Form Pit-Rc - New Mexico Rebate And Credit Shedule - 2012

ADVERTISEMENT

*120380200*

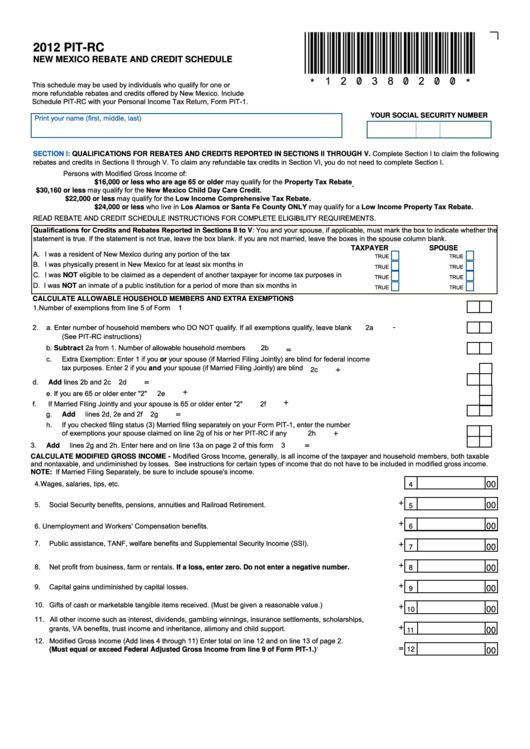

2012 PIT-RC

NEW MEXICO REBATE AND CREDIT SCHEDULE

This schedule may be used by individuals who qualify for one or

more refundable rebates and credits offered by New Mexico. Include

Schedule PIT-RC with your Personal Income Tax Return, Form PIT-1.

YOUR SOCIAL SECURITY NUMBER

Print your name (first, middle, last)

QUALIFICATIONS FOR REBATES AND CREDITS REPORTED IN SECTIONS II THROUGH V. Complete Section I to claim the following

SECTION I:

rebates and credits in Sections II through V. To claim any refundable tax credits in Section VI, you do not need to complete Section I.

Persons with Modified Gross Income of:

$16,000 or less who are age 65 or older may qualify for the Property Tax Rebate .

$30,160 or less may qualify for the New Mexico Child Day Care Credit.

$22,000 or less may qualify for the Low Income Comprehensive Tax Rebate.

$24,000 or less who live in Los Alamos or Santa Fe County ONLY may qualify for a Low Income Property Tax Rebate.

READ REBATE AND CREDIT SCHEDULE INSTRUCTIONS FOR COMPLETE ELIGIBILITY REQUIREMENTS.

Qualifications for Credits and Rebates Reported in Sections II to V: You and your spouse, if applicable, must mark the box to indicate whether the

statement is true. If the statement is not true, leave the box blank. If you are not married, leave the boxes in the spouse column blank.

TAXPAYER

SPOUSE

A. I was a resident of New Mexico during any portion of the tax year..................................................................

.....................

TRUE

TRUE

B. I was physically present in New Mexico for at least six months in 2012..........................................................

.....................

TRUE

TRUE

C. I was NOT eligible to be claimed as a dependent of another taxpayer for income tax purposes in 2012.......

.....................

TRUE

TRUE

D. I was NOT an inmate of a public institution for a period of more than six months in 2012...............................

.....................

TRUE

TRUE

CALCULATE ALLOWABLE HOUSEHOLD MEMBERS AND EXTRA EXEMPTIONS

1. Number of exemptions from line 5 of Form PIT-1....................................................................................................................... 1

2. a.

Enter number of household members who DO NOT qualify. If all exemptions qualify, leave blank .................................. 2a

-

(See PIT-RC instructions)

Subtract 2a from 1. Number of allowable household members ........................................................................................ 2b

b.

=

c.

Extra Exemption: Enter 1 if you or your spouse (if Married Filing Jointly) are blind for federal income

tax purposes. Enter 2 if you and your spouse (if Married Filing Jointly) are blind ............................................................. 2c

+

d.

Add lines 2b and 2c ........................................................................................................................................................... 2d

=

+

e.

If you are 65 or older enter "2" .......................................................................................................................................... 2e

+

f.

If Married Filing Jointly and your spouse is 65 or older enter "2" ...................................................................................... 2f

Add lines 2d, 2e and 2f ..................................................................................................................................................... 2g

=

g.

h.

If you checked filing status (3) Married filing separately on your Form PIT-1, enter the number

of exemptions your spouse claimed on line 2g of his or her PIT-RC if any ...................................................................... 2h

+

3.

Add lines 2g and 2h. Enter here and on line 13a on page 2 of this form .................................................................................. 3

=

CALCULATE MODIFIED GROSS INCOME - Modified Gross Income, generally, is all income of the taxpayer and household members, both taxable

and nontaxable, and undiminished by losses. See instructions for certain types of income that do not have to be included in modified gross income.

NOTE: If Married Filing Separately, be sure to include spouse's income.

00

4.

Wages, salaries, tips, etc. ..........................................................................................................................................

4

+

5. Social Security benefits, pensions, annuities and Railroad Retirement. ....................................................................

00

5

+

Unemployment and Workers' Compensation benefits. ..............................................................................................

00

6

6.

+

7. Public assistance, TANF, welfare benefits and Supplemental Security Income (SSI). ..............................................

00

7

+

8. Net profit from business, farm or rentals. If a loss, enter zero. Do not enter a negative number. ........................

00

8

+

9. Capital gains undiminished by capital losses. ...........................................................................................................

00

9

10. Gifts of cash or marketable tangible items received. (Must be given a reasonable value.) .......................................

+

00

10

11. All other income such as interest, dividends, gambling winnings, insurance settlements, scholarships,

+

grants, VA benefits, trust income and inheritance, alimony and child support. .......................................................

00

11

12. Modified Gross Income (Add lines 4 through 11) Enter total on line 12 and on line 13 of page 2.

.

=

12

(Must equal or exceed Federal Adjusted Gross Income from line 9 of Form PIT-1.) ........................................

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2