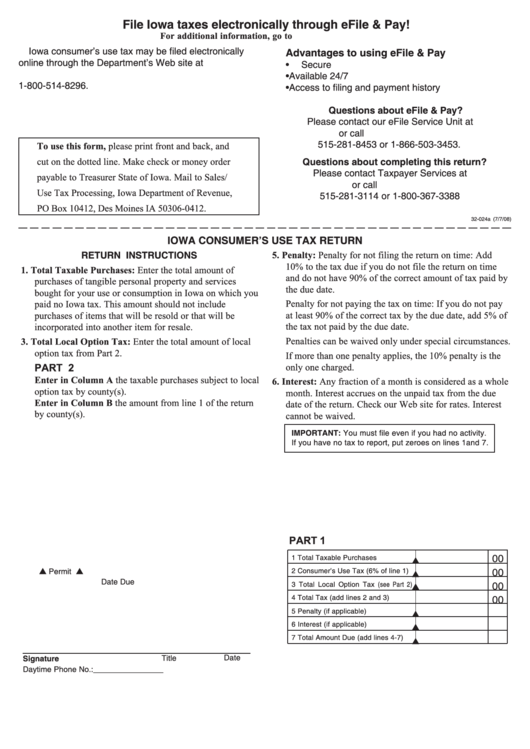

Form 32-024a - Iowa Consumer'S Use Tax Return

ADVERTISEMENT

File Iowa taxes electronically through eFile & Pay!

For additional information, go to

Iowa consumer’s use tax may be filed electronically

Advantages to using eFile & Pay

online through the Department’s Web site at

•

Secure

or by touch-tone telephone at

•

Available 24/7

1-800-514-8296.

•

Access to filing and payment history

Questions about eFile & Pay?

Please contact our eFile Service Unit at

idrefile@iowa.gov or call

515-281-8453 or 1-866-503-3453.

To use this form, please print front and back, and

cut on the dotted line. Make check or money order

Questions about completing this return?

Please contact Taxpayer Services at

payable to Treasurer State of Iowa. Mail to Sales/

idr@iowa.gov or call

Use Tax Processing, Iowa Department of Revenue,

515-281-3114 or 1-800-367-3388

PO Box 10412, Des Moines IA 50306-0412.

32-024a (7/7/08)

IOWA CONSUMER’S USE TAX RETURN

RETURN INSTRUCTIONS

5. Penalty: Penalty for not filing the return on time: Add

10% to the tax due if you do not file the return on time

1. Total Taxable Purchases: Enter the total amount of

and do not have 90% of the correct amount of tax paid by

purchases of tangible personal property and services

the due date.

bought for your use or consumption in Iowa on which you

paid no Iowa tax. This amount should not include

Penalty for not paying the tax on time: If you do not pay

purchases of items that will be resold or that will be

at least 90% of the correct tax by the due date, add 5% of

the tax not paid by the due date.

incorporated into another item for resale.

Penalties can be waived only under special circumstances.

3. Total Local Option Tax: Enter the total amount of local

option tax from Part 2.

If more than one penalty applies, the 10% penalty is the

PART 2

only one charged.

Enter in Column A the taxable purchases subject to local

6. Interest: Any fraction of a month is considered as a whole

option tax by county(s).

month. Interest accrues on the unpaid tax from the due

Enter in Column B the amount from line 1 of the return

date of the return. Check our Web site for rates. Interest

by county(s).

cannot be waived.

IMPORTANT: You must file even if you had no activity.

If you have no tax to report, put zeroes on lines 1and 7.

PART 1

00

1 Total Taxable Purchases

Permit No.

Period

2 Consumer’s Use Tax (6% of line 1)

00

Date Due

3 Total Local Option Tax (see Part 2)

00

4 Total Tax (add lines 2 and 3)

00

5 Penalty (if applicable)

6 Interest (if applicable)

7 Total Amount Due (add lines 4-7)

Date

Title

Signature

Daytime Phone No.: ________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2