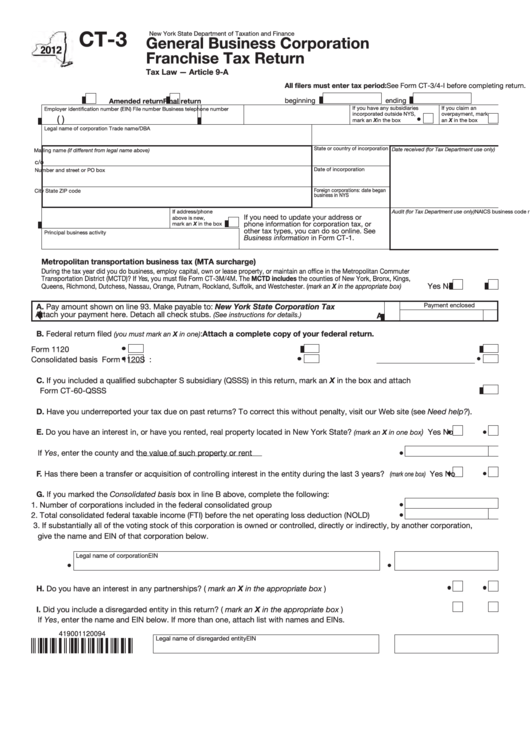

Form Ct-3 - General Business Corporation Franchise Tax Return - New York State Department Of Taxation And Finance - 2012

ADVERTISEMENT

CT-3

New York State Department of Taxation and Finance

General Business Corporation

Franchise Tax Return

Tax Law — Article 9-A

See Form CT-3/4-I before completing return.

All filers must enter tax period:

beginning

ending

Final return

Amended return

If you have any subsidiaries

If you claim an

Employer identification number (EIN)

File number

Business telephone number

incorporated outside NYS,

overpayment, mark

(

)

mark an X in the box

an X in the box

Legal name of corporation

Trade name/DBA

State or country of incorporation

Date received (for Tax Department use only)

Mailing name (if different from legal name above)

c/o

Date of incorporation

Number and street or PO box

Foreign corporations: date began

City

State

ZIP code

business in NYS

NAICS business code number

(from federal return)

If address/phone

Audit (for Tax Department use only)

If you need to update your address or

above is new,

phone information for corporation tax, or

mark an X in the box

other tax types, you can do so online. See

Principal business activity

Business information in Form CT-1.

Metropolitan transportation business tax (MTA surcharge)

During the tax year did you do business, employ capital, own or lease property, or maintain an office in the Metropolitan Commuter

Transportation District (MCTD)? If Yes, you must file Form CT-3M/4M. The MCTD includes the counties of New York, Bronx, Kings,

............

Yes

No

Queens, Richmond, Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk, and Westchester. (mark an X in the appropriate box)

Payment enclosed

A. Pay amount shown on line 93. Make payable to: New York State Corporation Tax

Attach your payment here. Detach all check stubs.

(See instructions for details.)

A

B. Federal return filed

Attach a complete copy of your federal return.

:

(you must mark an X in one)

Form 1120 ..............

Form 1120-H ................................

Form 1120-REIT or Form 1120-RIC

Consolidated basis

Form 1120S .................................

Other:

C. If you included a qualified subchapter S subsidiary (QSSS) in this return, mark an X in the box and attach

Form CT-60-QSSS ........................................................................................................................................................................

D. Have you underreported your tax due on past returns? To correct this without penalty, visit our Web site (see Need help?).

E. Do you have an interest in, or have you rented, real property located in New York State?

) Yes

No

(mark an X in one box

If Yes, enter the county

and the value of such property or rent

F. Has there been a transfer or acquisition of controlling interest in the entity during the last 3 years?

Yes

No

(mark one box)

G. If you marked the Consolidated basis box in line B above, complete the following:

1. Number of corporations included in the federal consolidated group ................................................

2. Total consolidated federal taxable income (FTI) before the net operating loss deduction (NOLD) ....

3. If substantially all of the voting stock of this corporation is owned or controlled, directly or indirectly, by another corporation,

give the name and EIN of that corporation below.

Legal name of corporation

EIN

H. Do you have an interest in any partnerships? ( mark an X in the appropriate box ).............................................. Yes

No

I.

Did you include a disregarded entity in this return? ( mark an X in the appropriate box ) .................................... Yes

No

If Yes, enter the name and EIN below. If more than one, attach list with names and EINs.

419001120094

Legal name of disregarded entity

EIN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8