Form Rpd-41247 - Certificate Of Eligibility For The Rural Job Tax Credit - State Of New Mexico Taxation And Revenue Department Page 2

ADVERTISEMENT

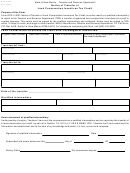

State of New Mexico - Taxation & Revenue Department

RPD-41247

Rev. 12/12/2011

INSTRUCTIONS FOR CERTIFICATE OF ELIGIBILITY FOR THE RURAL JOB TAX CREDIT

Tier Areas Defined:

ABOUT THIS CREDIT

Eligible employers may earn the rural job tax credit for each

This credit is not available for jobs performed or based in

qualifying job created after July 1, 2000. The holder of the

Los Alamos County, the cities of Albuquerque, Los Ranchos,

credit may apply all or a portion of the rural job tax credit

Corrales, Rio Rancho, Tijeras, Santa Fe, Las Cruces or

to gross receipts (excluding tax imposed by a municipality

Farmington, or within 10 road miles of any of these cities. Tier

or county), compensating, and withholding taxes due. The

two areas are Roswell, Clovis, Carlsbad, Hobbs, Gallup and

holder also may apply the credit to personal or corporate

Alamogordo. Tier one area is anywhere within New Mexico

income taxes due. See Form-41238, Application for Rural

not listed above. Effective June 3, 2003, Farmington and the

Job Tax Credit, for further details.

10 miles surrounding this city no longer qualified for the rural

job tax credit.

HOW TO COMPLETE THIS FORM

Complete all information requested in the address block. An

Eligible Employee Defined:

“eligible employer” is an employer in a tier one or tier two area

“Eligible Employee” means any individual other than an

(see below) who has been approved for in-plant training as-

individual who:

sistance by the Economic Development Department pursuant

a. bears any of the relationships described in Para-

to Section 21-19-7 NMSA 1978.

graphs (1) through (8) of the 26 U.S.C. Section 152(a) to the

employer or, if the employer is a corporation, to an individual

1. Enter the date the qualifying job was created. The qualify-

who owns, directly or indirectly, more than 50% in value of the

ing job must have been created after July 1, 2000.

outstanding stock of the corporation or, if the employer is an

2. Enter the name of the eligible employee(s) occupying the

entity other than a corporation, to any individual who owns,

qualifying job. If more than one employee occupied the job dur-

directly or indirectly, more than 50% of the capital and profits

ing the qualified period, include the names of each employee.

interest in the entity;

3. Enter the qualifying period for which this credit is claimed.

b. if the employer is an estate or trust, is a grantor,

See the definition of “Qualifying Period” below.

beneficiary or fiduciary of the estate or trust or is an individual

4. Enter the number of previous qualified periods claimed for

who bears any of the relationships described in Paragraphs

this job. The rural job tax credit may be claimed a maximum of:

(1) through (8) of the 26 U.S.C. Section 152(a) to a grantor,

a. four qualifying periods for each job performed or

beneficiary or fiduciary of the estate or trust, or

based at a location in a tier one area.

c. is a dependent, as that term is described in 26

b. two qualifying periods for each job performed or

U.S.C. Section 152(a)(9), of the employer or, if the taxpayer

based at a location in a tier two area.

is a corporation, of an individual who owns, directly or indi-

rectly, more than 50% in value of the outstanding stock of

the corporation or, if the employer is an entity other than a

I certify that:

To qualify, all of the following certifications must be met. Check

corporation, of any individual who owns, directly or indirectly,

the applicable boxes on the form.

more than 50% of the capital and profits interests in the entity

5. Certify that the employee(s) who is occupying the job during

or, if the employer is an estate or trust, of a grantor, beneficiary

this period meets the definition of “eligible employee” below.

or fiduciary of the estate or trust.

6. Certify the wages paid to the eligible employee(s) occupy-

ing the qualifying job for the qualified period. Enter the lower

Qualifying Period Defined:

of either the total wages paid to the employee or $16,000.

“Qualifing Period” means the 12 months starting on the first

The maximum that may be claimed is $16,000 per qualifying

day of an eligible employee’s working in a qualifying job, or

job, per qualifying period.

12 months starting on the anniversary of the day the eligible

7. Certify that an eligible employee has occupied this job for

employee begins working in a qualifying job.

at least 48 weeks of this period.

8. Certify whether the job is performed or based at a location

in a tier one or a tier two area.

Attach this form to Form RPD-41238, Application for Rural

Job Tax Credit, and mail to: Taxation and Revenue Depart-

ment, ATTN: Director’s Office, P.O. Box 8485, Albuquerque,

NM 87198-8485.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2