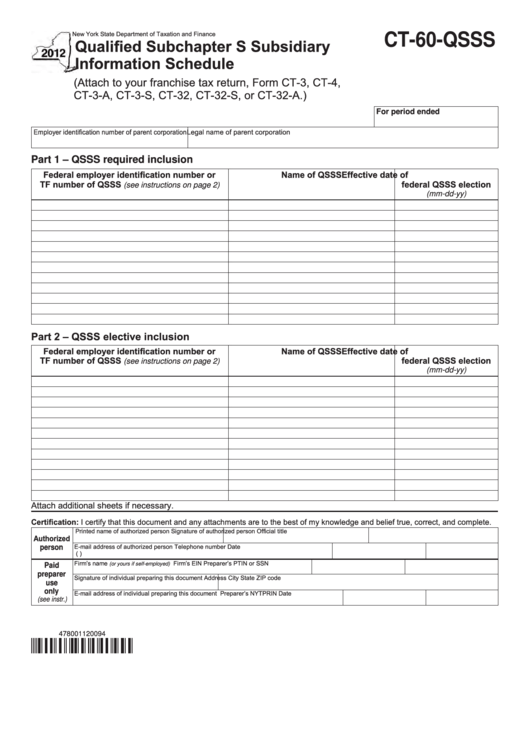

Form Ct-60-Qsss - Qualified Subchapter S Subsidiary Information Schedule - New York State Department Of Taxation And Finance - 2012

ADVERTISEMENT

New York State Department of Taxation and Finance

CT-60-QSSS

Qualified Subchapter S Subsidiary

Information Schedule

(Attach to your franchise tax return, Form CT-3, CT-4,

CT-3-A, CT-3-S, CT-32, CT-32-S, or CT-32-A.)

For period ended

Employer identification number of parent corporation Legal name of parent corporation

Part 1 – QSSS required inclusion

Federal employer identification number or

Name of QSSS

Effective date of

TF number of QSSS

federal QSSS election

(see instructions on page 2)

(mm-dd-yy)

Part 2 – QSSS elective inclusion

Federal employer identification number or

Name of QSSS

Effective date of

TF number of QSSS

federal QSSS election

(see instructions on page 2)

(mm-dd-yy)

Attach additional sheets if necessary.

Certification: I certify that this document and any attachments are to the best of my knowledge and belief true, correct, and complete.

Printed name of authorized person

Signature of authorized person

Official title

Authorized

E-mail address of authorized person

Telephone number

Date

person

(

)

Firm’s name

Firm’s EIN

Preparer’s PTIN or SSN

(or yours if self-employed)

Paid

preparer

Signature of individual preparing this document

Address

City

State

ZIP code

use

only

E-mail address of individual preparing this document

Preparer’s NYTPRIN

Date

(see instr.)

478001120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2