Form Rpd-41281 - Job Mentorship Tax Credit Claim Form - State Of New Mexico Taxation And Revenue Department

ADVERTISEMENT

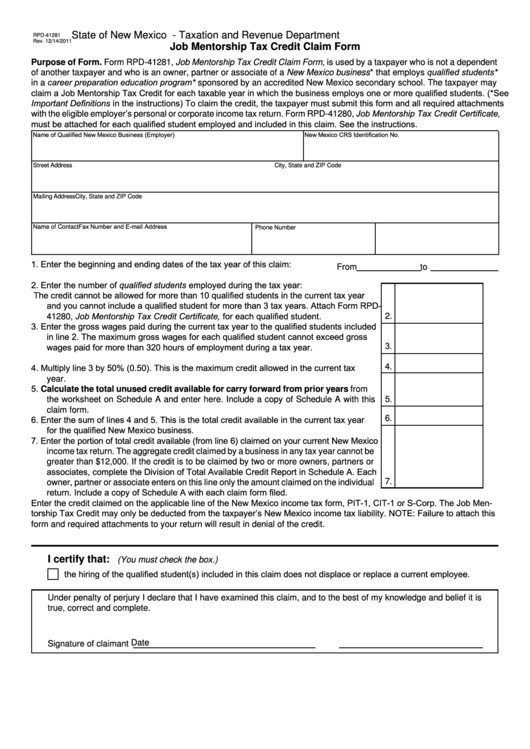

State of New Mexico - Taxation and Revenue Department

RPD-41281

Rev. 12/14/2011

Job Mentorship Tax Credit Claim Form

Purpose of Form. Form RPD-41281, Job Mentorship Tax Credit Claim Form, is used by a taxpayer who is not a dependent

of another taxpayer and who is an owner, partner or associate of a New Mexico business* that employs qualified students*

in a career preparation education program* sponsored by an accredited New Mexico secondary school. The taxpayer may

claim a Job Mentorship Tax Credit for each taxable year in which the business employs one or more qualified students. (*See

Important Definitions in the instructions) To claim the credit, the taxpayer must submit this form and all required attachments

with the eligible employer’s personal or corporate income tax return. Form RPD-41280, Job Mentorship Tax Credit Certificate,

must be attached for each qualified student employed and included in this claim. See the instructions.

Name of Qualified New Mexico Business (Employer)

New Mexico CRS Identification No.

Street Address

City, State and ZIP Code

Mailing Address

City, State and ZIP Code

Name of Contact

Phone Number

Fax Number and E-mail Address

1. Enter the beginning and ending dates of the tax year of this claim:

From

to

2. Enter the number of qualified students employed during the tax year:

The credit cannot be allowed for more than 10 qualified students in the current tax year

and you cannot include a qualified student for more than 3 tax years. Attach Form RPD-

2.

41280, Job Mentorship Tax Credit Certificate, for each qualified student.

3. Enter the gross wages paid during the current tax year to the qualified students included

in line 2. The maximum gross wages for each qualified student cannot exceed gross

3.

wages paid for more than 320 hours of employment during a tax year.

4.

4. Multiply line 3 by 50% (0.50). This is the maximum credit allowed in the current tax

year.

5. Calculate the total unused credit available for carry forward from prior years from

5.

the worksheet on Schedule A and enter here. Include a copy of Schedule A with this

claim form.

6.

6. Enter the sum of lines 4 and 5. This is the total credit available in the current tax year

for the qualified New Mexico business.

7. Enter the portion of total credit available (from line 6) claimed on your current New Mexico

income tax return. The aggregate credit claimed by a business in any tax year cannot be

greater than $12,000. If the credit is to be claimed by two or more owners, partners or

associates, complete the Division of Total Available Credit Report in Schedule A. Each

7.

owner, partner or associate enters on this line only the amount claimed on the individual

return. Include a copy of Schedule A with each claim form filed.

Enter the credit claimed on the applicable line of the New Mexico income tax form, PIT-1, CIT-1 or S-Corp. The Job Men-

torship Tax Credit may only be deducted from the taxpayer’s New Mexico income tax liability. NOTE: Failure to attach this

form and required attachments to your return will result in denial of the credit.

I certify that:

(You must check the box.)

the hiring of the qualified student(s) included in this claim does not displace or replace a current employee.

Under penalty of perjury I declare that I have examined this claim, and to the best of my knowledge and belief it is

true, correct and complete.

Date

Signature of claimant

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2