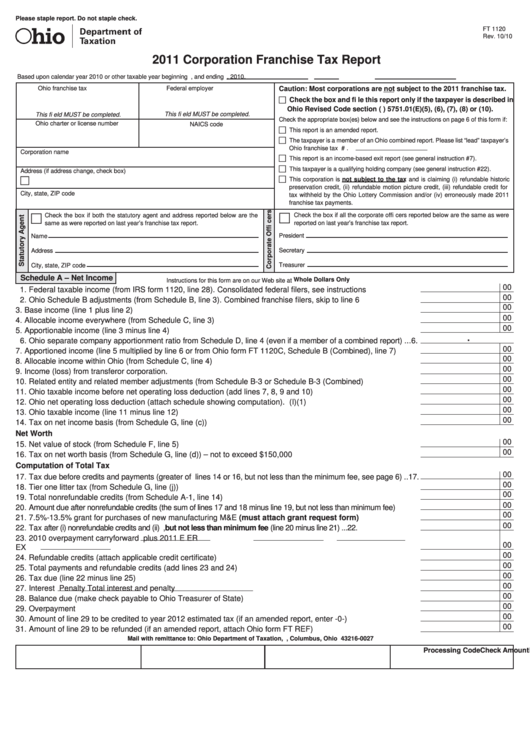

Please staple report. Do not staple check.

Reset Form

FT 1120

Rev. 10/10

2011 Corporation Franchise Tax Report

Based upon calendar year 2010 or other taxable year beginning

,

and ending

, 2010.

Ohio franchise tax I.D. number

Federal employer I.D. number

Caution: Most corporations are not subject to the 2011 franchise tax.

Check the box and fi le this report only if the taxpayer is described in

Ohio Revised Code section (R.C.) 5751.01(E)(5), (6), (7), (8) or (10).

This fi eld MUST be completed.

This fi eld MUST be completed.

Check the appropriate box(es) below and see the instructions on page 6 of this form if:

Ohio charter or license number

NAICS code

This report is an amended report.

The taxpayer is a member of an Ohio combined report. Please list “lead” taxpayer’s

Ohio franchise tax I.D. #

.

Corporation name

This report is an income-based exit report (see general instruction #7).

This taxpayer is a qualifying holding company (see general instruction #22).

Address (if address change, check box)

This corporation is not subject to the tax and is claiming (i) refundable historic

preservation credit, (ii) refundable motion picture credit, (iii) refundable credit for

City, state, ZIP code

tax withheld by the Ohio Lottery Commission and/or (iv) erroneously made 2011

franchise tax payments.

Check the box if both the statutory agent and address reported below are the

Check the box if all the corporate offi cers reported below are the same as were

same as were reported on last year’s franchise tax report.

reported on last year’s franchise tax report.

President

Name

Secretary

Address

Treasurer

City, state, ZIP code

Schedule A – Net Income

Whole Dollars Only

Instructions for this form are on our Web site at tax.ohio.gov.

00

1. Federal taxable income (from IRS form 1120, line 28). Consolidated federal fi lers, see instructions ....................1.

00

2. Ohio Schedule B adjustments (from Schedule B, line 3). Combined franchise fi lers, skip to line 6 .......................2.

00

3. Base income (line 1 plus line 2)..............................................................................................................................3.

00

4. Allocable income everywhere (from Schedule C, line 3) .......................................................................................4.

00

5. Apportionable income (line 3 minus line 4).............................................................................................................5.

.

6. Ohio separate company apportionment ratio from Schedule D, line 4 (even if a member of a combined report) ...6.

00

7. Apportioned income (line 5 multiplied by line 6 or from Ohio form FT 1120C, Schedule B (Combined), line 7) ....7.

00

8. Allocable income within Ohio (from Schedule C, line 4) .........................................................................................8.

00

9. Income (loss) from transferor corporation. R.C. 5733.053 .....................................................................................9.

00

10. Related entity and related member adjustments (from Schedule B-3 or Schedule B-3 (Combined) ...................10.

00

11. Ohio taxable income before net operating loss deduction (add lines 7, 8, 9 and 10) ...........................................11.

00

12. Ohio net operating loss deduction (attach schedule showing computation). R.C. 5733.04(I)(1) .........................12.

00

13. Ohio taxable income (line 11 minus line 12) .........................................................................................................13.

00

14. Tax on net income basis (from Schedule G, line (c)) ............................................................................................14.

Net Worth

00

15. Net value of stock (from Schedule F, line 5) .........................................................................................................15.

00

16. Tax on net worth basis (from Schedule G, line (d)) – not to exceed $150,000 .....................................................16.

Computation of Total Tax

00

17. Tax due before credits and payments (greater of lines 14 or 16, but not less than the minimum fee, see page 6) ..17.

00

18. Tier one litter tax (from Schedule G, line (j)) .........................................................................................................18.

00

19. Total nonrefundable credits (from Schedule A-1, line 14) .....................................................................................19.

00

20. Amount due after nonrefundable credits (the sum of lines 17 and 18 minus line 19, but not less than minimum fee) .....20.

00

21. 7.5%-13.5% grant for purchases of new manufacturing M&E (must attach grant request form) .....................21.

00

22. Tax after (i) nonrefundable credits and (ii) R.C. 122.173 grant, but not less than minimum fee (line 20 minus line 21) ...22.

23. 2010 overpayment carryforward

plus 2011 E

ER

00

EX

.......................................................................................................................................23.

00

24. Refundable credits (attach applicable credit certifi cate) .......................................................................................24.

00

25. Total payments and refundable credits (add lines 23 and 24) ..............................................................................25.

00

26. Tax due (line 22 minus line 25) .............................................................................................................................26.

00

27. Interest

Penalty

Total interest and penalty .............................27.

00

28. Balance due (make check payable to Ohio Treasurer of State) ...........................................................................28.

00

29. Overpayment ........................................................................................................................................................29.

00

30. Amount of line 29 to be credited to year 2012 estimated tax (if an amended report, enter -0-) ...........................30.

00

31. Amount of line 29 to be refunded (if an amended report, attach Ohio form FT REF) ...........................................31.

Mail with remittance to: Ohio Department of Taxation, P.O. Box 27, Columbus, Ohio 43216-0027

For Department Use Only

Date Received

Check Amount

Processing Code

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8