Form Rpd-41071 - Application For Refund - State Of New Mexico Taxation And Revenue Department

ADVERTISEMENT

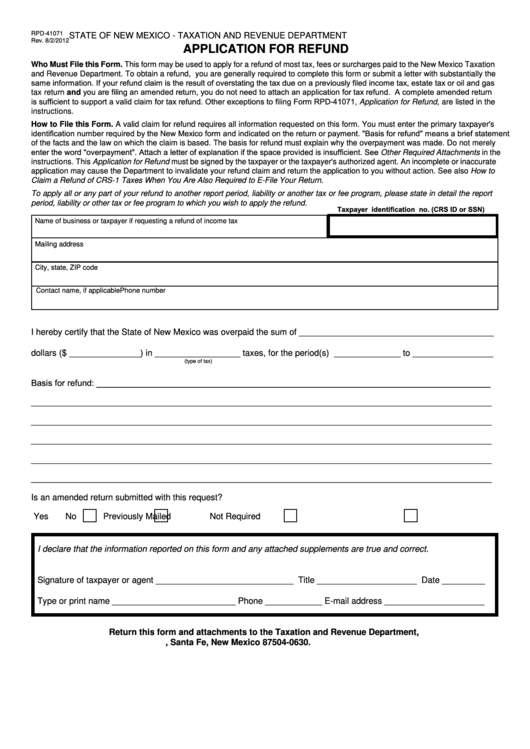

STATE OF NEW MEXICO - TAXATION AND REVENUE DEPARTMENT

RPD-41071

Rev. 8/2/2012

APPLICATION FOR REFUND

Who Must File this Form. This form may be used to apply for a refund of most tax, fees or surcharges paid to the New Mexico Taxation

and Revenue Department. To obtain a refund, you are generally required to complete this form or submit a letter with substantially the

same information. If your refund claim is the result of overstating the tax due on a previously filed income tax, estate tax or oil and gas

tax return and you are filing an amended return, you do not need to attach an application for tax refund. A complete amended return

is sufficient to support a valid claim for tax refund. Other exceptions to filing Form RPD-41071, Application for Refund, are listed in the

instructions.

How to File this Form. A valid claim for refund requires all information requested on this form. You must enter the primary taxpayer's

identification number required by the New Mexico form and indicated on the return or payment. "Basis for refund" means a brief statement

of the facts and the law on which the claim is based. The basis for refund must explain why the overpayment was made. Do not merely

enter the word "overpayment". Attach a letter of explanation if the space provided is insufficient. See Other Required Attachments in the

instructions. This Application for Refund must be signed by the taxpayer or the taxpayer's authorized agent. An incomplete or inaccurate

application may cause the Department to invalidate your refund claim and return the application to you without action. See also How to

Claim a Refund of CRS-1 Taxes When You Are Also Required to E-File Your Return.

To apply all or any part of your refund to another report period, liability or another tax or fee program, please state in detail the report

period, liability or other tax or fee program to which you wish to apply the refund.

Taxpayer identification no. (CRS ID or SSN)

Name of business or taxpayer if requesting a refund of income tax

Mailing address

City, state, ZIP code

Contact name, if applicable

Phone number

I hereby certify that the State of New Mexico was overpaid the sum of _________________________________________

dollars ($ _______________) in __________________ taxes, for the period(s) ______________ to _________________

(type of tax)

Basis for refund: ___________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

Is an amended return submitted with this request?

Yes

No

Previously Mailed

Not Required

I declare that the information reported on this form and any attached supplements are true and correct.

Signature of taxpayer or agent _____________________________ Title _____________________ Date _________

Type or print name __________________________ Phone ____________ E-mail address _____________________

Return this form and attachments to the Taxation and Revenue Department,

P.O. Box 630, Santa Fe, New Mexico 87504-0630.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3