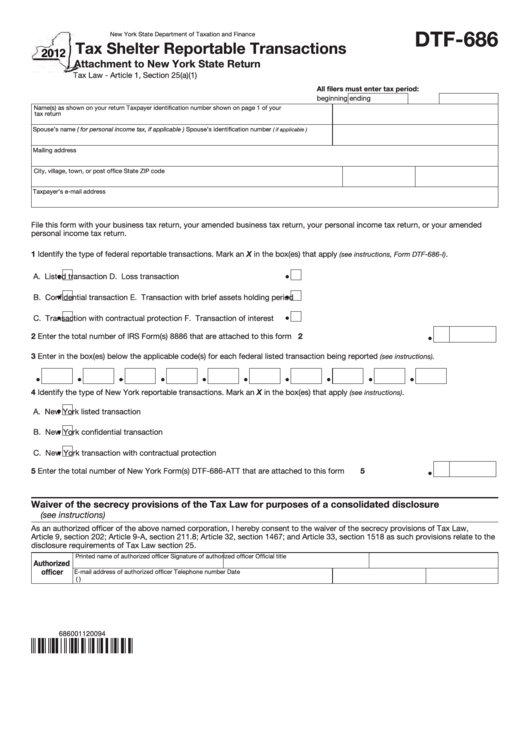

DTF-686

New York State Department of Taxation and Finance

Tax Shelter Reportable Transactions

Attachment to New York State Return

Tax Law - Article 1, Section 25(a)(1)

All filers must enter tax period:

beginning

ending

Name(s) as shown on your return

Taxpayer identification number shown on page 1 of your

tax return

Spouse’s name ( for personal income tax, if applicable )

Spouse’s identification number

( if applicable )

Mailing address

City, village, town, or post office

State

ZIP code

Taxpayer’s e-mail address

File this form with your business tax return, your amended business tax return, your personal income tax return, or your amended

personal income tax return.

1 Identify the type of federal reportable transactions. Mark an X in the box(es) that apply

.

(see instructions, Form DTF-686-I)

A.

Listed transaction

D.

Loss transaction

B.

Confidential transaction

E.

Transaction with brief assets holding period

C.

Transaction with contractual protection

F.

Transaction of interest

2 Enter the total number of IRS Form(s) 8886 that are attached to this form ............................................................

2

3 Enter in the box(es) below the applicable code(s) for each federal listed transaction being reported

(see instructions).

4 Identify the type of New York reportable transactions. Mark an X in the box(es) that apply

.

(see instructions)

A.

New York listed transaction

B.

New York confidential transaction

C.

New York transaction with contractual protection

5 Enter the total number of New York Form(s) DTF-686-ATT that are attached to this form ......................................

5

Waiver of the secrecy provisions of the Tax Law for purposes of a consolidated disclosure

(see instructions)

As an authorized officer of the above named corporation, I hereby consent to the waiver of the secrecy provisions of Tax Law,

Article 9, section 202; Article 9-A, section 211.8; Article 32, section 1467; and Article 33, section 1518 as such provisions relate to the

disclosure requirements of Tax Law section 25.

Printed name of authorized officer

Signature of authorized officer

Official title

Authorized

officer

E-mail address of authorized officer

Telephone number

Date

(

)

686001120094

1

1