Form Rpd-41341 - Solar Energy Systems Tax Deduction - Purchase And Use Statement - State Of New Mexico Taxation And Revenue Department Page 2

ADVERTISEMENT

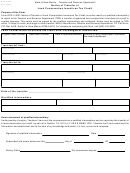

RPD-41341

STATE OF NEW MEXICO - TAXATION AND REVENUE DEPARTMENT

07/2007

Solar Energy Systems Tax Credit Deduction

Purchase and Use Statement

INSTRUCTIONS

that would qualify as an adjustment to basis for federal income

ABOUT THIS DEDUCTION: Form RPD-41341, Solar Energy

tax purposes. Labor for maintenance or service of a solar energy

Systems Gross Receipts Tax Deduction Purchase and Use

system does not qualify for the deduction in the absence of an

Statement, may be used by a New Mexico taxpayer for a gross

installation of some part of the system. Labor to perform post-

receipts tax deduction for receipts from the sale and installation

installation adjustments to the solar energy system qualifies

of a solar energy system. “Solar energy system” means an

when the adjustments are performed to optimize the operation

installation that is used to provide space heat, hot water or

of the solar energy system as part of the initial installation and

electricity to the property in which it is installed and is:

are performed within one year of the initial installation.

•

an installation that utilizes solar panels that are not

also windows, including the solar panels and all equip-

DEFINITIONS:

ment necessary for the installation and operation of the

Equipment means an essential machine, mechanism, or a

solar panels;

component or fitting thereof, used directly and exclusively in the

•

a dark-colored water tank exposed to sunlight, includ-

installation or operation of a solar energy system. Equipment

ing all equipment necessary for the installation and

that can be included in the solar energy system is limited to

operation of the waste tank as a part of the overall water

equipment that can be included in the basis of the property to

system of the property; or

which the solar energy system is installed as established under

•

a non-vented trombe wall, including all equipment

the applicable provisions of the Internal Revenue Code of 1986.

necessary for the installation and operation of the

trombe wall.

Trombe Wall is a sun-facing wall built from material that can

act as a thermal mass, such as stone, concrete, adobe or water

Receipts from sale and installation of solar energy systems

tanks, combined with an air space and glass to form a solar

pursuant to Laws 2007, Chapter 204, Section 10 may be

thermal collector.

deducted from gross receipts when the sale is made to a person

who submits a signed Form RPD-41341, Solar Energy Systems

Solar thermal collector means an energy system that col-

Gross Receipts Tax Deduction Purchase and Use Statement,

lects or absorbs solar energy for conversion into heat for the

or when the seller can provide evidence acceptable to the

purposes of space heating, space cooling or water heating.

department that the service or equipment is purchased for the

sole us of the sale and installation of a qualified solar energy

Solar panel is a solar thermal collector, such as a solar hot

system. Evidence acceptable to the department includes a

water or air panel used to heat water, air, or otherwise collect

description of what was sold, the amount of the sale and a

solar thermal energy. “Solar panel” may also refer to a photovol-

description of the solar energy system being sold and installed.

taic system.

When a seller accepts in good faith a person’s written statement

Solar thermal energy is a technology for harnessing solar

that the person is purchasing the equipment for the sole use of

power for practical applications from solar heating to electrical

the sale or installation of a solar energy system pursuant to

power generation.

Laws 2007, Chapter 204, Section 10, the written statement

shall be conclusive evidence that the proceeds from the trans-

Photovoltaic system means an energy system that collects or

action with the person having made this statement are deduct-

absorbs sunlight for conversion into electricity.

ible from the seller’s gross receipts.

COMPLETING THE STATEMENT: The purchaser must com-

Solar energy system includes components or systems for

plete the written statement (top and bottom portions) and sign

collecting and/or storing energy, but does not include compo-

and date the statement, declaring to the seller that the equip-

nents or systems related to the use of the energy. Examples of

ment or installation services were purchased solely for the use

use would include the pipes carrying heated water to a faucet

of installation and operation of a solar energy system. The

or the electrical wire carrying electricity to an outlet.

purchaser provides the top portion of the statement to the seller

to substantiate the deduction. Provide a contact name and a

Installation of a solar energy systems includes replacement

CRS identification number or Federal Employer Identification

of some part of the system, or a similar change to the system

Number (FEIN), if the purchaser is a business.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2