Form Rpd-41058 - Estate Tax Return

ADVERTISEMENT

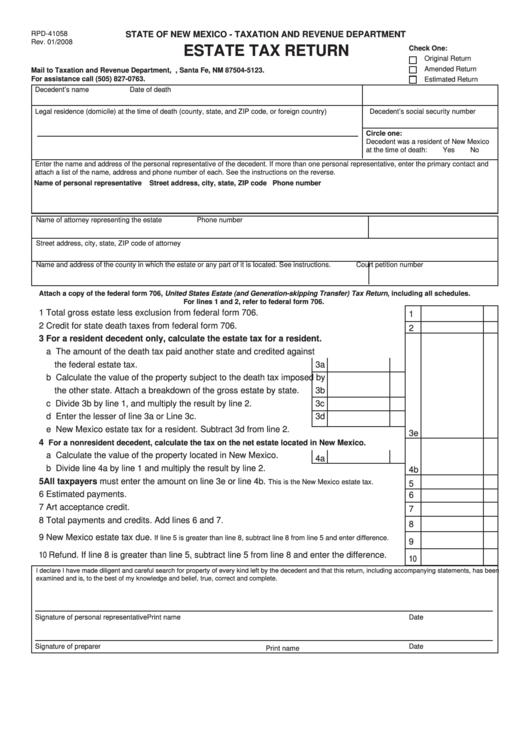

RPD-41058

STATE OF NEW MEXICO - TAXATION AND REVENUE DEPARTMENT

Rev. 01/2008

ESTATE TAX RETURN

Check One:

Original Return

Amended Return

Mail to Taxation and Revenue Department, P.O. Box 25123, Santa Fe, NM 87504-5123.

For assistance call (505) 827-0763.

Estimated Return

Decedent’s name

Date of death

Legal residence (domicile) at the time of death (county, state, and ZIP code, or foreign country)

Decedent’s social security number

Circle one:

Decedent was a resident of New Mexico

at the time of death:

Yes

No

Enter the name and address of the personal representative of the decedent. If more than one personal representative, enter the primary contact and

attach a list of the name, address and phone number of each. See the instructions on the reverse.

Name of personal representative

Street address, city, state, ZIP code

Phone number

Name of attorney representing the estate

Phone number

Street address, city, state, ZIP code of attorney

Name and address of the county in which the estate or any part of it is located. See instructions.

Court petition number

Attach a copy of the federal form 706, United States Estate (and Generation-skipping Transfer) Tax Return, including all schedules.

For lines 1 and 2, refer to federal form 706.

1

Total gross estate less exclusion from federal form 706.

1

2

Credit for state death taxes from federal form 706.

2

3

For a resident decedent only, calculate the estate tax for a resident.

a The amount of the death tax paid another state and credited against

the federal estate tax.

3a

b Calculate the value of the property subject to the death tax imposed by

the other state. Attach a breakdown of the gross estate by state.

3b

c Divide 3b by line 1, and multiply the result by line 2.

3c

d Enter the lesser of line 3a or Line 3c.

3d

e New Mexico estate tax for a resident. Subtract 3d from line 2.

3e

4

For a nonresident decedent, calculate the tax on the net estate located in New Mexico.

a Calculate the value of the property located in New Mexico.

4a

b Divide line 4a by line 1 and multiply the result by line 2.

4b

5

All taxpayers must enter the amount on line 3e or line 4b.

This is the New Mexico estate tax.

5

6

Estimated payments.

6

7

Art acceptance credit.

7

8

Total payments and credits. Add lines 6 and 7.

8

9

New Mexico estate tax due.

If line 5 is greater than line 8, subtract line 8 from line 5 and enter difference.

9

10 Refund. If line 8 is greater than line 5, subtract line 5 from line 8 and enter the difference.

10

I declare I have made diligent and careful search for property of every kind left by the decedent and that this return, including accompanying statements, has been

examined and is, to the best of my knowledge and belief, true, correct and complete.

Signature of personal representative

Print name

Date

Signature of preparer

Date

Print name

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2