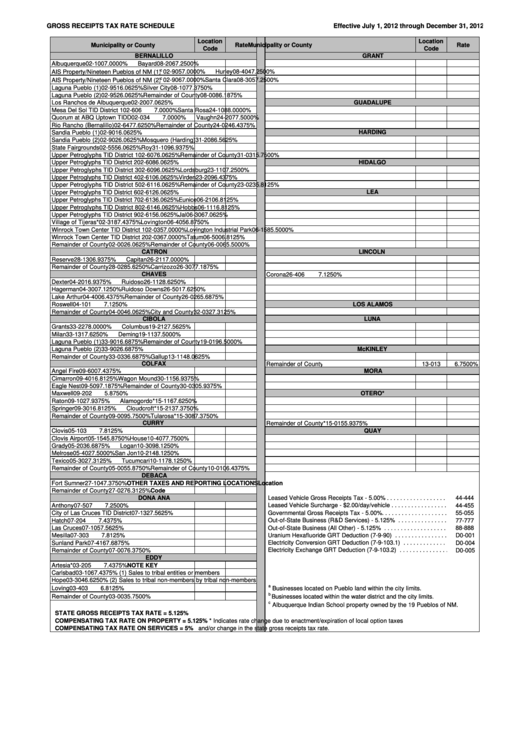

GROSS RECEIPTS TAX RATE SCHEDULE

Effective July 1, 2012 through December 31, 2012

Location

Location

Municipality or County

Rate

Municipality or County

Rate

Code

Code

BERNALILLO

GRANT

Albuquerque

02-100

7.0000%

Bayard

08-206

7.2500%

c

02-905

7.0000%

Hurley

08-404

7.2500%

AIS Property/Nineteen Pueblos of NM (1)

c

02-906

7.0000%

Santa Clara

08-305

7.2500%

AIS Property/Nineteen Pueblos of NM (2)

Laguna Pueblo (1)

02-951

6.0625%

Silver City

08-107

7.3750%

Laguna Pueblo (2)

02-952

6.0625%

Remainder of County

08-008

6.1875%

Los Ranchos de Albuquerque

02-200

7.0625%

GUADALUPE

02-606

Mesa Del Sol TID District 1

7.0000%

Santa Rosa

24-108

8.0000%

Quorum at ABQ Uptown TIDD

02-034

7.0000%

Vaughn

24-207

7.5000%

Rio Rancho (Bernalillo)

02-647

7.6250%

Remainder of County

24-024

6.4375%

Sandia Pueblo (1)

02-901

6.0625%

HARDING

Sandia Pueblo (2)

02-902

6.0625%

Mosquero (Harding)

31-208

6.5625%

State Fairgrounds

02-555

6.0625%

Roy

31-109

6.9375%

Upper Petroglyphs TID District 1

02-607

6.0625%

Remainder of County

31-031

5.7500%

Upper Petroglyphs TID District 2

02-608

6.0625%

HIDALGO

Upper Petroglyphs TID District 3

02-609

6.0625%

Lordsburg

23-110

7.2500%

Upper Petroglyphs TID District 4

02-610

6.0625%

Virden

23-209

6.4375%

Upper Petroglyphs TID District 5

02-611

6.0625%

Remainder of County

23-023

5.8125%

Upper Petroglyphs TID District 6

02-612

6.0625%

LEA

Upper Petroglyphs TID District 7

02-613

6.0625%

Eunice

06-210

6.8125%

Upper Petroglyphs TID District 8

02-614

6.0625%

Hobbs

06-111

6.8125%

Upper Petroglyphs TID District 9

02-615

6.0625%

Jal

06-306

7.0625%

Village of Tijeras*

02-318

7.4375%

Lovington

06-405

6.8750%

Winrock Town Center TID District 1

02-035

7.0000%

Lovington Industrial Park

06-158

5.5000%

Winrock Town Center TID District 2

02-036

7.0000%

Tatum

06-500

6.8125%

Remainder of County

02-002

6.0625%

Remainder of County

06-006

5.5000%

CATRON

LINCOLN

Reserve

28-130

6.9375%

Capitan

26-211

7.0000%

Remainder of County

28-028

5.6250%

Carrizozo

26-307

7.1875%

CHAVES

Corona

26-406

7.1250%

Dexter

04-201

6.9375%

Ruidoso

26-112

8.6250%

Hagerman

04-300

7.1250%

Ruidoso Downs

26-501

7.6250%

Lake Arthur

04-400

6.4375%

Remainder of County

26-026

5.6875%

Roswell

04-101

7.1250%

LOS ALAMOS

Remainder of County

04-004

6.0625%

City and County

32-032

7.3125%

CIBOLA

LUNA

Grants

33-227

8.0000%

Columbus

19-212

7.5625%

Milan

33-131

7.6250%

Deming

19-113

7.5000%

Laguna Pueblo (1)

33-901

6.6875%

Remainder of County

19-019

6.5000%

Laguna Pueblo (2)

33-902

6.6875%

McKINLEY

Remainder of County

33-033

6.6875%

Gallup

13-114

8.0625%

COLFAX

Remainder of County

13-013

6.7500%

Angel Fire

09-600

7.4375%

MORA

Cimarron

09-401

6.8125%

Wagon Mound

30-115

6.9375%

Eagle Nest

09-509

7.1875%

Remainder of County

30-030

5.9375%

Maxwell

09-202

5.8750%

OTERO*

Raton

09-102

7.9375%

Alamogordo*

15-116

7.6250%

Springer

09-301

6.8125%

Cloudcroft*

15-213

7.3750%

Remainder of County

09-009

5.7500%

Tularosa*

15-308

7.3750%

CURRY

Remainder of County*

15-015

5.9375%

QUAY

Clovis

05-103

7.8125%

Clovis Airport

05-154

5.8750%

House

10-407

7.7500%

Grady

05-203

6.6875%

Logan

10-309

8.1250%

Melrose

05-402

7.5000%

San Jon

10-214

8.1250%

Texico

05-302

7.3125%

Tucumcari

10-117

8.1250%

Remainder of County

05-005

5.8750%

Remainder of County

10-010

6.4375%

DEBACA

Fort Sumner

27-104

7.3750%

OTHER TAXES AND REPORTING LOCATIONS

Location

Remainder of County

27-027

6.3125%

Code

DONA ANA

Leased Vehicle Gross Receipts Tax - 5.00% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

44-444

Anthony

07-507

7.2500%

Leased Vehicle Surcharge - $2.00/day/vehicle . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

44-455

City of Las Cruces TID District

07-132

7.5625%

Governmental Gross Receipts Tax - 5.00%. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

55-055

Hatch

07-204

7.4375%

Out-of-State Business (R&D Services) - 5.125% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

77-777

Las Cruces

07-105

7.5625%

Out-of-State Business (All Other) - 5.125% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

88-888

Uranium Hexafluoride GRT Deduction (7-9-90) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Mesilla

07-303

7.8125%

D0-001

Sunland Park

07-416

7.6875%

Electricity Conversion GRT Deduction (7-9-103.1) . . . . . . . . . . . . . . . . . . . . . .

D0-004

Remainder of County

07-007

6.3750%

Electricity Exchange GRT Deduction (7-9-103.2) . . . . . . . . . . . . . . . . . . . . . .

D0-005

EDDY

Artesia*

03-205

7.4375%

NOTE KEY

Carlsbad

03-106

7.4375%

(1) Sales to tribal entities or members

Hope

03-304

6.6250%

(2) Sales to tribal non-members by tribal non-members

a

Loving

03-403

6.8125%

Businesses located on Pueblo land within the city limits.

b

Remainder of County

03-003

5.7500%

Businesses located within the water district and the city limits.

c

Albuquerque Indian School property owned by the 19 Pueblos of NM.

STATE GROSS RECEIPTS TAX RATE = 5.125%

* Indicates rate change due to enactment/expiration of local option taxes

COMPENSATING TAX RATE ON PROPERTY = 5.125%

COMPENSATING TAX RATE ON SERVICES = 5%

and/or change in the state gross receipts tax rate.

1

1 2

2