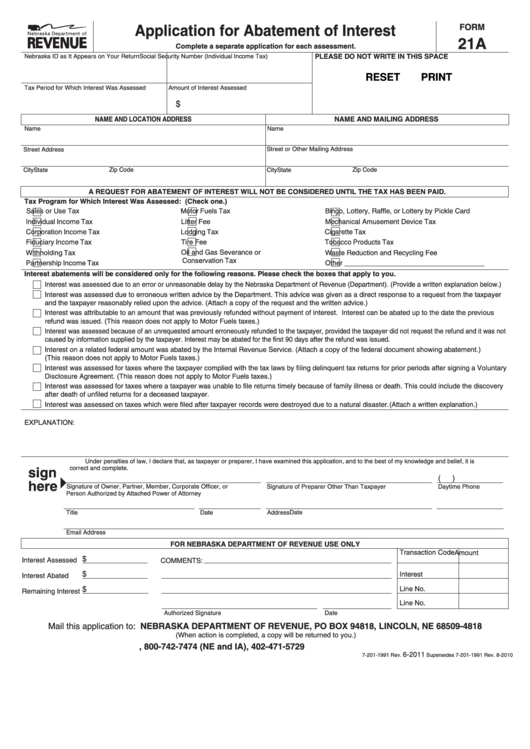

Application for Abatement of Interest

FORM

21A

Complete a separate application for each assessment.

PLEASE DO NOT WRITE IN THIS SPACE

Nebraska ID as It Appears on Your Return

Social Security Number (Individual Income Tax)

RESET

PRINT

Tax Period for Which Interest Was Assessed

Amount of Interest Assessed

$

NAME AND LOCATION ADDRESS

NAME AND MAILING ADDRESS

Name

Name

Street Address

Street or Other Mailing Address

City

State

Zip Code

City

State

Zip Code

A REQUEST FOR ABATEMENT OF INTEREST WILL NOT BE CONSIDERED UNTIL THE TAX HAS BEEN PAID.

Tax Program for Which Interest Was Assessed: (Check one.)

Sales or Use Tax

Motor Fuels Tax

Bingo, Lottery, Raffle, or Lottery by Pickle Card

Individual Income Tax

Litter Fee

Mechanical Amusement Device Tax

Corporation Income Tax

Lodging Tax

Cigarette Tax

Fiduciary Income Tax

Tire Fee

Tobacco Products Tax

Withholding Tax

Oil and Gas Severance or

Waste Reduction and Recycling Fee

Conservation Tax

Partnership Income Tax

Other ____________________________________

Interest abatements will be considered only for the following reasons. Please check the boxes that apply to you.

Interest was assessed due to an error or unreasonable delay by the Nebraska Department of Revenue (Department). (Provide a written explanation below.)

Interest was assessed due to erroneous written advice by the Department. This advice was given as a direct response to a request from the taxpayer

and the taxpayer reasonably relied upon the advice. (Attach a copy of the request and the written advice.)

Interest was attributable to an amount that was previously refunded without payment of interest. Interest can be abated up to the date the previous

refund was issued. (This reason does not apply to Motor Fuels taxes.)

Interest was assessed because of an unrequested amount erroneously refunded to the taxpayer, provided the taxpayer did not request the refund and it was not

caused by information supplied by the taxpayer. Interest may be abated for the first 90 days after the refund was issued.

Interest on a related federal amount was abated by the Internal Revenue Service. (Attach a copy of the federal document showing abatement.)

(This reason does not apply to Motor Fuels taxes.)

Interest was assessed for taxes where the taxpayer complied with the tax laws by filing delinquent tax returns for prior periods after signing a Voluntary

Disclosure Agreement. (This reason does not apply to Motor Fuels taxes.)

Interest was assessed for taxes where a taxpayer was unable to file returns timely because of family illness or death. This could include the discovery

after death of unfiled returns for a deceased taxpayer.

Interest was assessed on taxes which were filed after taxpayer records were destroyed due to a natural disaster. (Attach a written explanation.)

EXPLANATION:

Under penalties of law, I declare that, as taxpayer or preparer, I have examined this application, and to the best of my knowledge and belief, it is

sign

correct and complete.

(

)

here

Signature of Owner, Partner, Member, Corporate Officer, or

Daytime Phone

Signature of Preparer Other Than Taxpayer

Person Authorized by Attached Power of Attorney

Date

Title

Date

Address

Email Address

FOR NEBRASKA DEPARTMENT OF REVENUE USE ONLY

Transaction Code

Amount

$

Interest Assessed

COMMENTS:

$

Interest

Interest Abated

$

Line No.

Remaining Interest

Line No.

Authorized Signature

Date

Mail this application to: NEBRASKA DEPARTMENT OF REVENUE, PO BOX 94818, LINCOLN, NE 68509-4818

(When action is completed, a copy will be returned to you.)

, 800-742-7474 (NE and IA), 402-471-5729

6-2011

7-201-1991 Rev.

Supersedes 7-201-1991 Rev. 8-2010

1

1