Form Rpd-41248-12 - Application To Be A Qualified Employer - State Of New Mexico Taxation And Revenue Department - 2012

ADVERTISEMENT

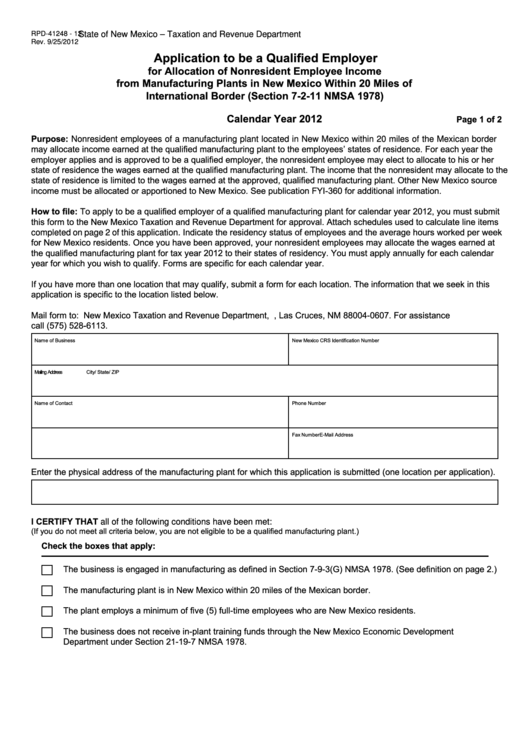

State of New Mexico – Taxation and Revenue Department

RPD-41248 - 12

Rev. 9/25/2012

Application to be a Qualified Employer

for Allocation of Nonresident Employee Income

from Manufacturing Plants in New Mexico Within 20 Miles of

International Border (Section 7-2-11 NMSA 1978)

Calendar Year 2012

Page 1 of 2

Purpose: Nonresident employees of a manufacturing plant located in New Mexico within 20 miles of the Mexican border

may allocate income earned at the qualified manufacturing plant to the employees’ states of residence. For each year the

employer applies and is approved to be a qualified employer, the nonresident employee may elect to allocate to his or her

state of residence the wages earned at the qualified manufacturing plant. The income that the nonresident may allocate to the

state of residence is limited to the wages earned at the approved, qualified manufacturing plant. Other New Mexico source

income must be allocated or apportioned to New Mexico. See publication FYI-360 for additional information.

How to file: To apply to be a qualified employer of a qualified manufacturing plant for calendar year 2012, you must submit

this form to the New Mexico Taxation and Revenue Department for approval. Attach schedules used to calculate line items

completed on page 2 of this application. Indicate the residency status of employees and the average hours worked per week

for New Mexico residents. Once you have been approved, your nonresident employees may allocate the wages earned at

the qualified manufacturing plant for tax year 2012 to their states of residency. You must apply annually for each calendar

year for which you wish to qualify. Forms are specific for each calendar year.

If you have more than one location that may qualify, submit a form for each location. The information that we seek in this

application is specific to the location listed below.

Mail form to: New Mexico Taxation and Revenue Department, P.O. Box 607, Las Cruces, NM 88004-0607. For assistance

call (575) 528-6113.

Name of Business

New Mexico CRS Identification Number

Mailing Address

City/ State/ ZIP

Name of Contact

Phone Number

E-Mail Address

Fax Number

Enter the physical address of the manufacturing plant for which this application is submitted (one location per application).

I CERTIFY THAT all of the following conditions have been met:

(If you do not meet all criteria below, you are not eligible to be a qualified manufacturing plant.)

Check the boxes that apply:

The business is engaged in manufacturing as defined in Section 7-9-3(G) NMSA 1978. (See definition on page 2.)

The manufacturing plant is in New Mexico within 20 miles of the Mexican border.

The plant employs a minimum of five (5) full-time employees who are New Mexico residents.

The business does not receive in-plant training funds through the New Mexico Economic Development

Department under Section 21-19-7 NMSA 1978.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2