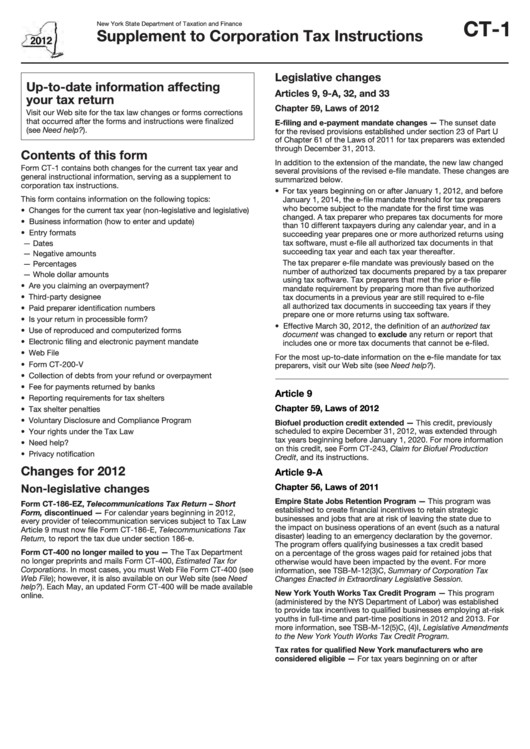

Instructions For Form Ct-1 - Supplement To Corporation Tax - New York State Department Of Taxation And Finance - 2012

ADVERTISEMENT

CT-1

New York State Department of Taxation and Finance

Supplement to Corporation Tax Instructions

Legislative changes

Up-to-date information affecting

Articles 9, 9-A, 32, and 33

your tax return

Chapter 59, Laws of 2012

Visit our Web site for the tax law changes or forms corrections

that occurred after the forms and instructions were finalized

E-filing and e-payment mandate changes — The sunset date

(see Need help?).

for the revised provisions established under section 23 of Part U

of Chapter 61 of the Laws of 2011 for tax preparers was extended

through December 31, 2013.

Contents of this form

In addition to the extension of the mandate, the new law changed

Form CT-1 contains both changes for the current tax year and

several provisions of the revised e-file mandate. These changes are

general instructional information, serving as a supplement to

summarized below.

corporation tax instructions.

• For tax years beginning on or after January 1, 2012, and before

This form contains information on the following topics:

January 1, 2014, the e-file mandate threshold for tax preparers

who become subject to the mandate for the first time was

• Changes for the current tax year (non-legislative and legislative)

changed. A tax preparer who prepares tax documents for more

• Business information (how to enter and update)

than 10 different taxpayers during any calendar year, and in a

• Entry formats

succeeding year prepares one or more authorized returns using

tax software, must e-file all authorized tax documents in that

— Dates

succeeding tax year and each tax year thereafter.

— Negative amounts

The tax preparer e-file mandate was previously based on the

— Percentages

number of authorized tax documents prepared by a tax preparer

— Whole dollar amounts

using tax software. Tax preparers that met the prior e-file

• Are you claiming an overpayment?

mandate requirement by preparing more than five authorized

• Third-party designee

tax documents in a previous year are still required to e-file

all authorized tax documents in succeeding tax years if they

• Paid preparer identification numbers

prepare one or more returns using tax software.

• Is your return in processible form?

• Effective March 30, 2012, the definition of an authorized tax

• Use of reproduced and computerized forms

document was changed to exclude any return or report that

• Electronic filing and electronic payment mandate

includes one or more tax documents that cannot be e-filed.

• Web File

For the most up-to-date information on the e-file mandate for tax

• Form CT-200-V

preparers, visit our Web site (see Need help?).

• Collection of debts from your refund or overpayment

• Fee for payments returned by banks

Article 9

• Reporting requirements for tax shelters

Chapter 59, Laws of 2012

• Tax shelter penalties

• Voluntary Disclosure and Compliance Program

Biofuel production credit extended — This credit, previously

scheduled to expire December 31, 2012, was extended through

• Your rights under the Tax Law

tax years beginning before January 1, 2020. For more information

• Need help?

on this credit, see Form CT-243, Claim for Biofuel Production

• Privacy notification

Credit, and its instructions.

Changes for 2012

Article 9-A

Non-legislative changes

Chapter 56, Laws of 2011

Empire State Jobs Retention Program — This program was

Form CT-186-EZ, Telecommunications Tax Return – Short

established to create financial incentives to retain strategic

Form, discontinued — For calendar years beginning in 2012,

businesses and jobs that are at risk of leaving the state due to

every provider of telecommunication services subject to Tax Law

the impact on business operations of an event (such as a natural

Article 9 must now file Form CT-186-E, Telecommunications Tax

disaster) leading to an emergency declaration by the governor.

Return, to report the tax due under section 186-e.

The program offers qualifying businesses a tax credit based

Form CT-400 no longer mailed to you — The Tax Department

on a percentage of the gross wages paid for retained jobs that

no longer preprints and mails Form CT-400, Estimated Tax for

otherwise would have been impacted by the event. For more

Corporations. In most cases, you must Web File Form CT-400 (see

information, see TSB-M-12(3)C, Summary of Corporation Tax

Web File); however, it is also available on our Web site (see Need

Changes Enacted in Extraordinary Legislative Session.

help?). Each May, an updated Form CT-400 will be made available

New York Youth Works Tax Credit Program — This program

online.

(administered by the NYS Department of Labor) was established

to provide tax incentives to qualified businesses employing at-risk

youths in full-time and part-time positions in 2012 and 2013. For

more information, see TSB-M-12(5)C, (4)I, Legislative Amendments

to the New York Youth Works Tax Credit Program.

Tax rates for qualified New York manufacturers who are

considered eligible — For tax years beginning on or after

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5