue

$

.00 $

.00 $

.00

Penalty and interest

$

.00

Do not send cash.

$

.00 $

.00 $

.00

Total amount due

$

.00

$

.00 $

.00 $

.00

$

.00 $

.00 $

.00

$

.00 $

.00 $

.00

1

1 2

2