Form Rpd-41324 - Gross Receipts Tax Credit For Certain Hospitals Claim Form - State Of New Mexico Taxation And Revenue Department

ADVERTISEMENT

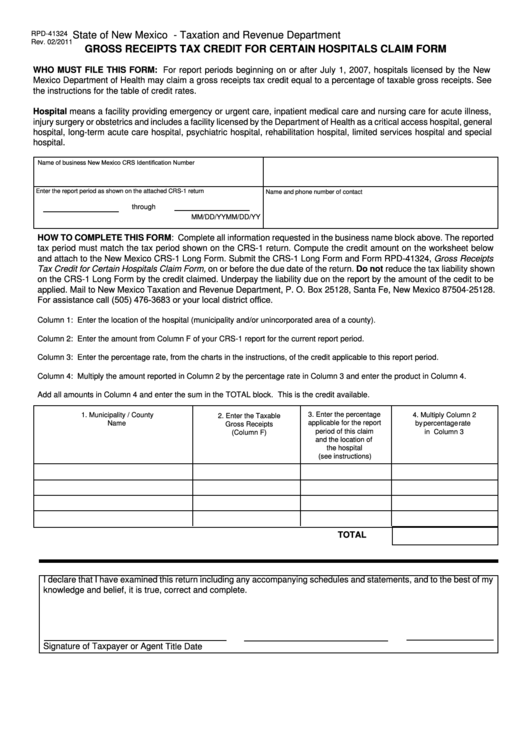

RPD-41324

State of New Mexico - Taxation and Revenue Department

Rev. 02/2011

GROSS RECEIPTS TAX CREDIT FOR CERTAIN HOSPITALS CLAIM FORM

WHO MUST FILE THIS FORM: For report periods beginning on or after July 1, 2007, hospitals licensed by the New

Mexico Department of Health may claim a gross receipts tax credit equal to a percentage of taxable gross receipts. See

the instructions for the table of credit rates.

Hospital means a facility providing emergency or urgent care, inpatient medical care and nursing care for acute illness,

injury surgery or obstetrics and includes a facility licensed by the Department of Health as a critical access hospital, general

hospital, long-term acute care hospital, psychiatric hospital, rehabilitation hospital, limited services hospital and special

hospital.

New Mexico CRS Identification Number

Name of business

Enter the report period as shown on the attached CRS-1 return

Name and phone number of contact

through

MM/DD/YY

MM/DD/YY

HOW TO COMPLETE THIS FORM: Complete all information requested in the business name block above. The reported

tax period must match the tax period shown on the CRS-1 return. Compute the credit amount on the worksheet below

and attach to the New Mexico CRS-1 Long Form. Submit the CRS-1 Long Form and Form RPD-41324, Gross Receipts

Tax Credit for Certain Hospitals Claim Form, on or before the due date of the return. Do not reduce the tax liability shown

on the CRS-1 Long Form by the credit claimed. Underpay the liability due on the report by the amount of the cedit to be

applied. Mail to New Mexico Taxation and Revenue Department, P. O. Box 25128, Santa Fe, New Mexico 87504-25128.

For assistance call (505) 476-3683 or your local district office.

Column 1: Enter the location of the hospital (municipality and/or unincorporated area of a county).

Column 2: Enter the amount from Column F of your CRS-1 report for the current report period.

Column 3: Enter the percentage rate, from the charts in the instructions, of the credit applicable to this report period.

Column 4: Multiply the amount reported in Column 2 by the percentage rate in Column 3 and enter the product in Column 4.

Add all amounts in Column 4 and enter the sum in the TOTAL block. This is the credit available.

3. Enter the percentage

1. Municipality / County

4. Multiply Column 2

2. Enter the Taxable

applicable for the report

Name

by percentage rate

Gross Receipts

period of this claim

in Column 3

(Column F)

and the location of

the hospital

(see instructions)

TOTAL

I declare that I have examined this return including any accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct and complete.

Signature of Taxpayer or Agent

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2